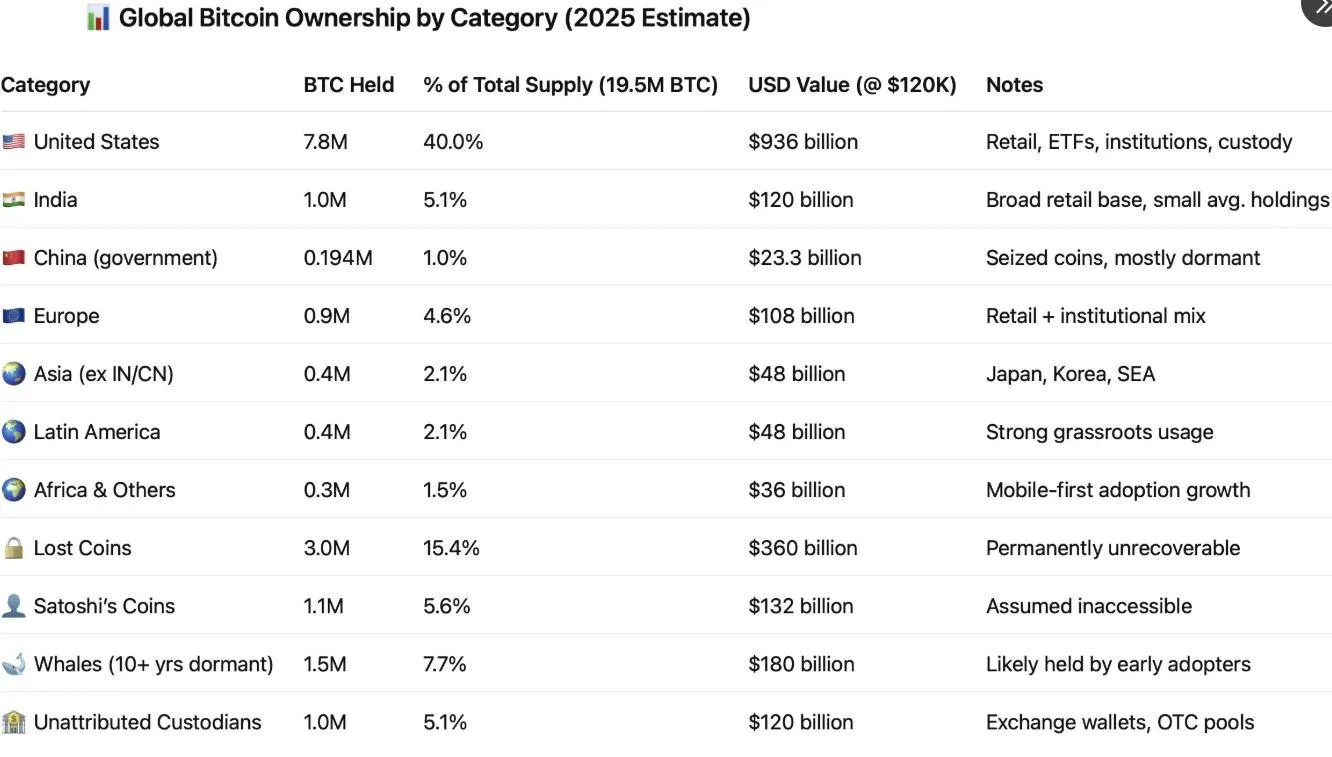

In 2025, who owns most bitcoin by country is no longer a mystery, but the answer is still shocking. In the latest $BTC news today, the U.S. owns almost 40% of the total supply, which is approximately 7.8 million tokens worth roughly $936 billion at $120K per coin.

But the real surprise? India now ranks second globally, with 1 million BTC, overtaking Europe and reshaping the global ownership map, according to Fred Krueger latest X post.

This power shift raises a bigger question: Are we witnessing the beginning of the world's largest cryptocurrency’s concentrated ownership era?

Recent information shows the United States has no competition. India has made quick advances triggered by retail adoption, exchange growth, and a strong digital asset culture.

Europe which was once a huge part of this, is now even less than 4.6%. China’s government owns about 190,000 BTC, captured by authorities as a result of legal enforcement.

And as seen in the chart, several other nations hold a smaller share of crypto king, but their combined presence still adds an interesting layer to the global picture.

Add in lost coins—around 15% of all supply—and Satoshi Nakamoto’s untouched 1.1 million BTC, and the scarcity narrative becomes even more compelling.

The top 2025 holders list blends mystery, corporate power, and national strategy. Leading the way is Satoshi Nakamoto, followed by giants like BlackRock (698,700 BTC), Binance (633,700 BTC), and MicroStrategy (597,000 BTC), and more.

Source: Biconomy.com

From a crypto analyst’s perspective, what company owns most BTC is not just a hype, it’s a market signal. When BlackRock or MicroStrategy moves, the market reacts. However the consumption is surely increasing now, as this data contains the final number till July only.

According to the June 1 report, this year marks a turning point for Bitcoin institutional adoption.

In 2025, ETFs, funds, and corporate treasuries have been buying this currency like crazy. They’ve taken more than 417,000 coins so far this year. That’s six times more than all the new mined coins in the same period.

At the same time, individuals sold 158,000 coins in the same period.

Fresh data from CryptoQuant and Biconomy paints the bigger picture:

Businesses gained about +157K tokens

Funds & ETFs added +49K

Governments secured +19K

Individuals lost − 247K

In simple terms, the currency is steadily moving out of personal wallets and into the hands of corporations, investment funds, and even governments — a clear sign of the growing institutional grip on the market.

The history now falls into three clear eras:

2010–2014 – Peer-to-Peer Cash phase.

2014–2020 – Digital Gold hedge era.

2020–2025 – The strategic reserve era, where institutions and states dominate holdings.

Institutional control could dampen volatility, but it also means fewer coins for retail buyers. Scarcity after the halving may create intense competition for available supply.

This 2025 ownership map makes one thing clear: the answer to who owns most bitcoin by country is increasingly about power, not just wealth. With the US leading, India’s rapid rise, and corporations seizing the moment, Bitcoin has entered its Strategic Reserve era and the future will be decided by the few who hold the most.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.