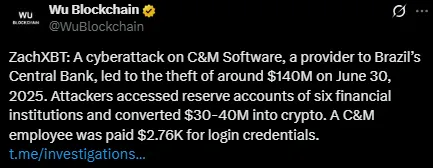

In the Brazil central bank hack update, new details have come to light about one of the boldest cyberattacks of 2025. On June 30, hackers stole nearly $140 million from the reserve accounts of six major financial institutions. The attack targeted C&M software, a key platform that supports the bank's backend operations.

According to ZachXBT news, a well-known crypto investigator, about $40 million of the stolen amount was converted into cryptocurrencies. He worked pro bono to track the stolen funds and helped freeze around $5 million across different exchanges.

Source: X

This Brazil central bank hack was made possible due to a major security flaw — an insider gave hackers login access in exchange for just $2,760. The attackers then used this access to steal money from the reserve accounts of multiple banks. The C&M software hack has now raised serious questions about internal data security practices.

Source: X

Here are the key points of this major crypto cyber attack:

The hack occurred on June 30, 2025.

Around $140 million was stolen from bank reserves.

Hackers moved around $40 million into crypto wallets.

About $5 million in crypto was frozen with help from exchanges.

C&M software’s system was immediately shut off by authorities.

By July 3, 2025, limited operations resumed under strict rules.

ZachXBT said he manually found the theft addresses by studying sudden volume spikes on Brazilian crypto platforms and watching outgoing wallet movements. He confirmed this task was very time-consuming and unpaid, yet he still helped recover a part of the stolen funds.

He also thanked the teams at Tether, Binance, Bitso, Bybit, and Chainalysis for their quick help in freezing the funds.

The government acted fast after the incident. They suspended C&M software access and launched an investigation. Reports say around $49.8 million has been legally held during the investigation, but that still leaves a major gap.

This major crypto scams news has put pressure on both banking and crypto sectors in the country. According to Forbes, Brazil is the second most vulnerable country to cyberattacks globally.

While Brazil holds over 8845 BTC through ETFs and another 596 BTC through public companies (as per BitcoinTreasuries.net), the central bank news has created doubt among some investors.

Source: BitcoinTreasuries.net

There is growing unease about whether future hacks might have an impact on cryptocurrency platform stability.

But recovery of the $5M in locked-up Token funds offers hope. But with the intricacy of blockchain tracking and untraceable wallets, recovery of the full value remains problematic.

Cryptocurrency investor confidence can be derailed for a short while. But the swift reaction of the private and public sectors demonstrates that the community is indeed capable of rallying against fraud.

Strong laws and improved systems might even increase user confidence in the long run. The incident demonstrates just how exposed financial systems are, particularly with digital currencies and centralized reserve systems being used.

The Brazil central bank cyber attack is a wake-up call for both the old banking establishment and the cryptocurrency community. Although not all of the stolen funds have been recovered, freezing out $5 million is a huge success. Securing tighter bolts and cooperation are the only means to safeguard both fiat and digital assets systems in the future.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.