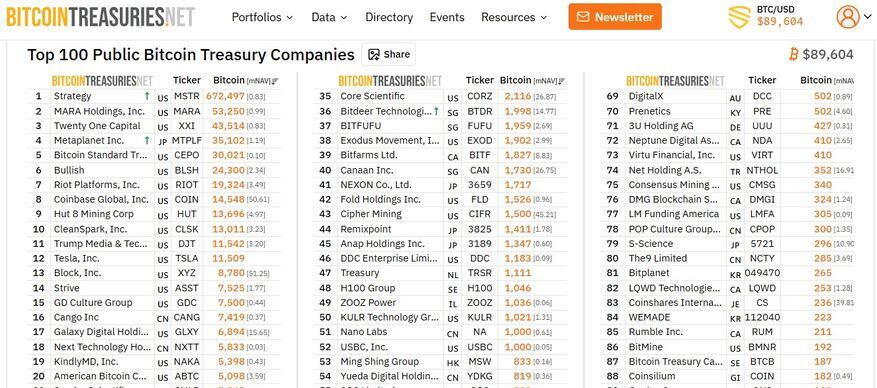

Top Bitcoin Treasury firms are currently trading below the net asset value of their holdings; the BTC Treasury ecosystem is under financial strain. According to the recent data, nearly 40% of the top 100 Bitcoin treasury firms are worth less than the virtual currency they hold.

Leading Bitcoin Treasury firms like Strategy are currently trading at a discount of about 17%. Recent data indicates that there is a sudden decline in investor confidence in investing in digital currency.

For much of 2025, digital coin reserve companies thrived on market enthusiasm. Their shares traded well above the value of the digital asset they held, allowing them to raise fresh capital with ease. This premium expands reserves, buys additional digital asset, and issues new shares without diluting shareholder value.

However, this expansion plan has failed because many businesses are now selling at a discount.

Experts caution that issuing shares below NAV puts businesses in a defensive and uncertain position and destroys rather than increases shareholder value.

Macro analyst Alex Kruger warned that the current framework cannot sustain itself, comparing it to the period when, Grayscale Bitcoin Trust premium collapsed and even labelling it a deeply flawed model.

This contrast draws attention to concerns that these discounts may deepen further if market confidence is not soon restored. Smaller businesses suffer even larger valuation gaps ranging from 30 to 60%, while major industry giants are now trading at a 17% discount.

The Bitcoin Treasuries Net data shows that most of the top leading companies failed to keep up with the S&P 500’s performance over the past years; the decline of these firms started picking up towards the end of 2025.

According to the data, around 60% of companies have purchased this digital asset at higher prices than its market current values, which is putting extra pressure on their financial positions. What was once a fast-growing momentum has now slowed significantly, and this sudden shift has clearly shaken investor confidence.

Consolidation may be the next significant step in the digital coin reserves industry, according to the market analysts. Now stronger companies may buy weaker ones trading at deep discounts, while others could become prime merger and acquisition targets.

Long-term planning, operational discipline and strategic restructuring are the options many companies will have to choose as capital-raising options are limited now.

digital coin reserves firms may switch from aggressive accumulation tactics to sustainable financial management as the scenario develops. Survival of the firms depends upon rebuilding market trust, ensuring transparency and adopting sustainable treasury strategies in this competitive and changing market.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.