What happens when the U.S. adds $18 billion in debt every single day? For Natalie Brunell, one of the most influential voices in crypto media, the answer is simple: Buy Bitcoin.

Speaking on Fox News, Brunell didn’t hold back, warning that America’s mounting loan and currency debasement could erase the value of the U.S. dollar faster than most expect.

Source: The Bitcoin Historian X Account

Her recent comments are now dominating Bitcoin news today, echoing other analysts like BitBull, who believe a global mess up for this cryptocurrency is bound to happen.

But is this just hype, or does the data support it? Let’s break it down.

Natalie Brunell, an award-winning journalist, host of the “Coin Stories” podcast, and a leading voice in Bitcoin news today has built her reputation on explaining how macroeconomics impacts the coin.

On August 4, 2025, she made her Fox News appearance with a direct message:

“The U.S. is adding $18 billion in debt a day. They are going to continue to debase. Better have BTC.” — Natalie Brunell

This isn’t just a statistic, it’s a currency decline machine. At $540 billion a month and potentially over $6 trillion in a year, the U.S. loan path is historic in scale.

While this crisis is already severe, a Federal Reserve rate cut may be a factor in the acceleration of the crisis. The Fed cuts rates, and if dues still exists, the purchasing power will fall further weakening the U.S. dollar. It will translate into costly imports and more inflation. This is where currency's scarcity becomes powerful.

As a crypto analyst, my take is clear:

High debt + rate cuts = weaker dollar.

Weaker dollar + inflation fears = demand for scarce assets.

$BTC’s fixed supply = inflation hedge on steroids.

Investor Strategy Now:

Use Dollar-Cost Averaging to accumulate the tokens without chasing spikes.

Watch Fed announcements for dovish signs — often bullish for the token.

Monitor this Bitcoin vs Dollar news because, while the long-term debt narrative favors the token, short-term volatility can be brutal.

The Bitcoin Historian Twitter account amplified Brunell’s remarks, framing them as bullish for adoption.

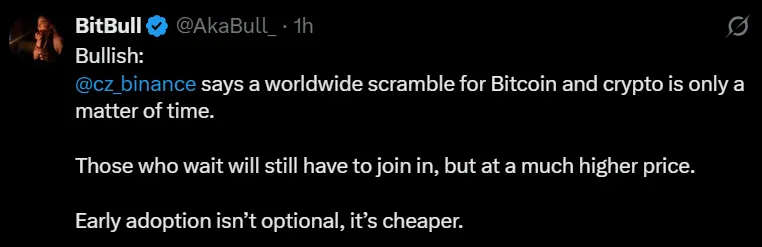

Meanwhile, BitBull offered this insight from CZ Binance:

“A worldwide scramble for $BTC and crypto is only a matter of time. Those who wait will still have to join in, but at a much higher price. Early adoption isn’t optional — it’s cheaper.”

Such endorsements from trusted analysts often shift sentiment quickly, adding weight to BTC bullish news narratives.

At the time of writing, its price is trading around: $115,318 (+0.96% in 24h)

Resistance: $118K–$120K

Support: $112K–$110.5K

Technical Indicators:

MACD: Bearish momentum slowing; possible bullish crossover ahead.

RSI: 49.68, leaving room before overbought territory.

Trend: Bounce from $112K shows buyers stepping back in.

From a macro perspective, high debt cycles historically benefit hard assets like gold. In today’s digital economy, $BTC is the new gold — borderless, limited to 21 million coins, and immune to printing presses.

If debt growth and dovish monetary policy align, it could enter a strong bullish phase, making this one of the most critical moments in Bitcoin macro analysis history.

What Happens Next? Short-Term BTC Scenarios

Bullish Path: A breakout above $120K could send the coin toward $125K and new all-time highs.

Bearish Path: Falling below $112K may lead to a $110K retest.

Natalie Brunell’s Fox News remarks aren’t just hype, they reflect an economic reality that’s unfolding fast. With U.S. $18 billion in daily debt, political winds leaning toward more spending, and macro indicators favoring scarce assets, currency’s long-term bullish case has rarely been stronger.

For investors following the latest Bitcoin news today, the question is simple: enter now with a smart strategy, or risk joining later at a much higher price. As Brunell said: “Better have BTC.”

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.