As per the reports by WSJ, U.S. Treasury Secretary Scott Bessent has warned President Donald Trump not to remove Federal Reserve Chair Jerome Powell before his term ends in May. According to a Wall Street Journal report, Bessent told Trump that an early Jerome Powell resignation could create panic in financial markets, bring legal trouble, and weaken the independence of the U.S. central bank.

Source: Wu blockchain

While Trump’s team has shown frustration with the chairman's recent decisions, Bessent is urging the President to wait for Fed Chair's eventual exit next spring. The President reportedly found Bessent’s advice “reassuring,” though he hasn’t made a final decision yet.

Several people close to Trump are pushing for Powell’s early exit. They’ve criticized his interest rate policies and even questioned the need for the Fed’s expensive $2.5 billion headquarters renovation. This has sparked talks about a forced Jerome Powell resignation, which would be rare in U.S. history.

In spite of the criticism, Jerome has remained keen on managing inflation and steering the U.S. economy through difficult times. Deposing him early would likely engender political control over the Federal Reserve.

If the Fed chair is ousted before his term expires, global markets could respond sharply.

Experts predict an early Jerome Powell resignation would harm investor confidence, drive uncertainty, and push stocks and bonds into a short-term downturn.

The crypto market would also be affected. Bitcoin and other cryptocurrencies typically react to U.S. interest rate decisions.

Any loss of leadership at the Fed could put crypto price swings into motion, particularly if it postpones or modifies future rate reductions.

Many in the crypto world are watching this story closely. If he leaves early and the Fed becomes more unpredictable, crypto prices could rise or fall quickly.

An unexpected Jerome Powell Resignation could drive investors to seek safer options or, for some, riskier ones like crypto.

On the flip side, if the chairman stays and the Fed cuts rates later this year, crypto markets may go up.

Lower interest rates often lead investors to take more risks, which usually benefits digital coins and tokens.

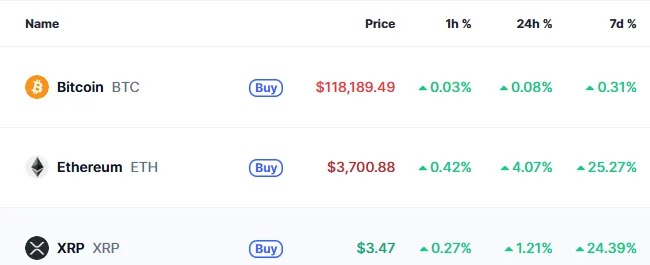

The cryptocurrency market currently has a market cap of $3.89 Trillion which has increased by 1% in the last 24 hours. Bitcoin is trading at $118,189 with an increase of 0.08%, while Ethereum is at $3700 with an increase of 4%, XRP is trading at $3.47 with an increase of 1.21% in the last 24 hours.

Source: CoinMarketCap

Removing Fed Chairperson on frivolous grounds may attract legal wrangles and severe political discussions. The Federal Reserve is modeled to be a political institution separate to the White House and an externally pressured Jerome Powell Resignation would unbalance that equilibrium. This action would perhaps make the presidents of the Fed more reserved or even partisan.

This risk is reflected by a warning that Scott Bessent made. He does not think he has any interest in moving till May and not disrupting markets or harmful effects on confidence in the Fed.

Jerome Powell resignation before the end of his term has been on everyone's lips. From Wall Street to the world of crypto, individuals are anxious about what is going to happen next.

Until now, Bessent's counsel could steady the ship, but the pressure is hardly yet over.

With Trump's re-election bid underway and the economy in the spotlight, Powell's future may be a top question of the coming months.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.

3 months ago

A good article to read. The writer has effectively managed the data to make the article engaging. In my opinion, this is a very good article.