Today, The cryptocurrency market extended its rally, with high-profile news dictating investor sentiment and market action. Bitcoin has spiked to record levels, regulatory action in the U.S. is warming up, and industry giants such as Binance and Metaplanet are in the spotlight.

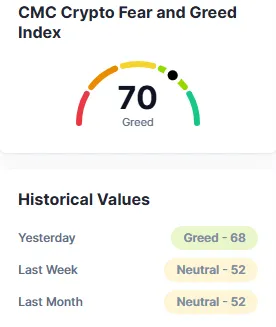

In the last 24 hours, global crypto Currency trading volume reached $185 billion, with Bitcoin dominance rising to 62.6%, indicating a strong shift back to BTC. Ethereum held its ground at 9.46% market share, showcasing continued investor trust in blue-chip assets. Meanwhile, the Crypto Fear and Greed Index hit 70 (Greed), reflecting growing bullish sentiment across the market.

Source: CoinMarketCap

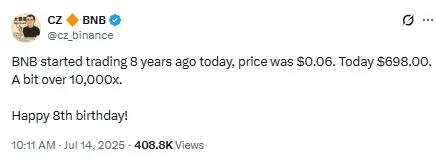

Today is the 8th anniversary of Binance Coin (BNB), the native token of Binance, the world’s biggest cryptocurrency exchange by trading volume. What began as a utility token in 2017 (its value was a mere $0.06) has turned into one of the most successful long-term digital assests investments.

If you put only $100 into BNB when it launched, you'd now be sitting on around $1 million, courtesy of an otherworldly increase in price of more than 10,000x. This milestone not only underlines the explosive growth of BNB but also Binance's enormous contribution to the global crypto ecosystem.

The anniversary has brought fresh attention to BNB, causing its price to rise slightly in today’s trading and sparking rumors about new possible uses for the token.

Binance founder Changpeng Zhao, also known as CZ, shared a short message on social media to celebrate BNB’s 8th anniversary. He highlighted how BNB grew from just $0.06 to $698 in eight years, approx 10,000x return.

Source: CZ

With its latest Bitcoin purchase, Japan-listed company Metaplanet, led by CEO Simon Gerovich, is back in the spotlight. The firm recently bought an additional 797 BTC for about $93.6 million, at an average price of $117,451 per coin.

This new investment brings Metaplanet’s total Bitcoin holdings to 16,352 BTC, with earlier purchases made at an average price of $100,191 per coin.

In a significant move from the Web3 and gaming world, Nasdaq-listed SharpLink Gaming has purchased 16,374 ETH, worth approximately $48.85 million, just seven hours ago. The company now has 270,000 ETH in Ethereum reserves as a result of this acquisition.

Source: Metaplanet INC.

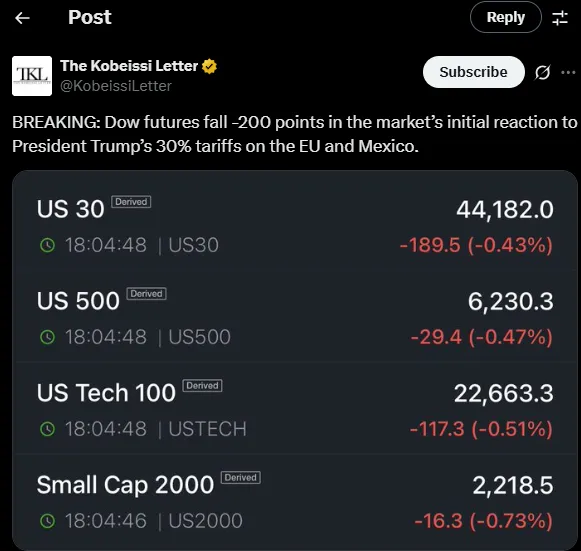

In a sensational market response, Bitcoin surged above $121,000 today following the announcement by the U.S. President Donald Trump intends to impose new tariffs of 30% on European Union and Mexican goods.

According to The Kobeissi Letter, Dow Futures fell by nearly 200 points amid a broader market sell-off.

The move incited further inflation and international trade turbulence fears - two catalysts that normally encourage investors to turn to decentralized, non-state assets such as Bitcoin.

In the hours following the news report, BTC experienced a dramatic surge in volume and demand. Market observers indicate this geo-political action could be a precursor to even more forceful crypto investment by investors looking to protect themselves from fiat-based economic policy.

Source: The Kobeissi Letter

Adding to market momentum, today the United States is entering a high-stakes crypto regulatory week with the House and Senate set to vote on important bills that may shape the future of digital assets legally as the U.S. Crypto Week Begins Today.

On the agenda are stablecoin regulation, regulation of DeFi, and token classification clarity (security vs. commodity). Bitcoin's weekend and Monday sharp run-up seems to be fueled in part by hope for more positive regulatory developments.

If enacted, these bills would make compliance clearer for companies and could potentially open up new inflows of capital from institutional players.

With a combination of regulatory expectation, macro-political stimuli, and historical milestones, the crypto space is abuzz with activity. Bitcoin's record rise to $121K is no fluke- it's riding on multi-layered optimism from all sides. Whether BNB's incredible 8-year ride or Metaplanet's savvy BTC stacking, one thing is certain: crypto confidence is back - and it's more international than ever.

Experienced Content Writer with 4+ years in producing SEO-optimized, engaging, and research-driven content for Technical, Crypto, Finance, and Travel domains. Crypto-journalist skilled in creating both short- and long-form content, delivering value-driven writing tailored to diverse audiences and platforms.