The crypto market got big news after Binance confirmed the RLUSD Integration on the XRP Ledger. Deposits for RLUSD are now open with full network support. Withdrawals will begin once enough liquidity is available.

Ripple’s Senior Vice President Jack McDonald called this move a “big deal.” Since it is the largest crypto exchange in the world, the Binance RLUSD Integration gives Ripple USD strong global exposure. It also sends a clear message that Ripple’s ecosystem is growing fast.

Source: X (formerly Twitter)

The announcement was made during XRP Community Day, where Ripple leaders shared their future plans for the network.

The Binance RLUSD Integration is not just another listing. It is a stablecoin, which means its value is tied to the US dollar. Stablecoins are very important in crypto because they help traders move money quickly and safely.

With RLUSD now available on the exchange, trading on the XRPL could become smoother. More liquidity usually means better price stability and faster transactions. This step also connects traditional finance with blockchain technology.

Recently, Franklin Templeton’s Onchain U.S. Dollar Fund was linked with RLUSD to improve liquidity. This shows that big financial companies are slowly entering the Ripple ecosystem.

The Binance RLUSD Integration comes at a time when institutions are showing more interest in the token. Reports say Goldman Sachs held about $152 million worth of XRP ETFs by the end of Q4 2025.

Ripple is also working with Aviva Investors to explore tokenizing traditional funds on the XRP Ledger. Tokenization is becoming one of the biggest trends in crypto because it allows real-world assets to be traded digitally.

Ripple CEO Brad Garlinghouse has said that XRP is at the center of the company’s long-term vision. He believes the organisation can grow to a trillion-dollar scale in the future.

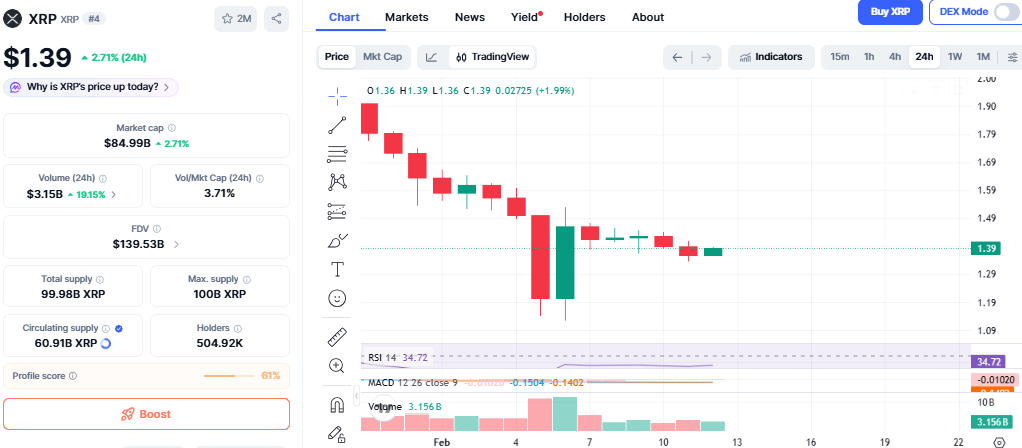

It is currently trading around $1.39, up about 2.5% in the last 24 hours. It is performing slightly better than Bitcoin in today’s market.

Even though this is positive news, the recent price move looks mainly technical. It bounced after becoming oversold. The Relative Strength Index (RSI) was near 34, which usually signals that selling pressure is slowing down.

Source: CoinMarketCap Chart

Buying volume also increased, and the price found support near $1.36, a key Fibonacci level.

Support Level: $1.36

If it stays above this level, the bounce may continue.

Resistance Level: $1.54

If buying pressure increases, it could test this level next.

If it falls below $1.36, the price could drop toward $1.13. Market sentiment is still in “Extreme Fear,” so traders should remain careful.

The Binance Integration is a strong long-term positive step for the overall ecosystem. However, in the short term, it still needs strong buying support.

If it holds above $1.36 and volume stays strong, the price could move toward $1.54. But if support breaks, the rally may slow down.

For now, the outlook is slightly positive but cautious.

The update shows that Ripple is expanding and building strong partnerships. Listing RLUSD on Binance increases trust and visibility in the market.

While XRP’s current price rise looks technical, the long-term impact of this integration could be much bigger. Investors should watch key support levels and overall market sentiment before making decisions.

Crypto markets remain volatile, so always manage risk carefully.

YMYL Disclaimer: This content is for informational purposes only and not financial advice. Crypto investments are risky. Do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.