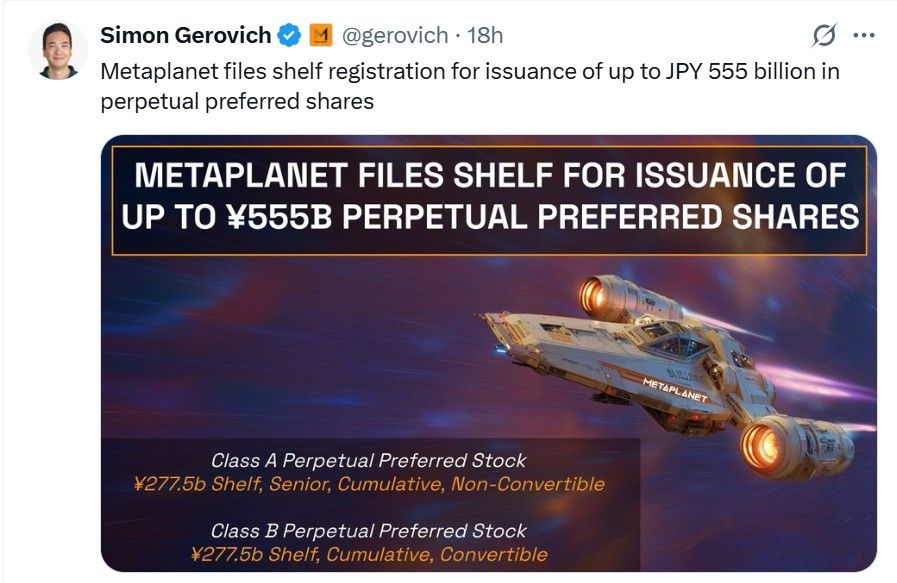

The Japanese digital assets treasury firm Meta Planet Announced that it has filed a shelf registration to issue up to 555B yen which is approx $3.7 billion of shares to fund its Bitcoin accumulation strateg

Source: X

This shelf registration will go effective from August 9,2025 to August 8 2027. Metaplanet plans to issue these securities in portions across the two years when the market conditions align. The latest filing gives a broader prospectus to its previously announced target of raising 210,000 coins by 2027. The plan also depends on the company's request to increase the number of authorized shares from 1.61 billion to 2.723 billion, which was disclosed in the same filing. At the Extraordinary General Meeting (EGM) on September 1, the proposals will be put to a vote. If the proposal is approved the firm will issue two new classes of perpetual preferred shares of Class A and Class B with each having a potential issue value of 277.5 billion yen. These shares would pay out dividends up to 6% more frequently than common stockholders, with the money raised going toward buying digital gold. Metaplanet also stated that there is no specific plan for issuance of Preferred Shares, it is in progress and It is unclear if such an issuance will occur.

Metaplanet started to acquire BTC from last April 2024 since then in 13 months it has accumulated 17,132 BTC which is worth $1.95B. Recently on July 28 the company acquired 780BTC. The proposed raise is 75% of companies total market capitalization 714B and could reshape its future plans.

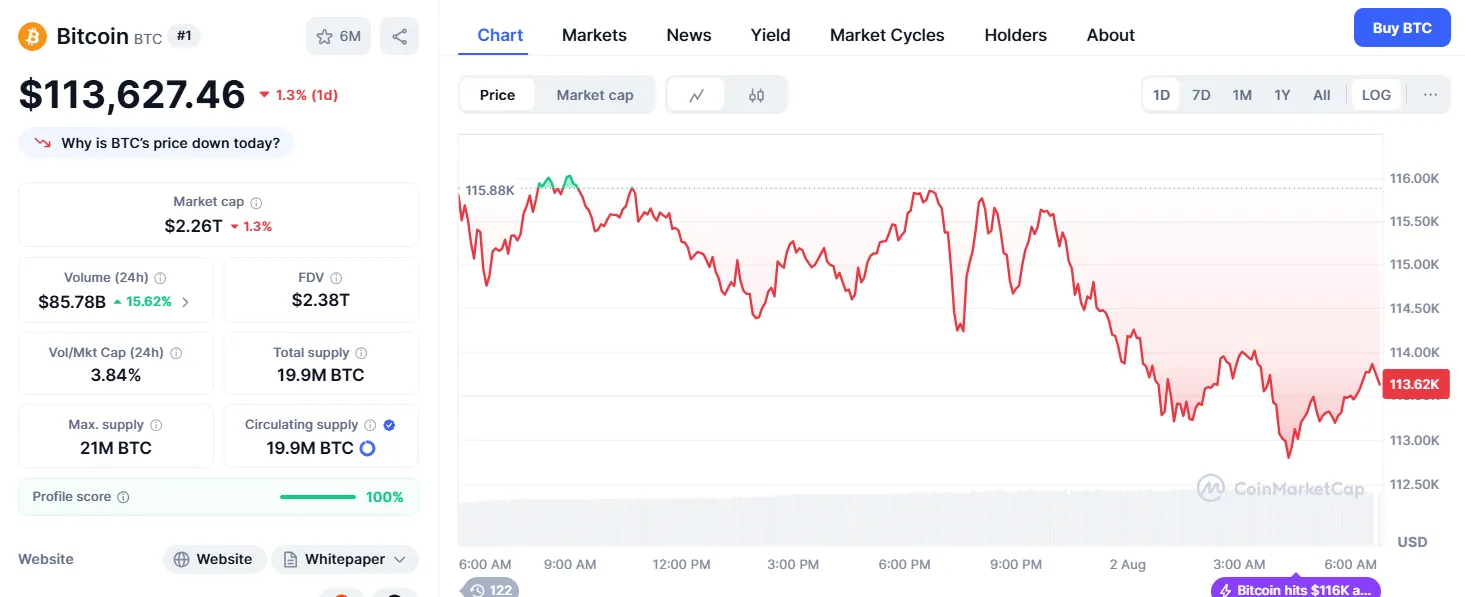

Source: coinmarketcap

Bitcoin has dominated the total crypto market with 61.2%. The dominance shows how this digital gold can play a crucial role in the volatility of the global crypto market. In past months, the token has seen its all time high and trading at $113,627 with a downfall of 1.3% in the last 24hrs, at the time of writing. Many technical and political factors affect the price of coins. Recent announcement of US job data, technical breakdowns and liquidation could be the reason behind the coin’s Dip.

The Bitcoin treasury trend is setting a major goal towards all giant financial institutions. Despite the dip, all of them want to buy and hold BTC, however many of them are turning towards Altcoins like Ethereum, XRP, Dogecoin and SOL nowadays. As per analyst when the token is facing downfall it's a great time to buy more and hold. The downfall shows the historic pattern of correction after hitting its all time high. That's why market sentiments are bullish. Metaplanet buys are signaling strong towards the rise of token again.

It may be approaching the end of its current bull market cycle. As per analyst reports it is anticipated that the token can reach between $130k- $150k target by the end of 2025. Many sleeping whales are awake and aggressively buying the digital gold. Strong institutional absorption is one factor contributing to this continuous balance. Businesses and exchange-traded funds (ETFs) keep accumulating Bitcoin steadily, which helps reaching the target.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.