In a massive move to boost digital asset space, Argentina’s central bank, Banco CEntral de la República Argentina, is reviewing plans to let banks offer crypto trading and custody services. If approved, this move would lift the long-standing Argentina crypto ban that has kept traditional banks out of digital assets.

Source: Wu Blockchain

For years, traditional banking systems were prohibited from touching cryptocurrencies. Now, regulators aim to shift from prohibition to oversight, bringing Bitcoin and stablecoin use into a regulated framework. This aligns with President Javier Milei’s market-friendly reforms and the country’s growing cryptocurrency ecosystem.

With the signals already pacing the way, is the country ready to open its banking systems to cryptocurrency? And why is it looking more strong now?

The shift comes from necessity. With high inflation and capital controls, Argentines have relied heavily on digital assets to protect their savings. Many receive salaries in Bitcoin or stablecoins and use them for everyday spending.

By allowing banks to handle cryptocurrencies, regulators aim to bring this widespread activity into the formal financial system, improving KYC and AML compliance and offering stronger consumer protection.

Currently, in the absence of regulatory overviews, local exchanges dominate the crypto market in Argentina. If banks join, they bring large customer bases, risk management expertise, and better capital infrastructure. This could lower trading fees, shrink spreads, and boost trust for users who previously avoided exchanges.

However, bank will need to meet strict capital and liquidity requirements for handling volatile digital assets like Bitcoin and stablecoins. Custody systems must be upgraded, and security standards strengthened. The competition promises better services for users while ensuring safer operations.

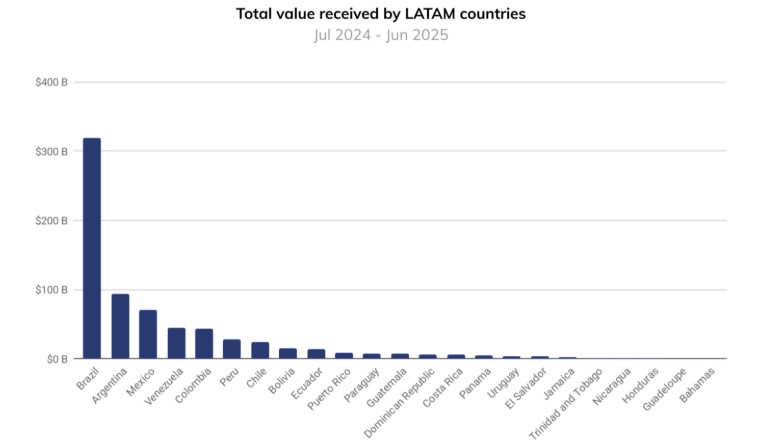

Following the global trend, Latin America’s crypto market is also growing rapidly. According to Chainalysis, between July 2022 and June 2025, transaction volumes reached nearly $1.5 trillion, with Brazil leading at $318.8 billion and Argentina second at $93.9 billion. Mexico, Venezuela, Colombia, and smaller markets like Peru and Chile are also seeing strong adoption, highlighting the region’s growing reliance on digital assets.

This policy change, knocking at this crucial development time period, could place the country as one of the most regulated crypto-markets in Latin America, offering safer on-ramps for users and new revenue streams for banks.

Allowing traditional institutes to trade and hold digital coins would be a historic step for Argentina crypto adoption, combining regulatory oversight with practical access for millions.

It reflects the country’s recognition of cryptocurrency as a key tool for financial stability in a challenging economic environment. For the digital asset community, it means safer services; for banks, it means a new business opportunity; and for the region, it marks a significant milestone in LATAM crypto adoption.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.