Ethereum Supply Shock fears are building as BitMine ETH holding crosses the $2 billion mark. With crypto whales and institutions locking up this token for staking, could we be entering a liquidity crunch?

Traders are now watching $3,700 closely—and asking the real question: Is the token headed toward $5,000?

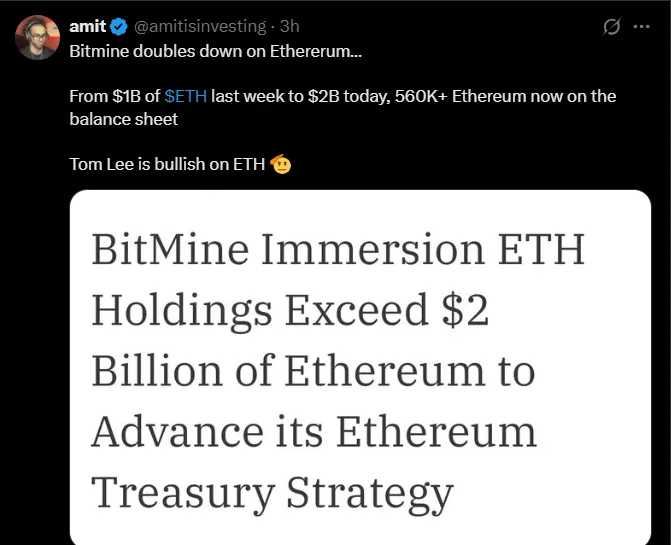

In a bold move shaking up the crypto world, BitMine has now become the biggest institutional ETH holder, beating SharpLink Gaming.

Source: X

As per Wu Blockchain, it holds 566,776 ETH tokens, worth over $2 billion, and this massive BitMine ETH Holding is sparking serious talk about a possible Ethereum Supply Shock in the near future.

This isn’t a casual treasury strategy. According to its public filings and community updates, the company is targeting up to 5% of all circulating coins—a maneuver that could trigger a massive Ethereum Supply Shock if mirrored by other firms.

Source: X Account

What’s really driving this transformation? As per my analysis being a crypto writer, it’s not just the innovation—it’s the returns.

The blockchain, through its proof-of-stake and DeFi framework, is now being treated like a blockchain-based income asset. BitMine, like many others, isn’t just purchasing the token, it’s staking it to earn yield—converting it into a sustainable revenue engine.

This “treasury pivot” reflects how large-scale investors view the protocol today—not merely as a smart contract platform, but as a high-performing financial instrument.

As BitMine and other large holders lock up more of this assets, the tradable volume on exchanges is shrinking. As interest keeps growing and more ETH gets locked up, we could be heading toward a serious Ethereum Supply Shock.

The token recently jumped from $3,200 to $3,850 and is now moving sideways between $3,550 and $3,700—a key zone for traders. Many are closely watching these levels to decide their next move.

Major resistance: $3,700

Critical support: $3,420

If activity spikes near resistance, we could see a push toward the psychological $5K zone this summer—as even CryptoGEMS hinted on X.

Not everyone is happy about this. Some people worry that the company's big ETH holding could cause centralization. If one company ends up holding too much staked coins, it might influence how the network works or cause liquidity issues—especially if the market takes a bad turn.

This is the growing debate—Ethereum latest news today isn’t just about valuation, it’s about influence. While some call it bullish, others warn of long-term disparities.

As a crypto analyst, I’d say this: BitMine’s action changes the landscape. BitMine ETH Holding at this scale is accelerating the shift toward institutional stockpiling, turning this token into a yield-generating reserve asset.

For traders, this means less coins to buy and more price ups and downs — signs of an Ethereum Supply Shock. Keep an eye on the $3,700 mark. If it goes above that with strong buying, the Ethereum Price Prediction of $5,000 could happen soon. But if it drops below $3,420, a small fall may come before it goes up again.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.