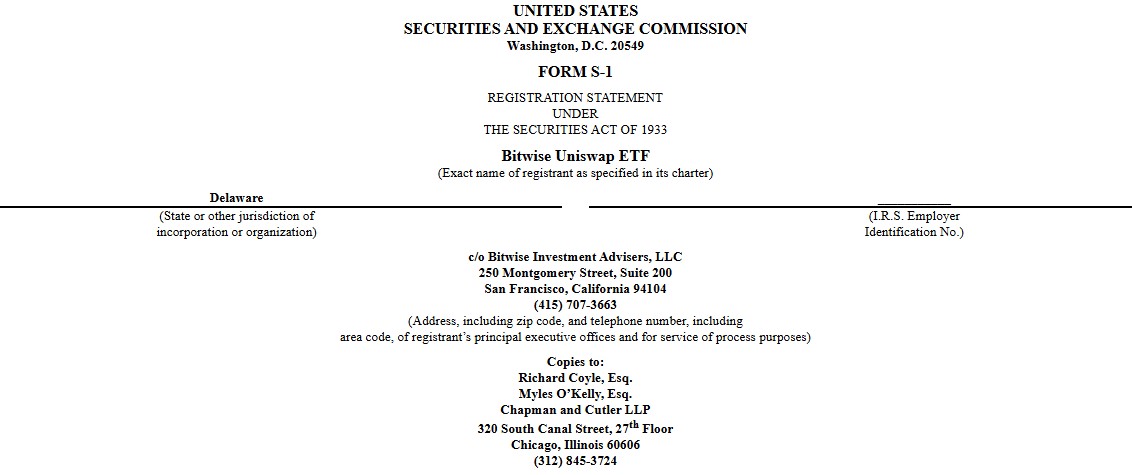

Bitwise, a leading crypto asset manager, has filed the first-ever S-1 registration for a spot Uniswap ETF with the US Securities and Exchange Commission (SEC). The filing, submitted on February 5, 2026, aims to give institutional regulated exposure to $UNI, the governance token of the largest decentralized exchange, Uniswap.

Source: SEC Official

The current move follows Bitwise’s initial step where it registered itself as a Uniswap ETF entity in Delaware on January 27, a common action made ahead of formal SEC filing. This registration does not signal regulatory approval or imminent trading, but simply creates the legal structure needed for a future application.

While the Uniswap ETF signals growing interest in DeFi products from traditional finance, the current $UNI price and broader market situations are raising concerns.

Despite the long-term significance of the Uniswap-ETF, UNI’s price dropped sharply. The coin fell over 12% in 24 hours, trading near $3.25, aligning with the other altcoins’ downtrend.

Source: CoinMarketCap

However, this decline is not altcoins specific. The total crypto market fell more than 8%, with Bitcoin down more than 8%, trading below its key level of $65k, driven by a macro-led liquidation cascade. Over $513.4 million was wiped out from the crypto ETFs marketplace with market sentiment dropped to "Extreme Fear” with point 5 rating on Fear & Greed Index.

many experts view the current market crash as a healthy reset, they believe it could lay the foundation for a stronger rebound ahead. However, trading volume surged nearly 87%, signaling heavy selling rather than healthy accumulations.

This initiative is a major regulatory milestone for altcoins after Hyperliquid, Chainlink, Litecoin, Avalanche, SUI. More than that, the filing highlights the first formal attempt to bring a major DeFi token into an ETF structure. If approved, it could unlock billions in potential institutional inflows, expanding DeFi’s reach beyond crypto-native investors.

According to the filing, the proposal directly tracks the price of $UNI. At launch, the fund would not include staking, though Bitwise noted that staking could be added later depending on regulatory clarity. Coinbase Custody Trust Company is selected as the custodian partner.

While $UNI’s price is reacting negatively in the short term, and depends on broader market stability, the Uniswap ETF filing is a meaningful step for decentralized finance and supports the long run.

It presents that despite high volatility, institutional interest in decentralized finance platforms continues to grow, paving the way for broader adoption once market conditions stabilize.

Disclaimer: The article is for information purposes only. It does not provide any financial or legal advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.

3 hours ago

Crypto trading doesn’t have to be confusing when you’re learning from the right people. Adeylnn Richardson shares helpful insights and guidance for those interested in understanding the market and trading step by step. If you’re curious and want to learn more, you can connect with her. WhatsApp +1 (820) 201-7380 or Facebook Adeylnn Richardsonftx