Once again, Bitcoin (BTC) is catching upward momentum from strong technical triggers and institutional buying interest. Analysts specified the historic setup may see the BTC plummeting to $200,000-$250,000 by 2025.

With market sentiment turning highly bullish, is this really the birth of the strongest rally has ever witnessed? Could Bitcoin really reach $200,000 by 2025?

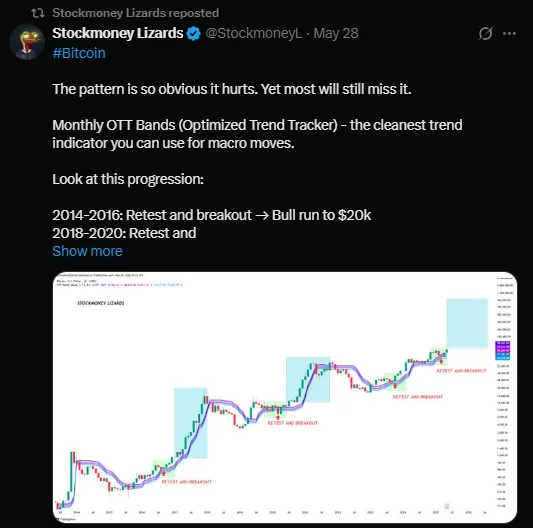

Renowned crypto analyst group Stockmoney Lizards recently released a compelling chart on Bitcoin’s constant "retest and breakout'' phase based on the Monthly OTT bands (Optimized Trend Tracker). It is in fact these patterns that, when appearing in the past, preluded huge bull runs. A breakout from 2014 to 2016 took BTC to $20,000; from 2018 to 2020, a similar breakout sparked a $69,000 rally. Now, in the 2022-2024 window, the breakout has happened again-the analysts believe that it may really be the dawn of the next great leg up.

Source: Stockmoney Lizards

The OTT bands are intended to give warning indications of when an asset is poised to take a big move and the asset is presently throwing that bullish signal. Stockmoney Lizards Adeny thinks this run may well see the asset hitting anywhere between $180,000 to $200,000 by the end of 2025, with another target of $250,000 coming somewhere in 2026 amid the prevailing macroeconomic backdrop.

Robert Kiyosaki, investor and author of Rich Dad Poor Dad, had somewhat similar opinions. While he warned that by the current resistance of the market beneath $100,000, Bitcoin may tend to some brief dip and go into $60,000, however, such shall be taken as a buy-in opportunity rather than a griefing panic.

Kiyosaki remains firmly bullish, projecting that BTC could reach $250,000 by 2025. He emphasized that the focus should now be on accumulation, not short-term price action. “Don’t trade it. Just buy more Bitcoin,” he urged his followers, highlighting the asset’s long-term potential as a hedge against fiat devaluation.

Adding further fuel to the bullish fire has been poured since Hayes, one of the BitMEX founders, has stated that Bitcoin could fly to $250,000 by 2025 in case the Federal Reserve resumes QE. Hayes expounded in a lengthy April blog post that somehow BTC is tied to fiat liquidity and hence, as soon as the Fed decides to go away from quantitative tightening (QT) and from that point on starts quantitative easing, the asset should rally hard.

This theory found its grounds on macroeconomic fundamentals. Ever-fiats injection liquidity cycle had always bought in bagged thick crypto rallies. The moment inflation comes down, with the Fed ultimately deciding to lower the rates or reinstate stimulus, the world's largest cryptocurrency will be set again on the track of its explosive growth.

Meanwhile, there is a very strong bullish sentiment being maintained by Standard Chartered at an international scale. Following Donald Trump’s issuance of a recommendation to form a U.S. Crypto Strategic Reserve, Geoff Kendrick, Head of Digital Asset Research at the bank, reiterated his call for Bitcoin to reach $500,000 by 2028. In the very near term, however, Kendrick projects that Bitcoin will hit $200,000 by the end of 2025.

Kendrick described the paradigm shift unfolding in crypto markets from selling rallies to buying dips, creating a so-called "Trump put," in analogy to the "Fed put" for equities markets. He mentioned rises in institutional acceptance and portfolios integrating BTC globally being the catalysts behind this price surge.

Source: blockchaincenter

With the historical cycles aligning, technical indicators flashing green, and institutional confidence growing, it looks as though BTC may be having its supercycle. Short-term volatility may continue but, by 2025, most expert predictions are converging somewhere between $200,000 and $250,000.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.