As Q1 2026 is moving toward its final months, searches around the AriChain listing date are rising fast. Some users expect a long-awaited launch, while others now question whether the project will ever list at all. The uncertainty has created a split narrative—hope on one side and scam fears on the other.

Community discussions intensified after a post from AriWallet Chain on X hinted that the token generation event (TGE) is “99% here.” However, since this update did not come from the core team, it cannot be treated as an official confirmation.

Source: X Post

The AriChain listing date is widely speculated to fall in Q1 2026, mainly due to past community-facing hints and common launch behavior of Telegram-driven crypto projects. February and March often see higher liquidity and stronger trader activity, making them popular months for new listings.

Another key signal is the expected TGE announcement. Community tracking suggests February as a possible window. If confirmed, it would indicate that development has not stalled. Until then, the AriChain listing date remains speculative, not guaranteed.

According to the circulating post, the ARI token supply is capped at 500 million, with 77.8% locked for ecosystem growth. No circulating supply data has been officially released yet.

Based on early-stage token launches with similar supply structures, ARI token price prediction models used by CoinGabbar analysts suggest an initial range of $0.20–$0.60. Some long-term projections stretch toward $1–$3, but only if liquidity, exchange listings, and roadmap execution align. These figures are estimates, not guarantees.

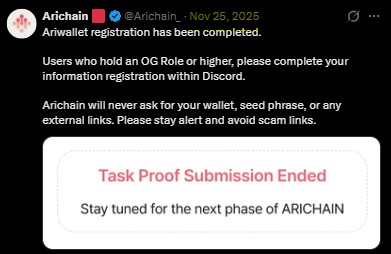

One major concern around the AriChain listing date is the lack of official communication. The project’s main X account has been inactive since November 2025. There is still no confirmed TGE date, exchange partner, presale record, or detailed tokenomics release.

Source: Official X

For many users, this silence mirrors patterns seen in abandoned projects. Others argue that delayed communication alone does not prove fraud, but the absence of transparency increases risk perception.

Despite concerns, the roadmap outlines multi-VM testnet, intent rollout, multi-VM mainnet, and ecosystem expansion. These are infrastructure-heavy milestones, suggesting long-term technical planning rather than a quick token flip. Whether these plans are active or paused remains the critical question.

The AriChain listing date is still possible in 2026, but far from certain. Community hints and roadmap depth offer some optimism, while silence and missing disclosures justify caution. Users should watch for official announcements, not social speculation, before forming expectations.

YMYL Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments carry risk. Always conduct independent research before making financial decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.