The 21Shares ONDO ETF filing is gaining attention across the crypto market, with investors closely watching what it could mean for ONDO’s future price. Crypto ETFs have already changed how institutions invest in digital assets, and many believe this move could open a similar door for real-world asset (RWA) tokens.

The conversation picked up after Bloomberg analyst Eric Balchunas said he had never heard of Ondo when reacting to the filing.

Source: X (formerly Twitter)

Crypto community members quickly responded, pointing out that Patrick McHenry, former chairman of the U.S. House Financial Services Committee and a strong supporter of crypto regulation is now Vice Chairman of Ondo Finance’s advisory board.

Balchunas later noted that there are over 5,000 ETFs in the market and crypto still makes up only a small portion, explaining why newer filings sometimes go unnoticed.

The proposed 21Shares ETF aims to connect traditional finance with decentralized finance in a regulated way. If approved, Coinbase Custody is expected to safeguard the assets, giving institutions a safer path to gain exposure.

Ondo Finance has already tokenized more than 200 tokenised stocks which are $500 million worth of U.S. Treasuries and yield-generating products. In simple terms, it allows investors to access government-backed returns through blockchain technology without relying fully on traditional intermediaries.

The firm has also worked with Pantera Capital on a reported $250 million investment focused on tokenized real-world assets. Developments like these suggest that tokenization is slowly becoming part of mainstream finance rather than just an experimental idea.

For investors, an Exchange traded fund could mean easier access, better liquidity, and stronger market trust.

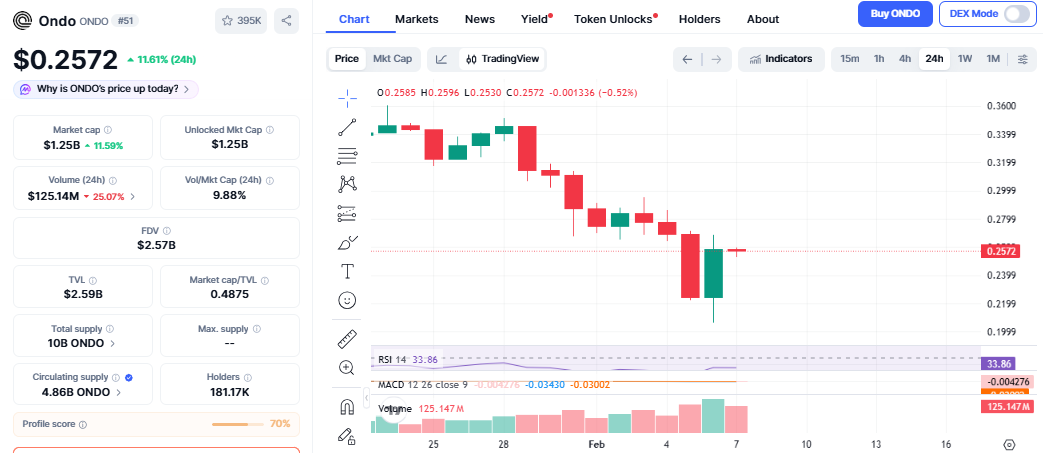

It is currently trading close to $0.257, posting a gain of about 12% in the past 24 hours as the broader crypto market rebounds as per the CoinMarketCap.

Source: CoinMarketCap

Technical data shows mixed signals:

RSI sits at 33.86, indicating the token is nearing oversold levels

Trading volume is around $125 million, though it has recently declined

Immediate support stands near $0.2445

Resistance is seen around the 7-day SMA at $0.268

A deeper drop could test the $0.206 zone

So far, the price jump appears tied more to the overall market recovery than directly to the 21Shares ONDO ETF news. It has been moving closely with traditional markets such as the S&P 500 and gold. This implies liquidity is driving the trend.

In case the 21Shares Exchange Traded Fund is approved by regulators, the most transformative impact might result from institutional investors entering the markets. ETFs will make investing easier for these funds, who may have favored regulated products over direct investments in crypto.

Typically, there is a well-trodden pattern observed with Exchange Traded Funds: excitement before an ETF approval, inflows after an ETF launch, and steady growth thereafter.

With regard to this token, this could help enhance credibility and change its perception as a mere altcoin into that of a recognized financial product.

Bullish case: If it stays above $0.2445 and breaks the $0.268 resistance, the price could move toward the $0.30–$0.34 range. ETF approval would likely strengthen this momentum.

Base case: Without immediate regulatory progress, it may continue trading between $0.21 and $0.27, largely following Bitcoin and overall market direction.

Bearish case: If support fails, the price could slide back toward $0.206, especially if global risk sentiment weakens.

With the 21Shares Exchange Traded Fund, there is more to this filing. It's a sign of the interest in blockchain-based versions of traditional financial products. In the quest for safe returns for institutional clients, tokenized products could become very attractive.

YMYL Disclaimer: This content is informational only, not financial advice. Crypto investments are risky. Always research carefully and consult a qualified financial advisor.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.