In a headline-making move that shook the crypto world. BlackRock, which is the world’s largest asset management firm, purchased $3.85 billion worth of BlackRock BTC investment in June 2025 alone.

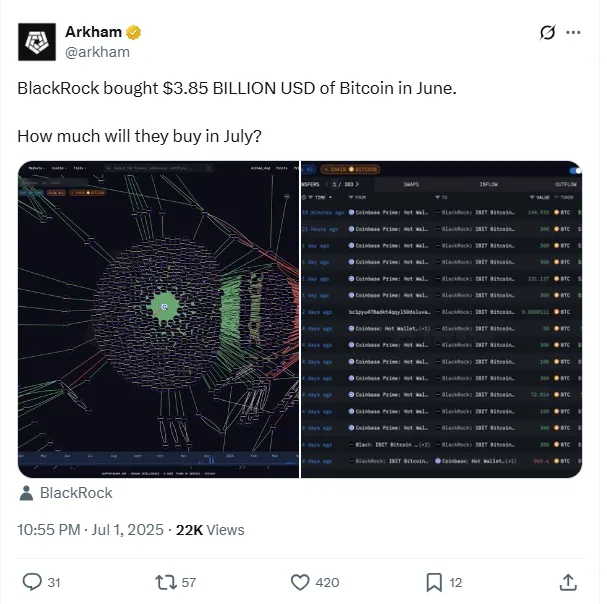

According to Arkham intelligence data, BlackRock BTC purchase is a big-scale investment shows its growing trust in the strongest currency and is highlighting how traditional finance is rapidly merging with the crypto space.

Source: X

Its data shows that in the Bitcoin Investment it didn’t buy all its Bitcoin at once. Instead, it followed a step-by-step strategy that is making multiple purchases which are ranging from $5 million to over $90 million. These trades happen via Coinbase Prime wallets, where Bitcoin is being sent to its IBIT wallets.

This slow and steady buying method helps in avoiding sudden price jumps and keeps the market stable. It’s a smart move that many big institutions use to reduce risk while amassing large amounts of digital currencies.

The Bitcoin purchase delivers a very powerful message in the market. When a top financial institution invests billions, it boosts the confidence among the traders and investors. Many believe that this Bitcoin investment could lead to a stronger bullish trend in the coming months.

Such actions also make it easier for the new investors to enter the market, especially those users who were waiting for signs of safety or mainstream approval. With firm in the game, it might happen that more people may see Bitcoin as a secure and long-term investor.

After its big Bitcoin investment in the month of June, many are wondering that like June will it buy more Bitcoin in July? Which is a very obvious question which comes to mind. While no-one can say for sure, its current strategy suggests that it could continue buying as long as market conditions stay stable.

The timing is interesting too. It recently showed an oversold signal which is usually a sign that it’s ready for a price jump. It also recorded its highest quarterly close ever, which could now attract more institutional buyers and push the prices higher.

Blackrock BTC entry into the market is more than just another investment. It signalled a shift in how the institutions view crypto, which is not as risky gamble, but as a serious asset class. If more of companies follow path as BlackRock BTC purchasing, then the strongest crypto cureency could become more liquid, stable and is accepted worldwide.

Their slow and smart purchasing strategy sets an example for other firms. Instead of chasing the hype, it is using data and planning to build a strong position in the world of crypto which is a big sign that institutional adoption is here to stay.

$3.85 billion BlackRock BTC purchase is not just a headline but it is a strong sign that the line between traditional finance and crypto is disappearing fast. This move could lead to more institutional buying, higher the market confidence and possibly a new all-time high for the strongest crypto currency.

If July follows the same pattern then you might see another wave of major BlackRock BTC investments and a market that is stronger than ever.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.