ANAP bitcoin holdings has reached its goal of owning over 1,000 bitcoin. Japanese fashion company is now one of the few consumer brands to have so much a large amount of Digital assets in its account. The company worked carefully and made smart partnerships to get there.

Source: X

CEO Yuta Sawaki sees the digital asset as a global safe that can strengthen the company and protect it from financial risks and market volatilities.

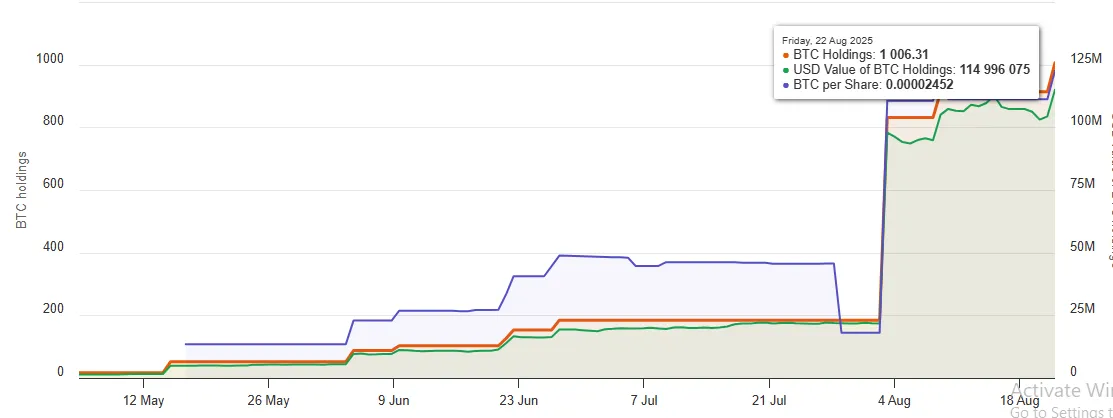

The plan of ANAP Bitcoin as a special reserve came in early 2025, that it would buy, calling it “digital gold.” It is commendable how the company built a hoard of 1000 ₿ in just four months. Although began accumulating in mid April, a major spark started from June 2025, when it had 102 BTC. A huge part that helped in the milestone is from Capital T Coin Corp., when it transferred around 584 BTC as a gift.

As of today it holds a total of 1,006 BTC worth $114 million, on the average of cost of $705 per coin, which represents a ~16K profit percentage, according to current market price, $113K.

Source: BitcoinTreasury.Net

Most companies holding large BTC reserves are generally in Technology, finance or mining. But ANAP bitcoin move started a new discussion forum. A clothing and retail company marking its presence in the world where big players are already competing. Not only this retail firm, but there are mainly organisations around the world, gathering the attraction through their crypto reserves. Some of them are:

Fold Holdings (USA): 1,492 ₿, payments

Canaan Inc. (USA): 1,484 ₿, tech/mining

Remixpoint (Japan): 1,232 ₿, tech

Bitfarms Ltd. (Canada): 1,166 ₿, mining

Note: Numeric Data are from BitcoinTreasury.Net

Bitcoin’s price can change a lot, but more companies are getting interested.then what next?, could this park new innovations, like crypto-themed fashion products or lifestyle offerings? or can other consumer brands follow the lead?

ANAP bitcoin holding shows that even fashion brands see crypto as a long-term store of value. Its plans include a trading desk, crypto-themed products, and mining support. This move shows a new trend of consumer brands entering crypto, so, let’s see if it helps or risks the firm.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.