Can BTC really be part of a normal investment portfolio? This question is now being taken more seriously as big banks start talking openly about Bitcoin portfolio allocation.

Brazil’s largest private bank, Itaú Unibanco, has advised investors to add a small portion of this digital asset to their portfolios. This advice shows how the sentiments around Bitcoin investment have changed. What was once seen as risky or experimental is now being discussed as a practical financial tool.

Source: X (formerly Twitter)

A senior executive at Itaú Asset Management, which manages investments for the bank, has suggested that investors consider a Bitcoin portfolio allocation of 1% to 3%. Renato Eid, who works on investment strategies at the firm, described BTC as a “dual opportunity.”

He explained that this cryptocurrency can help spread risk across a portfolio and also act as protection against weak local currencies. At the same time, Eid made it clear that crypto should not replace traditional investments like stocks or bonds. Instead, it should be added in small amounts to support long-term growth.

The idea behind Bitcoin portfolio allocation is simple. It does not move exactly like local markets, which can help balance a portfolio during economic ups and downs.

Brazil’s interest in this digital asset is closely linked to its currency issues. In late 2024, the Brazilian real fell sharply and touched record lows against the US dollar before recovering. Such sudden moves hurt savings and reduce purchasing power.

Because it is priced globally and not controlled by any government, many investors see it as a way to reduce the impact of currency shocks. In this situation, this cryptocurrency in investment portfolios can act as a partial shield against local currency weakness.

This is one reason why Brazil bank bitcoin allocation discussions are gaining attention across emerging markets.

Itaú also pointed to its own Bitcoin ETF, called BITI11. This fund started trading in 2022 on Brazil’s main exchange through a partnership with Galaxy Digital.

The total assets under its management are over $115 million, and it enables investors to invest in this cryptocurrency without dealing with wallets and keys. Investing in a BTC ETF feels much safer compared to direct investment in BTC.

The bank has also increased crypto offerings on its online platform. Since the end of 2023, customers have been able to trade BTC and Ethereum via the bank. Such developments portray increasing acceptance of crypto-regulated products.

However, Brazil is not alone in this matter. Bank of America advises a small crypto portfolio for wealth clients. Crypto research conducted by Morgan Stanley advises a small crypto exposure, especially in higher-risk investment portfolios.

Morgan Stanley explained that crypto markets can be volatile. A small cryptocurrency allocation can raise portfolio-wide risk, and thus it’s a good idea to rebalance consistently.

Recently, the coin dropped to a level of $89,300 due to reactions in global markets because of uncertainty in the economy. Worries over interest in Japan and heavy futures sales reduced the BTC price.

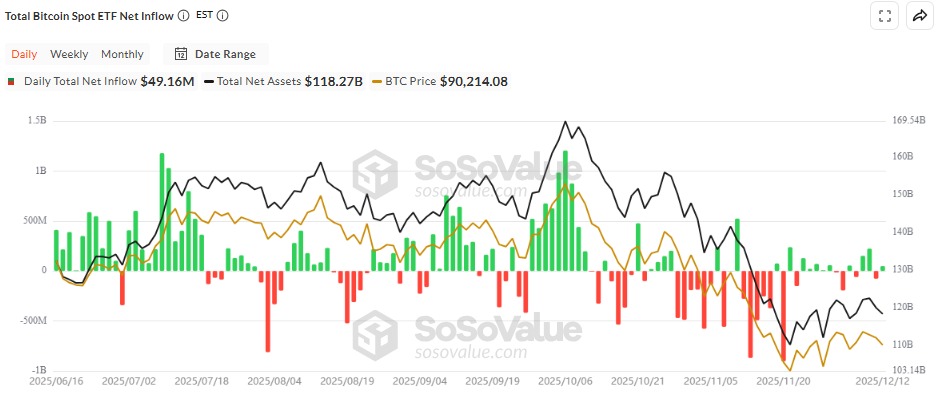

Nevertheless, interest from institutional investors is strong. Sosovalue Data on Bitcoin ETF inflows shows this. Spot BTC ETF products saw a net inflow of nearly $50 million on December 12, with this led by IBIT.

Source: Sosovalue

Bitcoin portfolio allocation is no longer a fringe idea. With support from Brazil’s largest private bank and acceptance in Wall Street, this crypto is slowly becoming part of mainstream investment. Although risks remain, careful sizing and long-term thinking are helping investors decide where the digital asset fits in their portfolios.

Disclaimer: This article is for informational purposes only, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.