Is Michael Saylor preparing to announce yet another major Bitcoin Purchase just as markets turn cautious? All signs point in that direction after the Strategy co-founder dropped a familiar hint on his social media account, reviving a pattern that has preceded nearly every recent purchase by the Microstrategy (now Strategy).

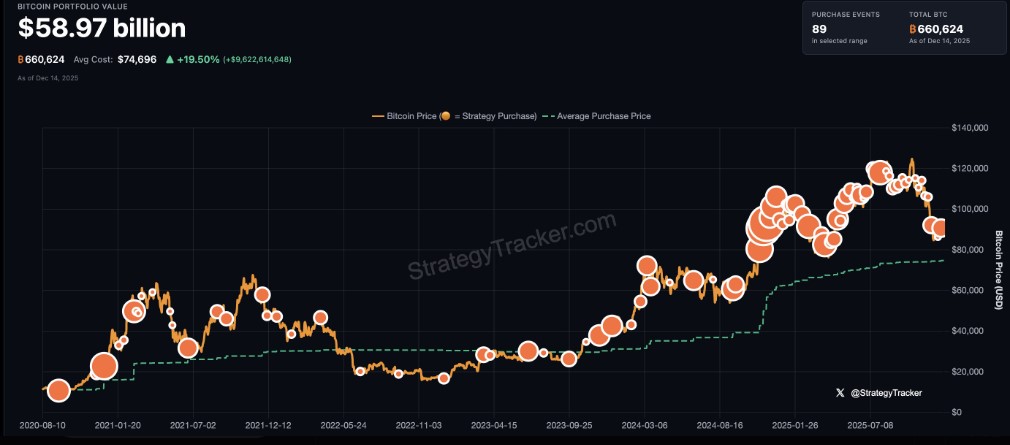

Just a day before, Michael Saylor posted a short but telling message on his official X handle: “₿ack to More Orange Dots.” For long-time observers, this phrasing is anything but random. Over the past month, Saylor has repeatedly used images and posts featuring orange dots to signal fresh Bitcoin buys by Microstrategy.

Now, with orange dots back in focus, the market is widely expecting a formal purchase announcement in upcoming days, consistent with the firm’s usual disclosure cadence.

If confirmed, the addition will further fuel Microstrategy’s massive treasury, which currently holds 660,624 Bitcoins, solidifying Strategy’s position as the largest corporate holder of Bitcoins globally.

The company’s balance sheet reflects both the scale and conviction behind its Bitcoin strategy. At current prices of BTC near $89,500 per coin, the firm’s reserve is valued at around $59.1 billion, exceeding its market capitalization of about $53 billion. While Strategy remains profitable long term due to its low average BTC cost, the value of its holdings have weakened with BTC’s 24% three-month pullback.

Strategy’s stock ($MSTR) is under pressure, driven by the broader crypto market downturn along with the golden asset. As of the current situation, MSTR was trading at $176.45 (down 3.74%), with a 47% decline in the last three months, and a 55% drop year-over-year.

Although the asset and $MSTR have shown some weaknesses in recent months, the company continues to see every dip as an opportunity. The net asset value of this company remains above 1.1, which indicates that investors have placed a premium on the firm’s exposure to Bitcoin and accumulation planning.

The Much-Needed Bitcoin Purchase comes at a time when there is great macro-economic uncertainty. The coin is down by nearly 1% over the last 24 hours and by over 2% this week, with its price below the important level of $90,000.

Source: CoinMarketCap

The principal factors which are affecting this sentiment include fears of a rate hike by the Bank of Japan, a drop in spot liquidity despite an increase in derivative liquidity, and liquidations in the long positions with a total of $59 million.

Against this backdrop, support from broader institutes including Microstrategy’s in-flows, would signal confidence at a moment when fear dominates short-term price action.

While macro pressures remain a concern, institutional adoption continues to build underneath the surface. U.S. spot BTC ETFs now collectively hold more than 1.5 million BTC, and major financial institutions are beginning to formalize allocation guidance.

Notably, Brazil’s Itaú Bank has recommended a 1–3% BTC allocation starting in 2026, considering BTC a tool for hedging against currency risk. These developments support the long-term bull case, even as near-term liquidity conditions remain fragile. A fresh bitcoin purchase by Strategy could reinforce this institutional narrative, reminding markets that long-term buyers are still active despite volatility.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.