Early 2026 did not start quietly for XRP. In the first week itself, the price moved close to 30%, and for a moment, it felt like XRP was finally waking up with the market. That move pulled attention back, especially as the broader crypto market was also gaining momentum.

After that jump, XRP cooled off. The price slipped lower, volume slowed, and the excitement faded a bit. This is the phase where things usually get confusing—not panic, not hype either, just a pause. That is exactly why XRP Price Prediction 2026 matters right now.

The big move already happened; now what comes next? Was that early push just a short reaction, or was it the start of something bigger? And if XRP does move again, will it hold or fade the same way it has in past cycles? Let's solve this puzzle below.

ETF data shows clients picked up $8.72 million worth of altcoins, pushing total ETF-held assets to $1.49 billion. This buying came after the early 2026 move, not at the top, and that matters.

Source: X@WhaleInsider

ETF money usually does not chase fast pumps. It builds positions when the price cools down. This does not guarantee a rally, but it does lean bullish. It shows XRP is still being accumulated quietly, even while short-term price action looks uncertain.

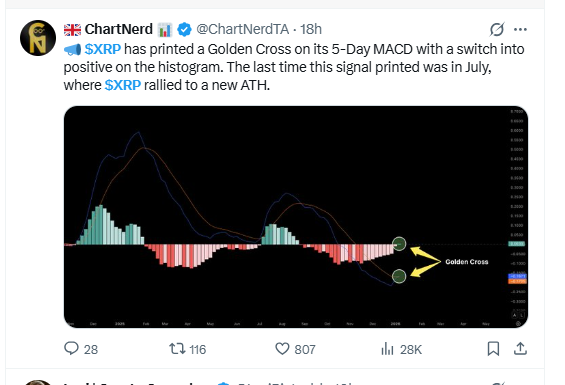

A Golden Cross has appeared on the Ripple's 5-Day MACD with a switch into positive on the histogram, and this signal has mattered in the past. Earlier scenarios of a similar crossover were followed by strong upside moves and a new all-time high.

Source: X@ChartNerdTA

The current signal is not new, but it is active again during a consolidation phase. This does not guarantee a rally, but historically, when this crossover held, XRP price momentum improved rather than faded.

On the 4-hour chart, price faced resistance and a sell-off near the $2.40 area. Price tried to stay above $2.30, but it did not hold due to selling pressure. Since then, XRP has slipped into the 0.5–0.618 Fibonacci zone around $2.10–$2.16. This area is where price is trading right now without any clear direction yet; price is in hesitation inside the current market structure.

Source: TradingView

Below this zone sits the 200 EMA, and just under that is the $2.00 psychological level; both matter. Especially $2.00, which earlier acted as resistance. Volume has also faded during this move down, which usually points to cooling, not panic.

If the price holds at the $2.00 area, the price can drift back toward $2.30 first and possibly $2.50 later. If this area fails to act as support, the next area to come into play is $1.80.

On the daily chart, Ripple is following a pattern that has shown up more than once in past cycles. Price usually goes through a sharp move lower, followed by a long, quiet base. Only after that phase does a real upside expansion begin. The recent pullback and sideways movement fit into that same structure.

Source: X@cryptoWZRD_

According to analysts who track Ripple's long-term behavior, these slow zones are the accumulation zone, where positioning often happens. Price is currently holding above the $1.85–$2.00 demand area, a level that previously acted as a launch zone. There is no sign of aggressive selling yet, which keeps the structure intact.

If this base holds, analysts see room for Coin to grind higher toward $2.80–$3.00 later in 2026. A stronger breakout could then bring the $3.20–$3.40 zone into focus. However, a loss of the $1.85 area would weaken this outlook and delay any upside move.

On the weekly chart, this altcoin is showing a familiar RSI behavior that has appeared before major moves in the past. Each time the weekly RSI broke out of a downtrend or compression, the price did not react immediately. Instead, price spent time building a base and then moved higher over the following weeks or months. That same setup seems to be forming again.

Source: X@Steph_iscrypto

Right now, the RSI is trying to hold above its recent break zone, while price remains above key weekly support. This combination usually points to weakening downside pressure rather than a confirmed breakout. According to analysts who track Ripple on higher timeframes, this phase often comes before a broader trend expansion.

If the RSI continues to hold and the price forms a higher low on the weekly chart, the coin could work its way toward the $3.00–$3.50 range first. In a stronger continuation scenario, an extended upside toward $4.00–$4.50 later in 2026 cannot be ruled out. A failure of this RSI setup, however, would delay this price outlook and keep altcoin range-bound longer.

XRP Price Prediction 2026 does not look straightforward or easy. The early 2026 rally already happened. After that, the price cooled off and started moving sideways. This usually decides what comes next. As long as coin holds its major support zones, upside toward $3.00–$3.50 looks realistic over time. In a stronger continuation, moves toward $4.00–$4.50 cannot be ruled out. If support breaks, the outlook slows down, but the bigger structure remains open.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.