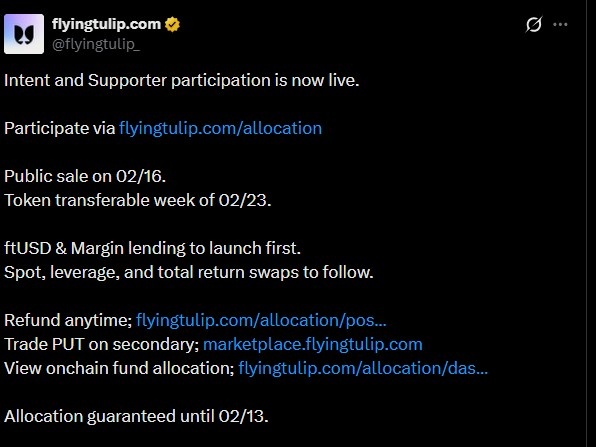

Andre Cronje has officially announced that his new DeFi venture, Flying Tulip , will launch its public sale on 02/16, open to all participants. Token transferability is scheduled for the week of 02/23, with deposits capped at $1 billion. The developer clarified that this is not a direct raise; instead, deposits are allocated into low-risk yield strategies such as Aave and Lido.

Users can redeem deposits at any time without restrictions. All protocol revenue, fees, and generated yield will be used to buy back FT and distribute value back to participants. This structure aims to provide downside protection while offering upside potential through token performance.

Source: X official

According to the official dashboard, the current invested value stands at $127.41 million, the cumulative yield has reached $87.63K, and the total FT value is $128.31 million. Notably, earnings are already being generated before the full protocol launch.

Funding history highlights strong institutional support:

Initial $200 million raise from Brevan Howard Digital, CoinFund, DWF, FalconX, Hypersphere, Lemniscap, Nascent, Republic Digital, Selini, Sigil Fund, Susquehanna Crypto, Tioga Capital, and Virtuals Protocol.

Follow-on $25 million round from Amber Group, Fasanara Digital, and Paper Ventures.

Highest raise on Impossible Finance at $55 million.

Third-largest raise on CoinList with $10 million.

The scale of backing signals confidence in Andre Cronje’s structured DeFi design and investor-protection model.

Flying Tulip introduces a “deposit with refund” approach. Funds are deployed into low-risk yield, currently 100% allocated into Aave. Depositors receive FT tokens. If FT outperforms the initial value, users withdraw tokens to gain. If not, they refund their principal at $0.10 per token, forming a programmatic floor.

The 10c protection works automatically. If someone sells below that mark, refund collateral unlocks and repurchases tokens to stabilize the price. Redemptions are already visible on-chain through the official dashboard and registry contracts.

There are no refund conditions. Investors control access through a PUT option and can withdraw anytime without interacting with the team.

The product becomes fully active once transferability begins. Every fee and yield source buys FT and redistributes it. Although volatile tokens are usually unsuitable for fixed returns, the 10c mechanism ensures minimum yield while allowing upside exposure.

Token Price: $0.10 per FT token.

Total Supply: 10,000,000,000 FT.

Public Sale Allocation: 2,000,000,000 FT (20% of total supply).

Vesting: 100% unlocked at TGE, initially wrapped in the Perpetual Put structure.

Minimum Purchase: $100.

Accepted Assets: USDC, USDT (ERC-20)

Initial offerings include:

ftUSD, a native stablecoin settlement layer. At launch, it wraps USDC into Aave. Later, it enables delta-neutral yield strategies similar to Ethena’s model, targeting 4%–8% returns on USDC or USDT deposits. Expansion modules may include CDP features and arbitrage tools.

Margin Lending is an equity-based system rather than an LTV-based system. It functions as a cross-exchange margin account, supporting standard lending and efficient on-chain leverage. Spot trading, leveraged spot, and Total Return Swaps are part of the roadmap, though rollout will be phased and capped initially.

Deployment is live across Ethereum, Sonic, Binance Smart Chain, Avalanche, and Base, with reviews underway for Hyperliquid, MegaETH, and Monad.

Flying Tulip represents Andre Cronje’s latest structured DeFi experiment, combining capital protection with yield generation. With institutional backing and a transparent on-chain model, Andre Cronje aims to reshape public token launches through refund rights and sustainable revenue design.

YMYL Description: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments carry risk, including potential loss of capital. Readers should conduct independent research before participating in any public sale or DeFi protocol.

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.