Digital currency is back in the spotlight this July as traders watch closely for signs of a Bitcoin July All Time High. While the top hasn’t been broken yet, real on-chain data and trader sentiment hint at a possible rally if conditions hold steady.

The Data shows open interest on major cryptoexchanges remains strong. Meanwhile, the forecast by Coinglass highlights Digital coins' history of stable July performance, adding fuel to bullish hopes and new Bitcoin ATH.

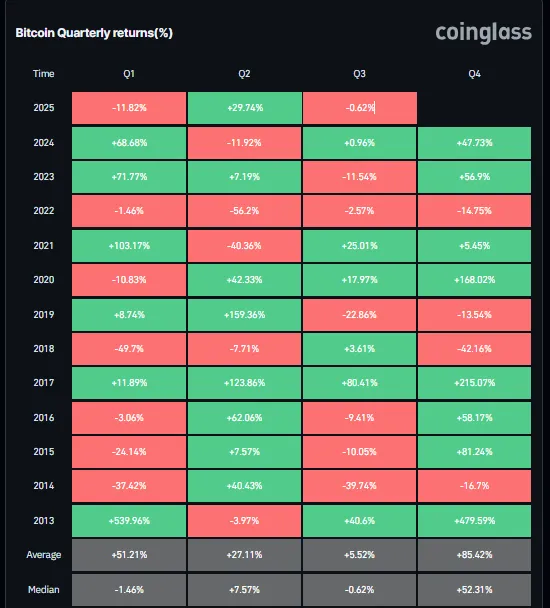

Source: Coinglass

The spark for this renewed hype came when Coinglass posted that digital coins has never dropped more than 10% in any July on record. Many traders see this as an early sign that a new Bitcoin ATH could be possible if no negative shocks hit this month.

So far, macro news has been calm, and there are no fresh crackdowns that could spook the market. That’s enough to get traders watching for any strong push.

Another reason some traders believe a new Bitcoin ATH could happen soon is the fresh data showing up on CoinGlass. So far, the signs suggest that the market still has some strength under the hood, and they are paying close attention.

Open interest is staying steady, which means traders aren’t panicking and closing out their positions. Instead, they’re holding tight, waiting to see if BTC push higher.

Funding rates remain balanced. This shows that wild, risky leverage hasn’t flooded the market yet, a good sign that the price isn’t just running on borrowed money.

Liquidations are calm for now, too. There haven’t been any big sudden wipeouts that force huge sell-offs, which is often a sign that big whales are dumping.

These details matter because when open interest stays strong and liquidations stay calm, it usually means traders have some trust in the trend. It doesn’t promise a new Bitcoin ATH, but it does make a strong rally possible if buyers get a reason to push the price over that final hurdle.

Over the years, BTC has shown some interesting seasonal patterns that traders still keep an eye on. For example, if you look back at 2015 and 2016, the price followed a similar up-and-down flow each quarter.

In 2015, the first quarter saw a drop of about -24%, but by the second quarter, prices had bounced back +7.5%. Then there was another dip of around -10% in the third quarter, followed by a big surge of +81% in the final three months of the year.

In 2016, a similar story played out. The first half started slow with a -3% dip, then the second quarter jumped up by +62%. A small drop of about -9% came in the third quarter, but the year ended strong with a +58% rise in the last quarter.

Looking at 2025 so far, the first quarter saw a -11% slide, but the second quarter already posted a gain of +29%. Now, with a small dip of around -0.6% so far in the third quarter, some traders think B TC might repeat its old pattern, with a strong push in the final months of the year.

While nobody can guarantee what will happen, this repeating pattern from past cycles gives some traders hope that a new Bitcoin ATH could come if the final quarter sees a similar +25% to +30% bump. Of course, the market can still surprise everyone, but past data shows how BTC often saves its biggest moves for the year-end.

These zones matter because they show where big decisions get made. A clean breakout can attract fresh buying pressure and push BTC to new record prices. But if the price can’t hold its ground, traders may wait for a stronger signal before jumping in again.

Traders know Bitcoin’s July trend has a history of surprise upside. Right now, no major government bans or macro shocks have hit. Some institutions also keep adding Bitcoin as a hedge while stocks look shaky.

So far, these small positives are enough for bulls to hold out hope for a new Bitcoin ATH this month, but caution remains essential.

Traders know crypto can flip anytime. A sudden global headline, new tough rules, or a whale dump could wipe out gains fast. That’s why experienced traders:

Use stop losses.

Scale into positions.

Follow verified data from places like CoinGlass and trusted feeds.

Without careful risk control, hoping for a new Bitcoin ATH can backfire quickly.

A new Bitcoin ATH in July is possible but not guaranteed. Real data, calm funding rates, and steady open interest show the market isn’t dead yet. For now, traders watch the charts and plan for both sides.

Ilan Rakhmanov, CEO and Founder of ChainGPT AI, is a pioneering figure in the Web3 and AI industries.