What happens when a crypto project declares “TGE INCOMING,” then quietly reshapes the dates? That question is now driving market attention as BlockDAG launch date and TGE delay updates triggered confusion on $BDAG mainnet day.

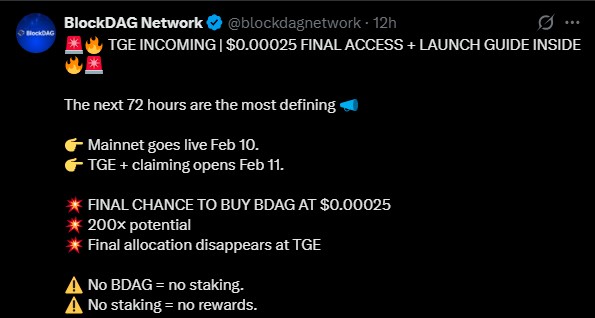

On X, the official BlockDAG Network account framed the next 72 hours as decisive. The message was sharp: mainnet on February 10, Token Generation and claiming on February 11, and final access at $0.00025 price. With BDAG exchange listings 2026 teased across MEXC, LBank, XT, Coinstore, and BitMart, the transition looked locked.

“Then the website told a different story, raising fresh questions among investors around the project's timeline.” In this article, we will cover the key development behind these massive changes.

As of today, BDAG Mainnet is still set for February 10. However, visitors noticed that BlockDAG launch date and TGE milestones no longer align across platforms.

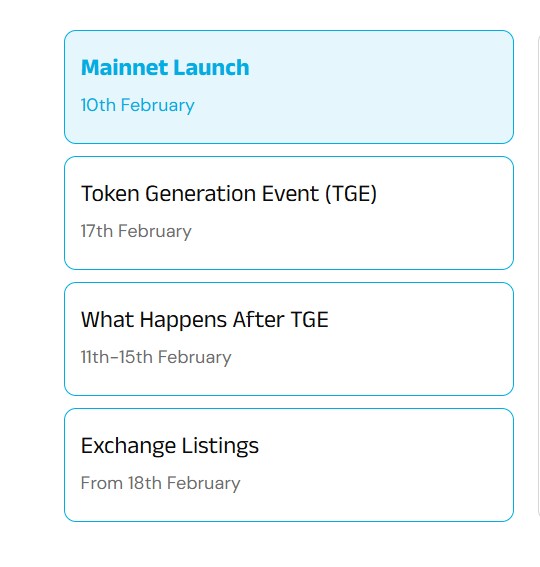

On the BDAG mainnet website, the Token Generation Event appears shifted from Feb 11 to Feb 17. Exchange listings, earlier shown as February 16, now moved to 18th of this month. Meanwhile, the primary main page still shows February 16 for listings, adding to the mismatch.

The most confusing gap is February 11–15. This window is now described as an infrastructure readiness phase.

Key clarifications many missed:

Token Generation Event on February 17 is token issuance and claiming, not trading

Tokens must be manually claimed via the network’s dashboard

Trading begins from February 18, and each exchange lists independently.

This creates a logical sequence—BDAG Mainnet (10th) → Infrastructure (11–15) → TGE (17th) → updated BlockDAG listing date (18th).

“Traders should note that these dates should be treated as updated roadmap guidance, not a final timeline schedule until the real X account confirms it.”

Timeline shifts at this stage usually signal recalibration, not collapse. With a presale price fixed at $0.00025, aggressive 200× narratives, and staking locked behind token ownership, the project cannot afford a flawed debut.

“Any problem—technical issues, low liquidity, or exchange delays—can hurt trust. Taking more time helps reduce that risk.”

Another factor is remaining inventory. On-chain figures show that out of a 50 billion presale allocation, about 97.89 million tokens remain unsold. While small, visible leftover supply can increase early sell pressure. Extending the window allows demand to tighten before open markets.

The private allocation also remains open at $0.00025 until Token Generation Event. This phase includes no vesting, 100% token delivery on launch day, and a roughly nine-hour head start before public trading.

Despite BDAG Listing and TGE delays, hype remains strong. The confirmed $0.05 listing price still implies nearly 100× upside from presale. However, a more controlled launch may cap extreme spikes.

Revised listing range: $0.035–$0.055 (Early profit-taking is likely due to zero vesting, with possible dips below $0.04 before stabilization.)

Short-term BDAG launch price outlook:

Mid-February: $0.12–$0.20

March: $0.10–$0.16 consolidation, but steady adoption and miner growth could support $0.22–$0.35 range.

Expert Perspective: As per Coingabbar’s market expert, these changes focus more on stability than speed. A controlled token release, delayed trading, and stronger infrastructure can help lower the risk of a sharp price crash.

The BlockDAG launch date and TGE delay reflect caution, not collapse. BDAG Mainnet is live, distribution is controlled, and trading is staged. Until all official channels align, investors should treat dates as guidance, watch claiming rules closely, and expect steadier price action over hype-driven spikes.

YMYL Disclaimer: This article is strictly for informational purposes only and not financial advice. Cryptocurrency investments involve risk. Readers should verify details and do their own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.