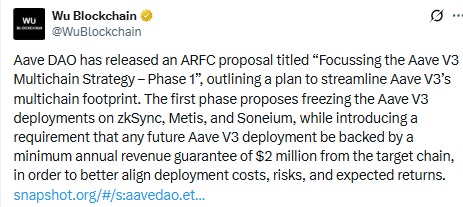

The Aave community has introduced a governance proposal that could change how the protocol grows across blockchains. Known as the Aave V3 Multichain Strategy, Phase 1, the plan focuses on improving efficiency and making sure every deployment contributes meaningful revenue instead of stretching resources too thin.

As part of the multichain strategy, the protocol plans to pause activity on its V3 versions running on zkSync, Metis, and Soneium. This does not mean the platforms will disappear, but no new upgrades or expansions ar expected there for now.

Source: X (formerly Twitter)

The DAO noted that these networks show low usage and limited growth potential, yet still require monitoring, governance updates, and risk management.

For everyday users, this shift may actually feel reassuring.

Many community members prefer a platform that runs smoothly rather than one that expands too quickly and creates technical risks.

However, by concentrating on the stronger chains, they can then focus more on stability, liquidity, and borrowing conditions that directly affect users.

The more blockchains it supports, the more complex it becomes. Each chain that is supported increases operational costs and the risk profile of the protocol. The Aave DAO proposal of Multichain Strategy is designed to simplify this process and focus on the chains that are actively supporting the ecosystem.

One of the biggest positives of this proposal is the new revenue rule. From now on, the platform will only deploy V3 on blockchains that can reasonably guarantee at least $2 million in annual revenue. It is simple: expansion needs to be justified and must provide long-term value.

This is a clear indication that Aave is moving away from the growth-at-all-costs strategy to a more disciplined approach, which many investors believe is a sign of maturity for one of the biggest lending platforms in the DeFi space.

Aave V3 allows people to lend crypto, earn interest, or borrow assets using collateral without relying on traditional banks. Its smart contract system keeps transactions automatic and transparent while improving risk controls and gas efficiency.

With the Multichain Strategy, users on major networks could benefit from fewer bugs, steadier interest rates, and stronger support. However, those active on the paused chains might notice slower improvements and possibly thinner liquidity over time.

For token holders, the strategy points toward stronger financial discipline. Limiting deployments to revenue-generating chains may improve profitability, reduce wasted spending, and build investor confidence. Still, the stricter policy could slow Aave’s expansion into emerging ecosystems, which some growth-focused traders may view cautiously.

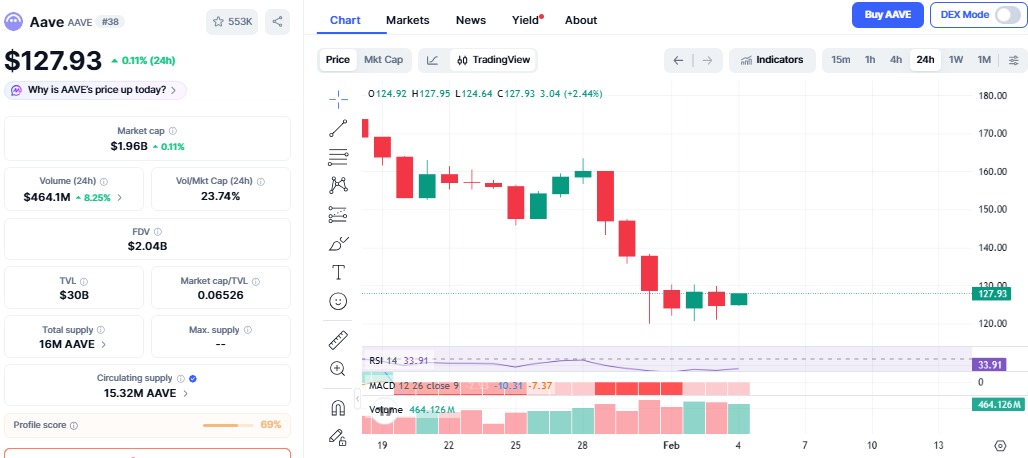

Currently, It is trading close to $127.93, with a slight positive daily momentum despite the overall market downturn as per the Coinmarketcap. Technical analysis shows that the asset is highly oversold, which is a common signal for short-term buyers to enter the market.

Source: CoinMarketCap

Market observers are also waiting to see if the price can hold above the $125 pivot point. If this level is held, it could lead to a relief rally, but a break below it could send the token price tumbling back to the $119 support level.

From a fundamental perspective, there are some positive developments. The native GHO stablecoin has broken past the $500 million market cap, which is a sign of increasing adoption in the space. Additionally, the U.S. SEC has closed its multi-year investigation into the asset, which has reduced regulatory uncertainty.

For the short term, It is likely to trade between $119 and $135.

If adoption continues to rise and revenue strengthens under the multichain strategy, sentiment could gradually turn positive. However, overall crypto market direction will remain the key factor shaping momentum.

YMYL Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.