Could stablecoins really threaten traditional banks? During Bank of America's Q4 earnings call, CEO Brian Moynihan said that yield-bearing stablecoin could drain as much as $6 trillion from U.S. bank deposits.

Unlike USDT or USDC, these digital coins hold their reserves in safe assets and do not lend them out; such a scenario could hike the costs of loans for consumers and small businesses.

Source: Crypto Rover

Moynihan also said that if deposits start to move into stablecoins, then banks would have to resort to more expensive funding. Though he added that Bank of America would adjust, crypto enthusiasts view the warning as confirmation that stable coins are gaining traction for their higher yields compared to traditional saving accounts’ near-zero interests.

The fixed value pegged virtual coins work similar as money market funds, maintaining deposits in secure assets in-place of fueling loans. This reduces the banking system’s lending capacity and could affect smaller organizations unequally.

The concern is shared by banking groups lobbying Congress to regulate stablecoin yields under frameworks like the GENIUS Act and proposed CLARITY Act, which restricts direct interest but allows transaction or staking rewards.

The statement directly ties with the debate over the Digital Asset Market CLARITY Act, which seeks to restrict yields or “rewards” on stablecoin to prevent them from competing with bank deposits. Banks are strongly pushing for these restrictions, however, private players showing great discontent.

Coinbase head Brian Armstrong publicly pulled back its support for the act a few days ago, calling it harmful for stablecoin rewards, DeFi privacy infrastructure, and innovative space. The withdrawal of the nation’s largest crypto trading platform leads to the Senate Banking Committee to delay markup, stalling pro-crypto reforms.

Market experts said that the move favors traditional monetary systems, but strong opposition keeps delays and puts regulations in limbo.

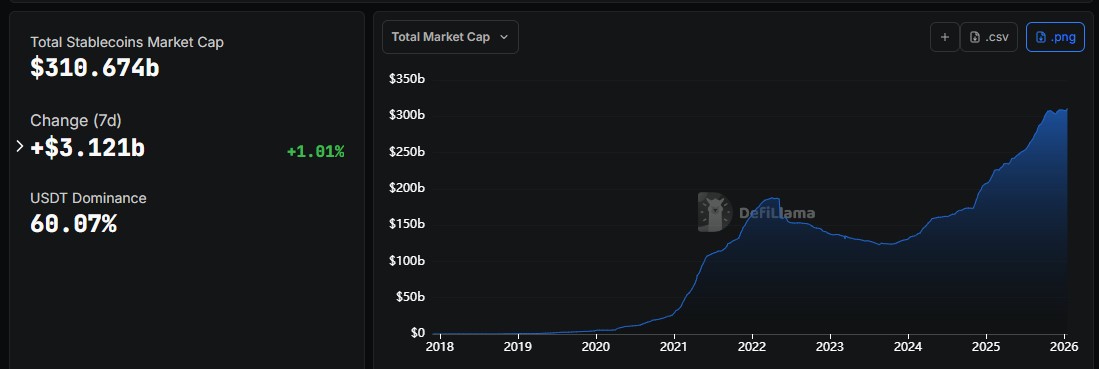

Despite being involved in regulatory issues, the crypto market exhibits momentum. The stablecoin facilitate payments as well as cards above $1.5 billion on a monthly basis, and Interactive Brokers provides USDC, RLUSD, and PYUSD as funding options for accounts. The market capitalization of stablecoin is above 310 billion, with 222 million users worldwide.

Source: DeFiLlama Data

The tug-of-war between banks and crypto innovators also underlines a critical juncture in which stablecoins are revealed to be a true competitor to traditional finance. Yields in their regulation might well end up determining in which capacity these stablecoins are developed.

As for now, this January 2026 provides evidence about rising tensions in the American financial sector, with banks securing their funds, and the value of cryptos being confirmed in the mainstream finance system.

Disclaimer: This article is for informational purposes only. It doesn’t consist of any financial advice. Crypto investment carries risk.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.