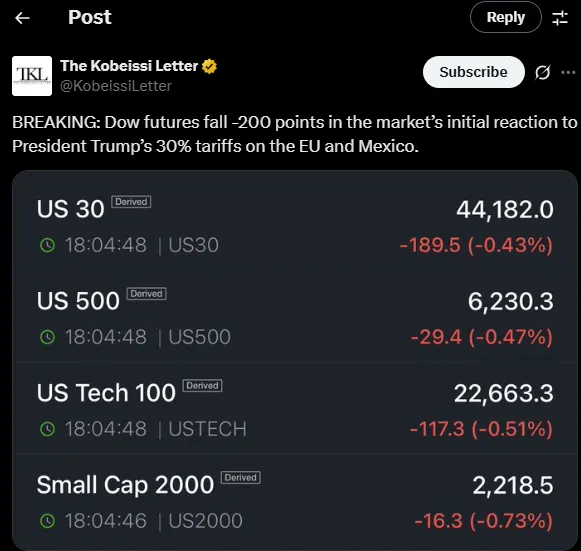

US stocks index futures tumbled after President Trump Announces New Tariffs of 30% on the European Union and Mexico, intensifying Global trade tensions. Dow Futures dropped nearly 200 points, as per The Kobeissi Letter. Despite the broader market sell-off, Bitcoin resisted the upheaval, surging past $121,000 and hitting a fresh all-time high.

Source: X

U.S. president Donald Trump Announces New Tariffs of 30% on imports from the EU and Mexico, escalating fears of a full-blown trade war. This move comes on the heels of earlier charges imposed on Canada, Japan, South Korea, and Brazil, as well as a huge 50% duty on Copper imports. Scheduled to take effect on August 1, these actions are mounting pressure on affected countries to finalize trade agreements with the U.S. On the other side, customs duty collections have already reached a record of $133.3 billion in the starting nine months of the FY 2025 and are on track to hit $300 billion by the year ending.

Stock index futures opened lower last evening. S&P 500, Nasdaq 100 and Dow Jones futures all fell 0.4%, reflecting investor unease over trade tensions (as Trump Announces New Tariffs) and inflationary risks. Upcoming CPI inflation data, Due Tuesday (July 15), is in sharp focus as markets access the cost impact of trade war. Meanwhile, the second quarter earning season is lined up to start under the leadership of key financial players like JPMorgan, Wells Fargo ,and more.

By showing strong potential, Bitcoin Surge amid levy soared to a new all-time high of more than $120,000, twice over the past year. The crypto market showed strength even as traditional markets wavering, hinting investor’s confidence in decentralized assets amid policy uncertainty.

Source: CoinMarketCap

While Wall Street stumbles as Trump Announces New Tariffs and looming inflation, bitcoin is breaking records. As mainstream markets show downturn, crypto is gaining ground, stimulated by institutional demand, ETF optimism, and the start of “Crypto Week” in the U.S legislature. The contrast marks a lucid shift in investor confidence for decentralized assets amid worldwide economic uncertainty.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.