The AAVE price prediction is starting to look different from earlier sessions. AAVE is trading 1.85% up today. After a long time of downside moves, price is no longer pushing lower with force. Instead, it is sitting near a support range and consolidates. Long wicks are visible, and candles are now smaller, indicating uncertainty on both sides; at least for now, panic selling is not available, and the price is respecting the lower zones.

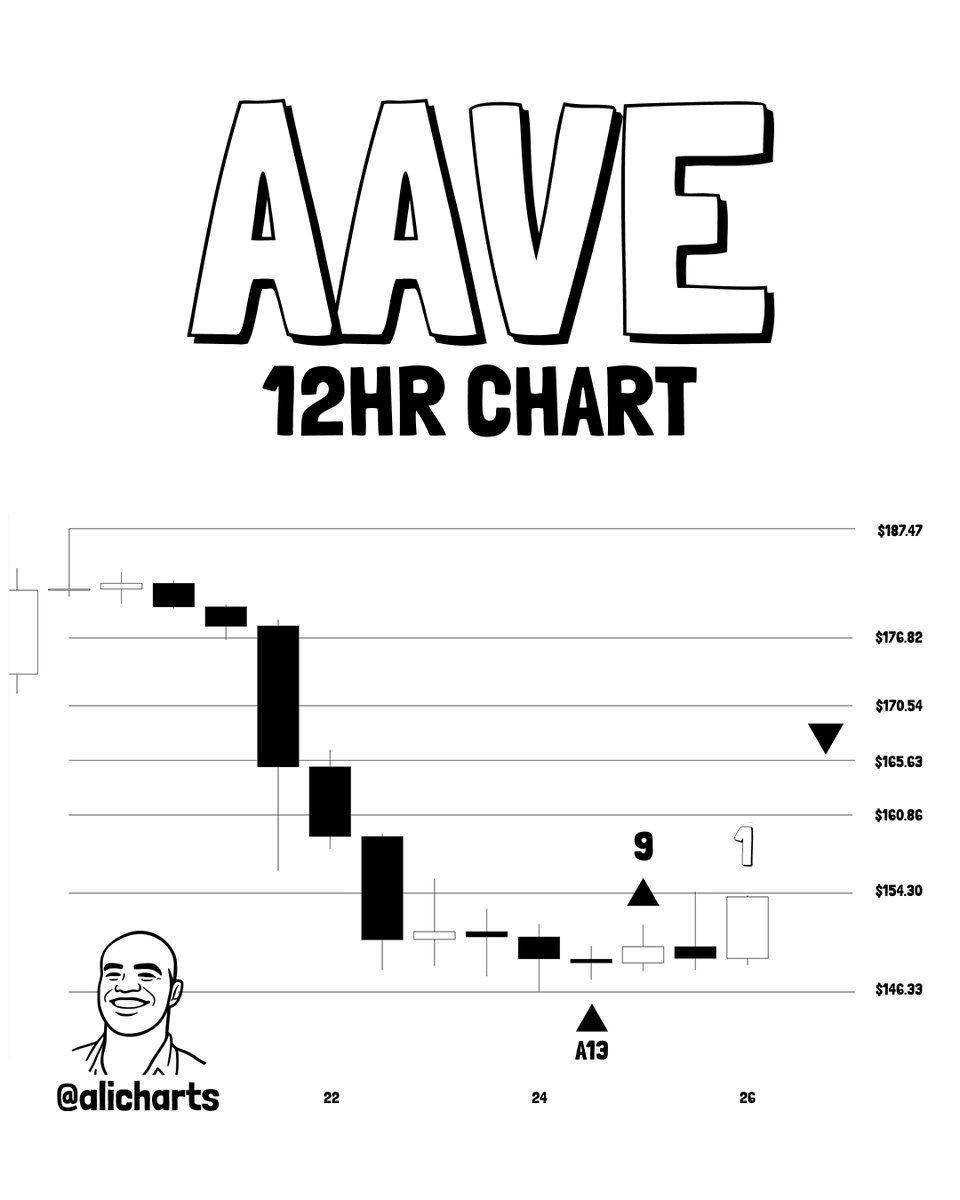

One of the analysts suggests that the TD Sequential indicator has just flashed a buy signal on AAVE, a sign that selling pressure may be getting stretched. On the 12-hour chart, the drop was sharp and aggressive, with the price falling quickly into the lower range.

Source: X@alicharts

If sellers were still in control, price would not stay stuck here for this long. A close above $154 would change the structure and open the door for a push toward the $165 level.

On the hourly chart, Aave prices form a base near the $145 zone and take a U-turn. Analyzing the chart, a rounded bottom was seen, and the price was moving inside it. If the pattern succeeds, then the price can touch up to $170 in the short term and close above the next resistance zone at $200.

As the RSI is seen at 57 levels, it indicates that there is room for upside. However, the price is trading above 50 SMA. The price is trading near the upper Bollinger Band; in the short term, the band can expand, and a short recovery can be seen.

Chart Source: TradingView

Looking at the long-term view on the daily timeframe, on 21 and 22 Dec the price fell from $180 to the $146 zone. After that the price takes a breath and forms small tiny candles, and yesterday a bull candle formed, invalidating the weakness.

Apart from this, AAVE is still stuck inside a descending channel, so the bigger picture has not really improved yet. The recent bounce came from the middle of the channel, which was expected, but it has not been enough to change the trend.

Chart Source: TradingView

Volume on the daily timeframe is still on the weak side. Buyers are present, but not with enough force to change the direction. On the chart, the RSI turned from the 30 level, which is known as the oversold zone, and is currently sitting near 37, which shows the possibility of more upside. If the price holds the $150-$145 zone and sustains above it, the price prediction for next door is towards the $200 zone.

Token is getting some short-term breathing room after a long drop. Momentum has picked up near support, but the bigger structure is still unclear since price remains inside a descending channel. The $150 area matters here. If that level slips, attention will likely shift back to lower zones.

Disclaimer This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile; do your own research before making any investment decisions

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.