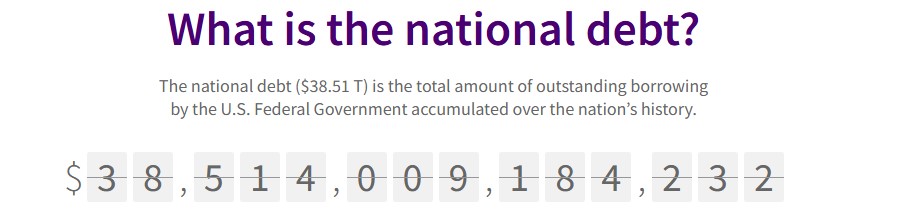

The US national debt has officially climbed to a new all-time high of $38.51 trillion in early January 2026, according to Treasury data. Just one year ago, total debt was calculated around $36.2 trillion, meaning the government added more than $2.3 trillion in fresh borrowing within 12 months.

Source: Official Fiscal Data

Adding on, the Federal Reserve injected around $74.6 billion into the financial system through overnight repo operations, its largest liquidity move this year. Too much money in the system can reduce the value of money and push prices higher.

Looking from here, with liabilities rising, money supply expanding, many traders are once again hoping on cryptocurrencies, especially Bitcoins, which are out of any central control and limited in numbers.

Icing on the cake, the United States is known for its pro-crypto stance and a massive Bitcoin reserve. So, BTC becoming the preferred inflation hedge in a debt-heavy economy is real or just speculation of the investors as the asset is also showing a downturn for now.

With $30.6 trillion worth GDP, the United States of America ranks #1 globally, in the IMF 2025 report.

Even after this, the nation is under growing pressure as its national debt climbed to record $38.51T, showing the widening gap between national spending and revenue. This $1.8T gap forced the government to rely heavily on borrowing to meet its obligation.

At the same time, the money supply continues to expand as the Federal Reserve steps in to stabilize financial markets. The Fed has now conducted three consecutive liquidity injections:

adding $26 billion on December 29

$3 billion on December 30

and $74.6 billion most recently ($31.5B in Treasury bills and $43.1B in mortgage-backed securities).

These actions signal that monetary support remains necessary to keep the system functioning smoothly.

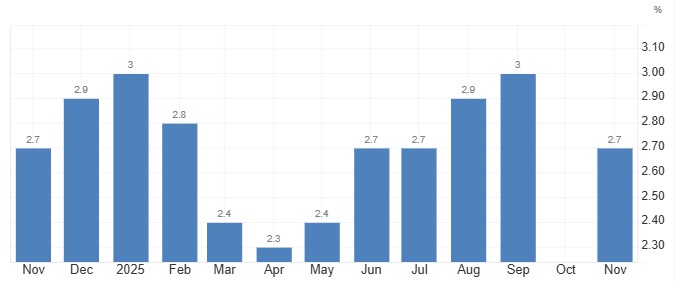

However, this can also trigger the inflation rate in the country which recently touched 3% in September and currently at 2.7%, still up from 2% target.

Source: Trading Economics

As debt levels rise and liquidity support becomes more frequent, investors are increasingly questioning whether traditional fiscal and monetary tools are enough to maintain economic stability, setting the stage for alternative assets like Bitcoin to gain attention.

The Bitcoin inflation hedge narrative is gaining renewed traction as the U.S. national debt number increases. Bitcoin’s fixed supply of 21 million coins stands in sharp contrast to fiat currencies, which can be printed endlessly which also reduces their value.

Due to the scarcity, Bitcoin is often compared to digital gold, especially during periods of rising borrowing and persistent inflation pressures.

Importantly, the USA, especially under President Trump, achieved a well known status in cryptocurrencies. The country currently holds around 198,012 BTCs in its reserve which roughly worth $17.78B.

Along with that, the ETF flows in the country are also showing positivity. After seven straight days of outflows, BTC ETFs recorded a $355 million net inflow on December 30. Ethereum ETFs also turned positive, led by $50 million in inflows into Grayscale’s ETHE.

Looking at that the community and the natives hoping that Bitcoins will surely work as a hedge against growing liabilities.

But at the same time, the frequent price changes in the asset increases concerns. BTC lost around 7% in a year, and is currently trading at $89,731.59.

The surge in U.S. national debt to $38.51 trillion underscores growing concerns about fiscal sustainability and long-term purchasing power. BTC’s fixed supply, growing adoption, and independence from government policy make it attractive as a long-term hedge, but not a guaranteed fix.

For now, most experts view Bitcoin as a portfolio diversifier rather than a cure for the borrowing crisis. Still, as deficits persist and liquidity injections continue, the question remains, will Bitcoin’s scarcity matter more as the U.S. national debt keeps climbing?

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.