Arbitrum crypto is back in the spotlight with a big price rally. The token is now trading at $0.368, after jumping over 20% in a single day. In the past week, the price is up 40%, and in the last month, it has gained more than 10%. But why is Arbitrum pumping today? Let’s look into the key reasons behind this sudden spike.

Robinhood Fireside Chat Sparks Hype: At the Cannes Lions event, Robinhood hosted a fireside chat featuring Ethereum co-founder Vitalik Buterin, Robinhood Crypto’s GM Johann Kerbrat, and Offchain Labs’ CSO A.J. Warner.

Source: X

The event led to speculation of a possible Robinhood-Arbitrum partnership, especially after earlier rumors that Robinhood might use Arbitrum or Solana to offer stock trading in Europe. This buzz around a potential partnership has played a key role in the recent price surge.

Gemini Launches Tokenized Stocks: In another big move, Gemini launched tokenized US stocks on the Arbitrum network through a deal with Dinari. The service started with MicroStrategy (MSTR) and allows 24/7 trading of US stocks using blockchain. This step by Gemini Launches Tokenized Stocks has increased market attention and brought new utility to the ecosystem.

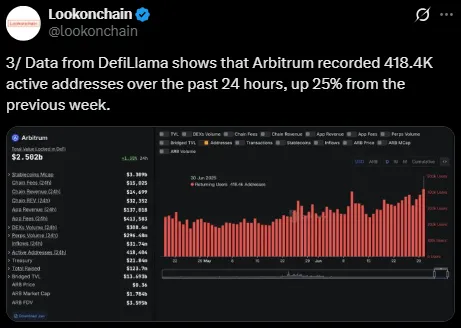

Whale Activity and On-Chain Data: According to DefiLlama, the platform had 418K+ active addresses in the past 24 hours, up 25% from the previous week. A multisig wallet possibly linked to Gelato Network sent 20M tokens to market maker GSR.

Source: X

Since then, GSR deposited 9.48M ARB to Binance, and another wallet (possibly linked to Monetalis) now holds over 77M ARB, making it the 13th largest ARB holder. This shows increasing market interest and whale activity in this crypto.

The chart shows a bullish breakout. It recently hit a high of $0.38, and the RSI at 63 suggests there’s still room for growth. MACD is in the positive zone.

Source: TradingView

Bullish Scenario: If momentum continues, it could break above $0.38, head towards $0.42, and reach $0.50 in the coming weeks. If the broader market supports this trend, ARB coin price prediction may reach $1 by Q4 2025.

Bearish Scenario: If it fails to stay above $0.34, the price may drop to $0.30 or even $0.28. A reversal in RSI or MACD could confirm the trend weakness.

So, the current price zone is critical, and price prediction depends on volume strength and market behavior.

With rising activity, whales getting involved, and strong brand collaborations, the crypto is regaining attention. Both the Robinhood partnership talk and Gemini launches tokenized stocks news show big players are trusting the network. While risks remain, especially with market volatility, many in the community see it as a good time to explore ARB coin.

Arbitrum’s sudden surge isn’t just hype—it’s backed by strong updates from Robinhood, Gemini, and a sharp rise in on-chain activity. If this trend continues, ARB might aim for $0.50 soon and possibly $1 by year-end. But investors should stay alert for market changes.

Disclaimer: This article is for informational purposes only and does not offer financial advice. Always do your own research before investing in cryptocurrencies.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.