The numbers said “calm.” But the market felt “chaos.”

Despite the U.S. Federal Reserve’s preferred inflation gauge—the Core PCE—falling to 2.5% in April, headline price rise easing to 2.1%, and Trump tariff fear, the crypto market didn’t respond with cheers. Instead, Bitcoin, Ethereum, and most altcoins are deep in the red, with total market cap shedding nearly 3% in the last 24 hours.

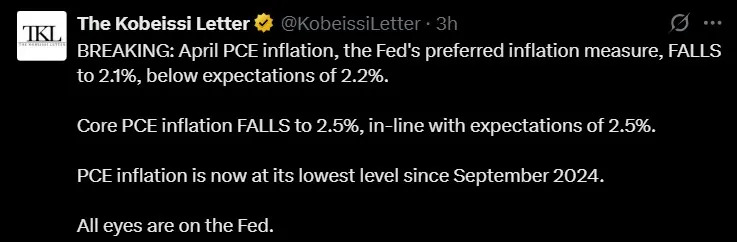

Just hours after this US inflation data dropped, The Kobeissi Letter—one of the most closely watched macro voices on X—posted:

Source: The Kobeissi Letter

That should have been a green light for risk assets. But instead of rallying, markets paused—and then reversed.

What’s going on?

The answer isn’t just in the numbers—it’s in politics, trade tension, and fear. And right now, all eyes are on Donald Trump Tariff news.

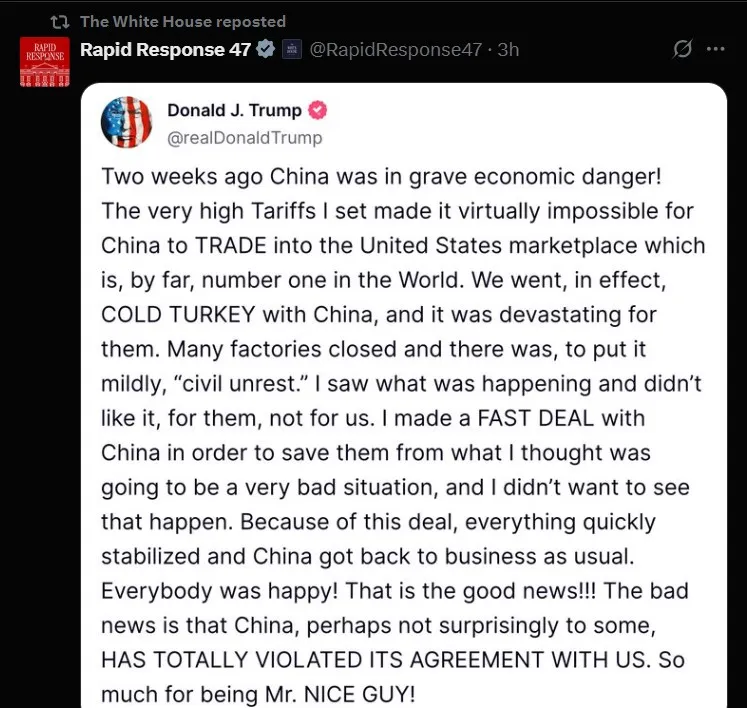

Earlier this week, a White House post on X alleged that China violated its recent trade agreement with the U.S. Donald responded publicly, claiming he had been “too nice” during negotiations and suggesting a renewed wave of Trump tariff could soon hit Chinese imports.

Source: WhiteHouse X

This single message triggered a ripple effect across global markets:

S&P 500 futures dropped 0.5%

Volatility Index (VIX) jumped past its 12-month average

Risk assets, especially crypto, saw immediate selling pressure

To traders who remember the 2018–2020 trade war era, this isn’t just noise. It’s a flashback to uncertainty, when sudden tax destabilized both traditional and digital markets.

Cryptocurrency doesn’t just track (US inflation rate 2025) or interest rates cut-off—it thrives on sentiment and clarity. And when sentiment collapses, crypto often leads the way down.

The problem today is mixed signals:

In the latest US Inflation news, it is falling—usually bullish. According to Karoline Leavitt, the Assistant to the President and White House Press Secretary, posted on X, President Donald J. the economic agenda is working.

Source: Karoline Leavitt X

But trade barrier threats are inflationary long-term—bearish.

The Fed is data-dependent—but this Core PCE inflation US data is outdated and doesn’t reflect new geopolitical risk.

No FED interest rate cut in sight—and the labor market may now matter more to the Fed than inflation.

Meanwhile, April’s U.S. trade deficit dropped from $162.3 billion to $87.6 billion—a record collapse. Imports fell nearly 20%, largely in consumer and industrial goods, especially from China.

But here's the flip side:

Retailers may soon face supply shortages, unable to shift sourcing fast enough.

Lower imports mean lower tariff revenue, possibly undermining tax agenda.

The crypto market has had a solid recovery in recent weeks. But it now stands at a dangerous inflection point. If Trump tariff reignites a full-blown trade war—whether legal or symbolic—it could be the spark that reverses months of gains in risk assets.

Crypto doesn’t fear inflation—it fears unpredictability. And right now, we’re staring into the storm. Stay alert. The weekend could change everything.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.