In the past day, Ethereum has surpassed the psychological threshold of $3,000 and BTC has reached its highest point ever, trading above $121,000. A new wave of institutional and governmental interest is making headlines as the value and confidence of the global cryptocurrency market continue to rise.

Bold players are expanding their exposure to BTC and ETH from El Salvador to Japan to the Nasdaq, indicating a significant shift toward mainstream cryptocurrency adoption. However, what are the true implications of these recent high-profile acquisitions for the future of the market?

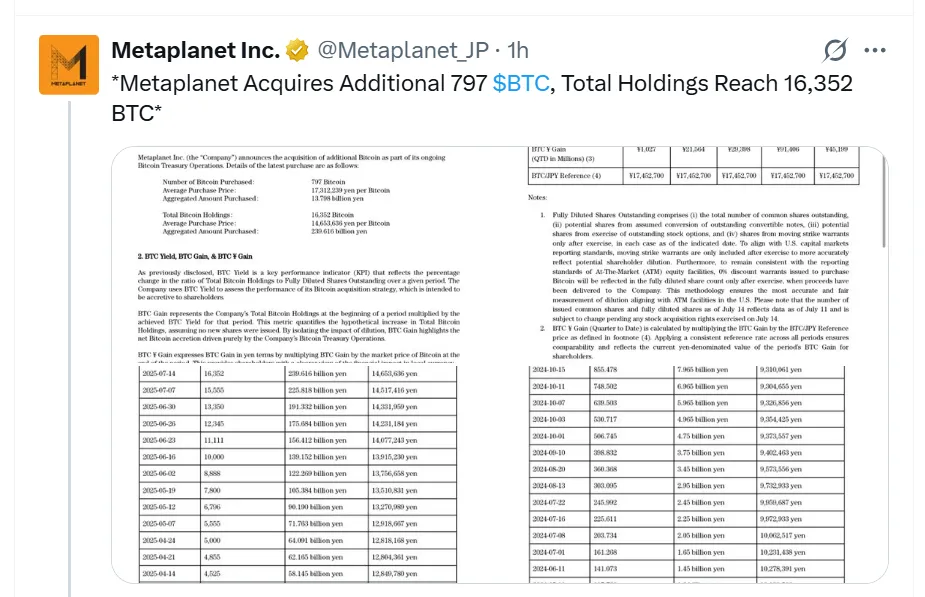

With the Metaplanet Bitcoin acquisition, Japan-listed company, led by CEO Simon Gerovich, has once again made headlines. The company recently purchased an additional 797 BTC, amounting to approximately $93.6 million at an average price of $117,451 per coin. The most recent acquisition, which was made at an average price of $100,191 per coin, increases the company's total holdings to 16,352BTC.

Source: Metaplanet

In a move reflecting growing confidence in Digital gold as a long-term store of value, this aggressive Metaplanet Bitcoin Acquisition strategy places it among the top corporate holders of digital assets in Asia. The company's move underscores Asia's increasing institutional dominance in cryptocurrency adoption and mirrors MicroStrategy's well-known BitcoinStrategy. Is Metaplanet Bitcoin Acquisition the Next MicroStrategy?

El Salvador's national Bitcoin Strategy, meanwhile, keeps making history, holding 6237.18 BTC. The nation's Strategic Reserve has formally surpassed the $750 million valuation milestone. Over the past 7 days, the reserve grew by 8%, and in the last 30 days, by 31%, according to data from El Salvador’s official Strategy Office.

Source: X

The reserve’s value now stands at $754,262,678, as per the government dashboard. President Nayib Bukele’s bold policy—initiated in 2021—has consistently drawn global attention. The current numbers underscore a long-term conviction that continues to pay off. For developing economies, El Salvador's Bitcoin playbook could soon become a model worth replicating.

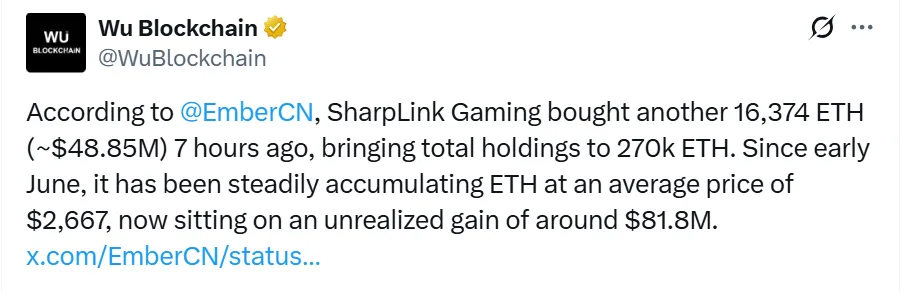

In a significant move from the Web3 and gaming world, Nasdaq-listed SharpLink Gaming has purchased 16,374 ETH, worth approximately $48.85 million, just seven hours ago. The company now has 270,000 ETH in Ethereum reserves as a result of this acquisition.

SharpLink has been systematically acquiring Ethereum since early June at an average purchase price of $2,667, resulting in an unrealized profit of $81.8 million. This action enhances SharpLink's position in the decentralized gaming and blockchain infrastructure market, as Ethereum is set to undergo significant updates and attract increasing institutional interest.

Source: Wu Blockchain

Both BTC and ETH are displaying indications of persistent bullish momentum due to growing institutional interest and significant acquisitions. Ethereum is consolidating above the $3K mark, suggesting the possibility of an upward breakout, while coin's price is still well above the $120,000 range.

Source: CoinMarketCap

The acceptance of BTC and Ethereum ETFs in several nations is another important factor influencing institutional purchasing. By introducing cryptocurrency to retirement portfolios, pension funds, and hedge fund portfolios alike, these products reduce the barrier for traditional investors. The aggressive Metaplanet Acquisition from past months has surged financial institutions to take a chance for BTC adoption. We are seeing the beginnings of what may turn out to be a significant capital shift into the digital asset space due to the increasing inflows into ETFs.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.