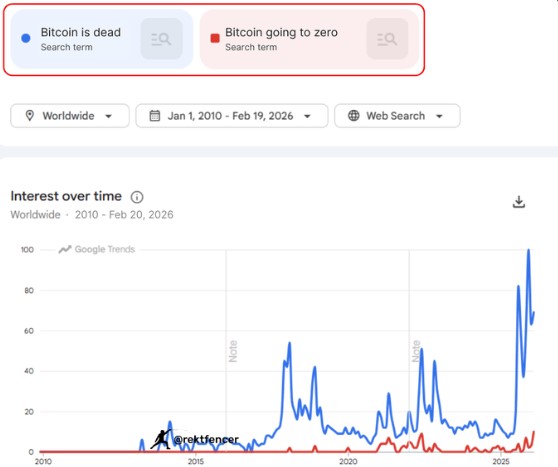

Searches for Bitcoin is Dead are exploring again, and history says this moment matters.

Source: Rekt Fencer

In February 2026, Google Trends data shows the phrase “Bitcoin is Dead” hit a score of 100, matching its all-time high from the November 2022 FTX collapse. That spike has reignited a familiar debate: Is Bitcoin actually going to zero, or is this peak fear before another rebound?

Let’s break down what’s driving this trend and why many investors are betting on it.

The main factor for now pushing Bitcoin $0 narratives is the most obvious one, its continuous declining prices.

After an all-time high of $126,000 in October 2025, the asset has fallen bitterly. Currently it is trading near $67,000 measuring almost 50% value lost since its peak era that too in just a few months. Such fast drops often shake confidence, especially among late buyers.

Notably, BTC after the 2025 crash, only saw downtrends. The coin went into the $110k-90k range in November, $90k–80k range in December 2025–January 2026, and is currently testing in the $70k–60k range.

Well-known market commentators predicting some more worst-case scenarios coming ahead in 2026. Prominent asset managers like JPMorgan and Standard Chartered have also reduced their 2026 BTC price targets.

These headlines amplify panics and often push nervous investors to Google whether the golden asset is truly finished.

Adding on, BTC ETFs have also been measuring consecutive outflows since October, with the current month observing -1.08 billion so far as per SoSoValue Data.

The current “Bitcoin is Dead” search surge mirrors past crash moments. In the 2018 crash, the coin rose nearly 300% from its lows. Following the 2020 panic, it entered one of its strongest bull runs ever. Even after the FTX collapse in 2022, the crypto asset eventually stabilized and recovered.

In these periods, retail fear peaked just as long-term buyers quietly accumulated.

Binance founder and former CEO, Changpeng Zhao weighed in, questioning whether the surge in “BTC going to zero” signals doom, or opportunity. The comment echoed a long-standing crypto belief: maximum pessimism often appears near market bottoms.

The idea of BTC going to zero resurfaced during every major crash, and after which surge is significant. Although that doesn’t guarantee immediate gains, short-term volatility remains, it continues to grow year after year gradually.

Adoption, infrastructure, and institutional involvement also continue to grow the network's strength.

Disclaimer: This content is for informational purposes only and not financial advice. Crypto markets are volatile—do your own research before investing.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.