The Abu Dhabi BlackRock Bitcoin ETF investment story has taken center stage in global crypto news. Two major sovereign wealth funds from Abu Dhabi have built positions worth more than $1 billion in BlackRock’s spot Bitcoin ETF, known as IBIT. This move signals growing confidence in the crypto asset, even during market weakness.

Recent 13F filings with the U.S. Securities and Exchange Commission show that Mubadala Investment Company holds 12,702,323 shares of BlackRock IBIT, valued at about $631 million at year-end prices. This represents a 46% increase from its previous quarter filing. For much of last year, Mubadala held over 8 million shares, but it used the market pullback to grow its position.

Al Warda Investments, linked to the Abu Dhabi Investment Council, reported owning 8,218,712 shares worth around $408 million. Combined, these holdings pushed the Abu Dhabi BlackRock BTC ETF exposure above $1 billion at the end of last year.

Source: X (formelry Twitter)

This development stands out in abu dhabi crypto news because it shows oil-rich funds increasing exposure to digital assets through regulated U.S. products.

BlackRock IBIT is the largest spot BTC ETF in the United States, managing around $58 billion in assets. The Abu Dhabi BlackRock Bitcoin ETF stake highlights how institutional investors are using ETFs instead of directly holding the asset.

Even though BTC price today is under pressure, these funds treated the dip as a buying opportunity. It has fallen roughly 20% this year, and the current value of their combined position has slipped closer to $800 million. Still, the long-term commitment remains clear.

Institutional buying during a Bitcoin price crash often sends a strong message to the market. It suggests that large investors see value despite short-term volatility.

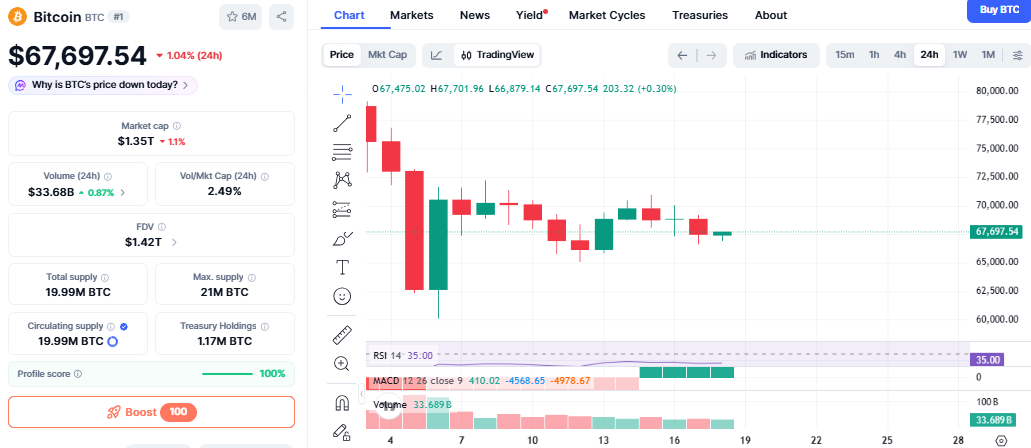

At the time of writing, Bitcoin price today stands near $67,697, down about 1% in 24 hours. The broader crypto market also declined, and the digital currency moved closely with total market capitalization. Data shows a 54% short-term correlation with Gold, pointing to macro-driven flows.

Source: CoinMarketCap Chart

Technically, BTC is trading below its 30-day Simple Moving Average around $67,932, which now acts as resistance.

Immediate support sits near the 61.8% Fibonacci level at $67,603. If it holds above this level, it could attempt a retest of the $67,932 zone. However, a clear break below $67,603 may open the door to $67,169 as the next support.

Derivative data does not show extreme stress. Open interest is slightly higher, and liquidations remain moderate. This suggests controlled selling rather than panic.

The Abu Dhabi BlackRock BTC ETF move shows that sovereign wealth funds are willing to increase exposure even during weak market phases. While short-term technicals lean bearish, strong institutional participation may provide long-term support.

For now, traders should watch the $67,603 level closely. Holding above it could stabilize BTC news in the near term. A breakdown, however, may extend the correction before any meaningful recovery begins.

YMYL Disclaimer: This content is for informational and educational purposes only and should not be considered financial or investment advice. Cryptocurrency investments are highly volatile and involve significant risk. Always conduct your own research and consult a qualified financial advisor before making any investment decisions.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.