Canary Capital has filed an S-1 form with the U.S. Securities and Exchange Commission (SEC). This is for an exchange-traded fund (ETF) that tracks Axelar’s AXL token.

This is a big step for Axelar. It means more investors may soon buy AXL through an ETF. If approved, this will be the first ETF for Axelar’s token.

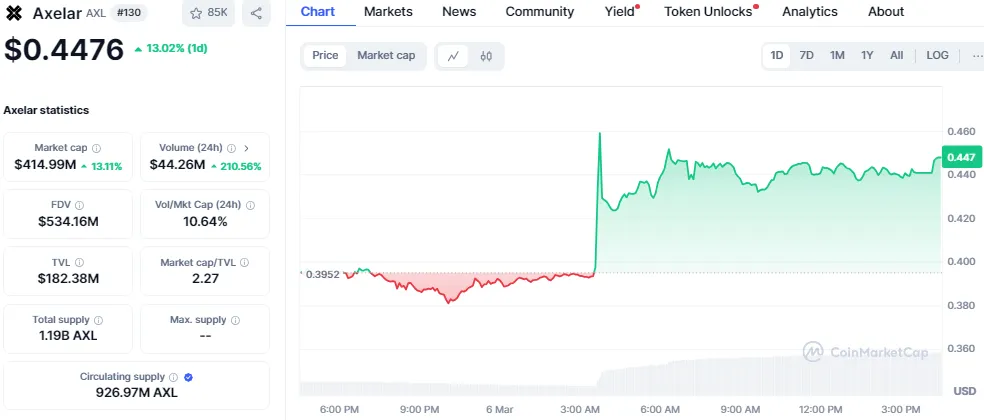

After the ETF announcement, Axelar’s AXL token surged 15%. The price reached $0.44 before settling.

Investors reacted quickly to the news. Many believe the ETF will bring more demand for AXL. The market is now watching for SEC approval.

Axelar is making it easier for blockchains to work together. The platform connects major networks like Ethereum, Arbitrum, and Optimism. This helps users move assets and data smoothly across different chains.

Axelar has also partnered with big names like J.P. Morgan, Microsoft, Uniswap, and MetaMask. These partnerships strengthen its position in the crypto world. With strong connections and growing support, Axelar is set for more success.

Axelar’s co-founder, Sergey Gorbunov, believes clear rules will help crypto grow. He says regulatory clarity is key to bringing in more institutions.

Big companies want to follow the law when using blockchain. Clearer rules will make them feel safer. With Axelar’s strong partnerships and focus on compliance, the platform is ready to attract more institutional users.

Axelar is growing fast with support from top investors. Binance, Coinbase, Dragonfly, and Polychain have backed the platform. This shows strong trust in Axelar’s future.

Axelar passed $1 billion in total value locked (TVL). This means more people and institutions are using the platform. A high TVL helps build confidence in the project.

Brooks is a well-known name in the crypto world. His experience in legal and financial matters will help Axelar grow. His involvement also shows strong institutional interest in the platform.

With Brooks on board and major investors backing it, Axelar is in a strong position for future success.

Crypto-based ETFs are becoming more popular. Canary Capital is leading the way by filing for multiple altcoin ETFs, including Solana ETF, XRP, and Litecoin. These ETFs allow investors to gain exposure to crypto without directly holding the assets.

Recently, Canary Capital’s Litecoin ETF was filed on the DTCC platform under the ticker LTCC. This has sparked speculation that approval could come soon. The success of Bitcoin and Ethereum ETFs has encouraged more filings, showing strong institutional interest in regulated crypto investments.

Mohit Raghuwanshi is an Indian journalist working at Coin Gabbar’s news desk, passionately following the ever-evolving crypto market. With a keen interest in blockchain technology and digital assets, he delivers in-depth reports on industry trends, regulations, and market movements. He holds a bachelor's degree in Journalism and Mass Communication and previously worked as a content writer at a PR agency, honing his skills in crafting compelling narratives and analyzing financial markets.