BTC just crossed $118K, and Charles Hoskinson is once again making headlines—this time with a bold prediction: Bitcoin to hit $250K soon, with altcoins following.

With short sellers under pressure, major legislation on the horizon, and its market cap near Amazon’s, a major flip could happen any moment, so is crypto about to enter its biggest bull run ever?

Let’s break down why Hoskinson’s call may not be hype—but a high-probability forecast.

It is no longer playing catch-up—it’s leading the global asset race. After smashing past $118,000, Cardano founder Charles Hoskinson took to X with his explosive statement, reignite the bulls:

This bold $250K prediction comes just as its market cap inches closer toward a historic milestone—flipping this tech giant, one of the world’s biggest tech giants.

This Bitcoin news today gains traction, especially as the U.S. nears regulatory clarity through two new billa.

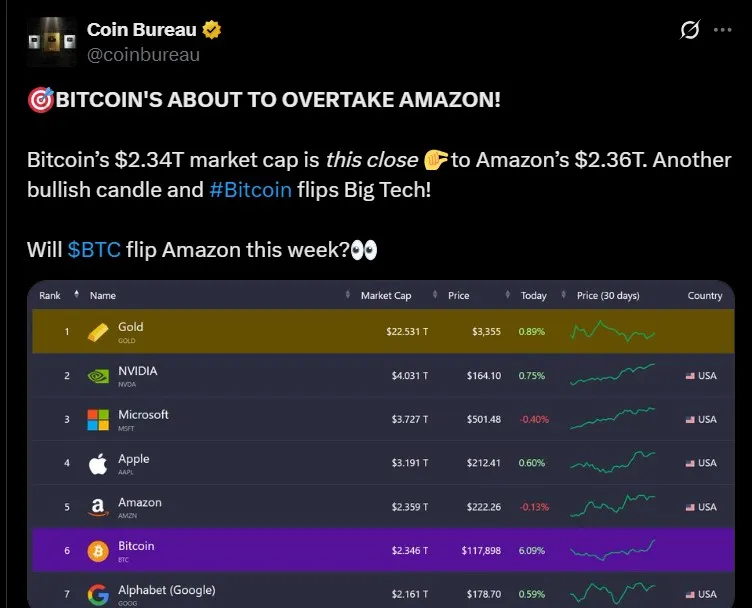

As of now, BTC boasts a $2.346 trillion market cap, barely $0.014 trillion behind Amazon’s $2.359 trillion valuation. With its current momentum and another bullish daily candle, if Bitcoin flips Amazon, it would officially become the 5th-largest asset in the world.

Why This Flip Matters:

It signals crypto's dominance over traditional tech.

Validates $BTC as a top institutional asset

Builds mass confidence among ETF investors

Boosts altcoins as capital rotates into the broader market

Now, the question is no longer “Can it surpass Amazon?” but when.

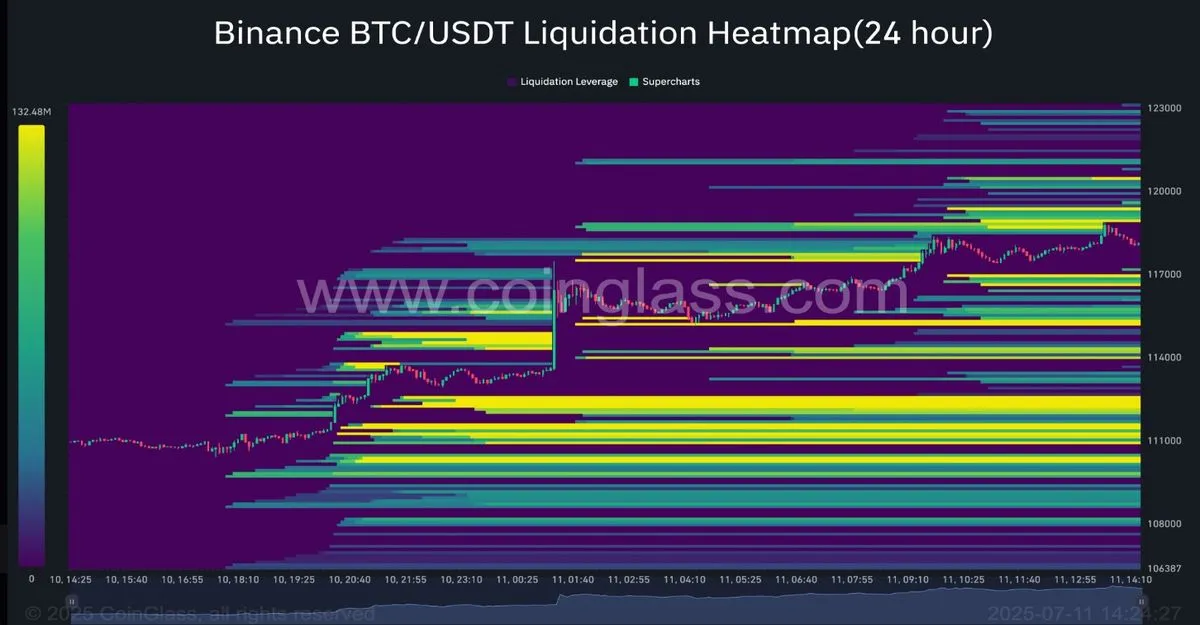

According to Coin Bureau, the cryptocurrency has already taken out key short liquidation zones at $117,000, and if price moves past $119,000, then it could trigger a short liquidation cascade toward $120K+.

“A bullish push could spark a cascade past $120,000. If not, nearly $96M at $117,000 could get flushed, killing momentum.”

This setup shows liquidity pressure is heavily biased upward, meaning more short positions may soon get liquidated—fueling the Bitcoin price prediction towards $250K

Hoskinson points to two major upcoming U.S. crypto bills:

The Clarity Act

The Financial Innovation and Technology for the 21st Century Act (Genius Act)

As per my market research and analysis, these laws could fully legalize crypto framework for institutions and ETFs. If passed then these scenarios are approaching soon:

Fully legalize crypto frameworks for institutions

ETFs and banks can legally hold and offer crypto

Triggers a crypto supercycle, potentially pushing the coin to $250K

With the currency already nearing Amazon's market cap and on track to become a top-5 global asset, this btc price target doesn’t seem like just a moonboy dream anymore.

Past ATH: $118,500+ (2025)

Next Milestone: $120,000 (short squeeze zone)

Market Cap Needed for $250,000: ~$5 trillion (near Apple)

Final Take: Is the $BTC Supercycle Already Here?

All signs point to yes. If the token flips Amazon’s market cap, and with massive short liquidations, regulatory clarity on the horizon, Bitcoin to hit $250,000 may not just be a wild forecast—but the start of a new financial era—just as Hoskinson predicted.

Keep your eyes on the next candle that closes above $120,000, as the bull run narrative will soon turn into full-blown reality.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.