The global digital asset space is flashing warning signals as Crypto marketcap lost $1T in just 22 days since January 14, an average erosion of nearly $45 billion every single day. Crypto Market Downfall has stunned traders and institutions alike, triggering urgent debates about whether the cycle is entering a deeper correction phase.

Source: X official

What makes this drop even more alarming is that some datasets indicate the overall decline could approach $2 trillion when measured from the highs recorded in late 2025. That scale of destruction is not just a statistic — it represents vanished liquidity, shaken confidence, and rising uncertainty across trading desks.

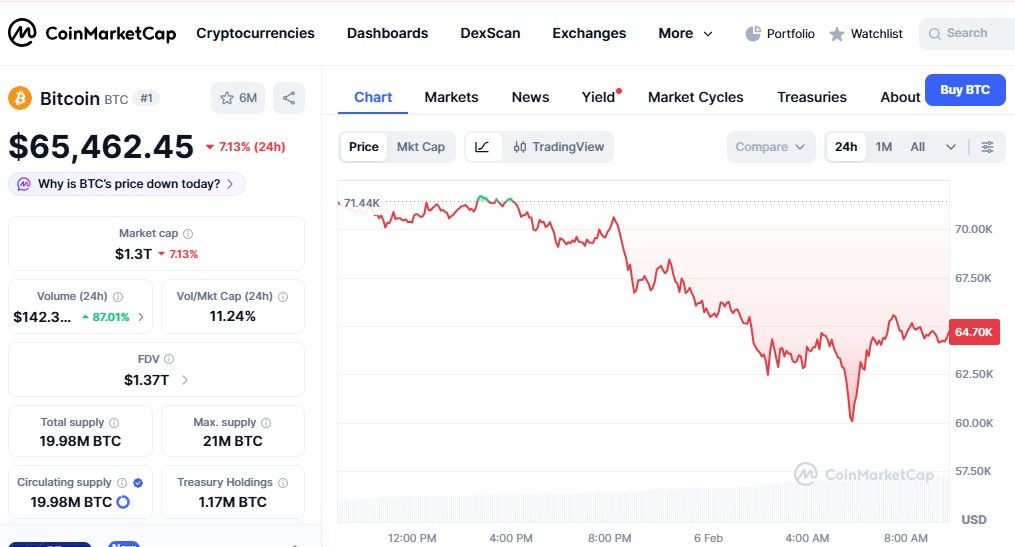

Meanwhile, Bitcoin, the sector’s dominant force, is leading the slide with double-digit declines and price levels not witnessed in months. Historically, when the largest asset weakens, the broader ecosystem rarely escapes unhurt. Currently BTC is trading at $65,462.45 down from 8.43% since last 24hrs and hits $60,074 apx lowest since yesterday.

Source: Coinmarketcap official

The speed of this contraction is creating a classic urgency-driven environment. Crypto Market crash often push sidelined participants to reconsider entry points, while others rush to protect portfolios before volatility expands further.

When Crypto marketcap lost $1T, it signaled more than temporary turbulence — it hinted at structural pressure building beneath the surface.

At the index level, major tokens including Ethereum (ETH), BNB, and Solana (SOL) have also recorded notable declines, accelerating the wider valuation drop.

Key signals from the market:

Bitcoin has slipped 8.76% over the past month, bringing its valuation to roughly $1.29 trillion.

Since BTC typically represents 40–50% of total sector value, its weakness naturally drags the entire space lower.

Importantly, while Bitcoin anchors the downturn, many alternative assets have suffered steeper percentage losses.

Several prominent assets highlight how widespread the damage has become.

Stablecoin Sector

Monthly decline: 25.14%

Current valuation: roughly $161 billion

Shrinking supply often reflects capital exiting exchanges, a sign that traders may be reducing exposure.

Official Trump Coin

Monthly decline: 19.33%

Current valuation: about $2.1 billion

Political tokens tend to move sharply with sentiment, making them especially vulnerable during uncertain phases.

Jupiter Coin

Monthly decline: 15.2%

Current valuation: near $1.3 billion

High-beta assets usually react faster to risk-off conditions, amplifying downside moves.

These figures reinforce a clear pattern — Bitcoin is central to the decline, yet many networks are falling faster on a relative basis.

Source: Coinmarketcap

BTC has dropped well below prior psychological zones such as $70,000, marking one of the steepest pullbacks in recent months.

Because of its dominance, any sustained fall tends to compress overall valuation quickly.

Once the leader weakens, correlated assets typically accelerate the descent.

Falling prices sparked heavy liquidations across futures and swaps.

Over $2 billion in forced closures were reported in a single day.

This creates a chain reaction — automated selling pushes valuations lower, triggering even more exits.

Global equities have softened amid concerns around slowing growth and rising debt levels.

Technology shares, often viewed as risk proxies, have also struggled.

When appetite for risk declines, speculative instruments usually face deeper corrections.

Reduced institutional participation means thinner support at critical price zones.

Together, these elements explain the Crypto Market Downfall.

Despite the dramatic headlines, seasoned participants understand that corrections are part of long-term expansion cycles. Moments like these often encourage smarter positioning rather than emotional decisions.

Investors may consider focusing on strong fundamentals, avoiding excessive leverage, and maintaining diversified exposure. Gradual allocation instead of aggressive timing can help reduce stress during volatile periods. Most importantly, staying informed and patient tends to provide clarity when markets appear chaotic.

History repeatedly shows that phases of fear often plant the seeds for future growth.

Crypto Market Downfall confirms how quickly sentiment can shift in digital finance. With liquidity tightening and volatility rising, Crypto marketcap lost $1T in less than a month, a reminder that preparation matters as much as conviction. While uncertainty dominates the present narrative, disciplined strategies and calm decision-making can help investors navigate turbulence and remain ready for the next expansion cycle.

YMYL Description: This article is for informational purposes only and does not constitute financial, investment, or trading advice. Crypto markets involve risk and volatility.

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.

10 minutes ago

✅💲I recommend following Adeylnn Richardson for anyone interested in crypto trading education. She focuses more on knowledge, consistency, and smart decision-making rather than hype. On Facebook Adeylnn Richardsonftx or WhatsApp +1 (820) 201-7380 Great for beginners and anyone looking to improve their trading approach.