Bitcoin is no longer just a number on a chart—it's a cultural moment. This week, a perfect storm of politics, power, and price action is setting the stage for what some call “the final push.”

And it all started with a mic-drop moment from Donald Trump.

As per Michael Saylor, the latest post on X, the token just got a major endorsement from none other than the U.S. President Donald Trump. During a recent event today, Trump bitcoin speech today turned heads with one simple line:

“Bitcoin is amazing. It’s a great thing for our country.”

Source: Michael Saylor X Account

But that wasn’t all. When he was asked about critics of his tariffs, his quick reply — “Go back to business school,” reflected confidence in his economic strategy.

That's not all for Bitcoin news today, even binance co-founder CZ also said something about $BTC which went viral on twitter.

Just hours before the president’s statement, Binance co-founder CZ dropped a bold forecast:

Source: Coin Bureau

It simply means that one day, owning just 0.1 BTC will be more valuable than a house in America. This isn’t a random tweet-it was basically CZ bitcoin price prediction for what’s coming next.

The cryptocurrency closed this week at $107,269, marking a solid 6.19% gain from the previous week. The coin peaked at $108,358 and dipped to $99,705. Still, the bull run remains untouched.

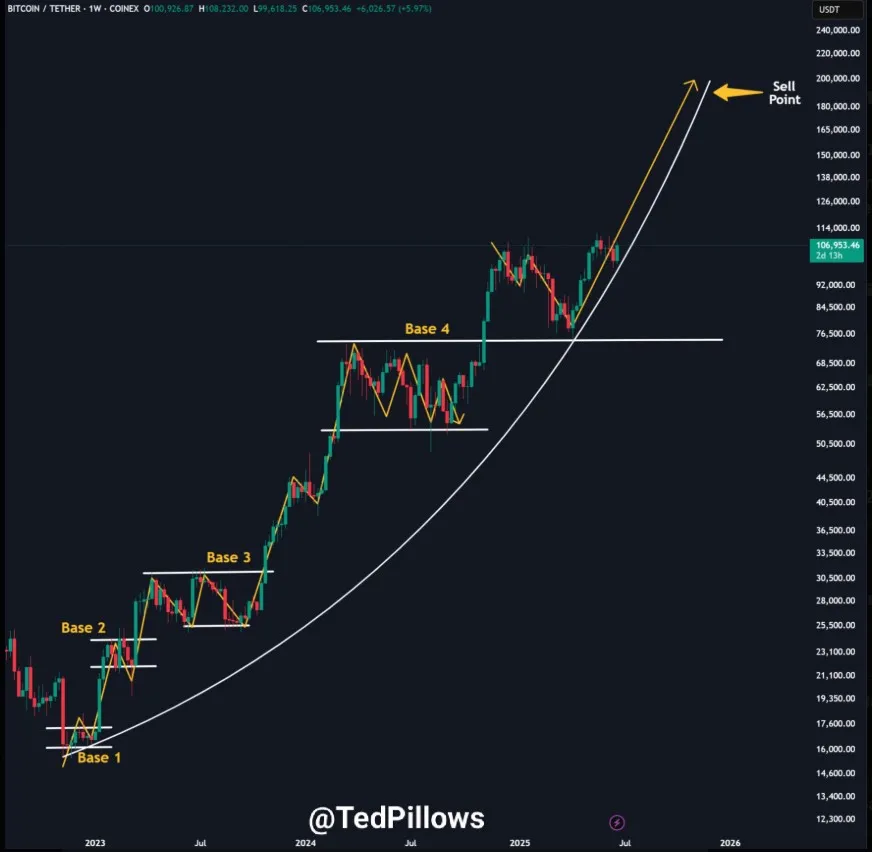

Being a crypto analyst, as per my TradingView chart observation This strong green candle shown in the chart confirms that bullish momentum is continuing.

Indicators:

MACD: Bullish crossover → Histogram at +707 (gaining strength)

RSI: 62.54 → Bullish but not overbought

Volume: $44.44B (24h) → Slight uptick confirms conviction

This suggests buyers are gaining strength and that the uptrend is accelerating. Since March 2025, its chart is making higher highs and higher lows.

Support: $99,000 and $91,000

Resistance: $108.5000, $112K, $118000

Breakout Zone: $120,000+

Short Term (Next 7 Days): $109,000 to $112,000

The $108,000 resistance might hold briefly, but bullish momentum could push through.

Mid Term (2–3 Months): $115,000 to $125,000

If RSI crosses 70 and macro conditions (like Fed cuts) align, a new all-time high is in sight for the breakout zone.

Long Term (End of 2025): $135,000 to $155,000

Supply crunch, and institutional demand could push BTC prices into the $150K+ range. But be warned: dips to $90K–$95K are still possible on negative news.

This also aligns with a bold prediction from OKX Ted BTC price target, who recently posted:

“It has one major leg up left. It’ll be the most explosive move before a blow-off top.”

His target? BTC to $160K+ in 2025. And honestly, it doesn’t sound crazy when the chart backs it up.

The weekly chart is clearly bullish—Trump quote, CZ btc price target, bullish charts and $44B in 24h volume, all signal a bull run ahead. But here’s the real question: Will this be the final blow-off to $160K? Or are we just halfway up there?

If macro conditions like ETF inflows and Fed rate cuts support it, then this BTC price prediction 2025 is all set to come true.

Disclaimer: Always do your own research before making any investment decisions. Crypto market is highly volatile and prices shift instantly here.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.