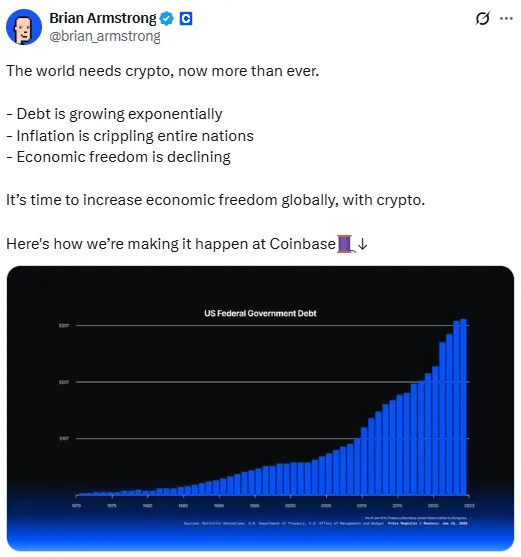

Coinbase CEO Brian Armstrong is raising concerns on the increasing danger of the United States and world economy. In a series of public statements and tweets, Armstrong depicted a dismal picture of the state of the global financial health. As inflation increases, government debt reaches new records, and faith in governments declines. In his opinion, traditional economic systems are now outdated and crypto could be the solution.

Armstrong referenced a trio of issues: runaway debt, uncontrollable inflation, and waning economic freedom. "The world needs crypto now more than ever," he said, advising investors that government deficits and central bank failures are driving individuals to seek alternative solutions.

Source: Brian Armstrong X Handle

Source: Brian Armstrong X Handle

His point was straightforward: governments are issuing too much currency, the central banks are increasing interest rates to check inflation, and the common man is losing financial traction. Armstrong sees digital currency presenting a more fair system, one without the intermediaries and covert charges that characterize the world's banks today.

At the same time, the U.S. Senate is debating a tax cut bill that could add up to $3 trillion more to the national debt over the next decade. Some experts warn that this move could push the U.S. closer to a financial crisis.

The bill, which Donald Trump has described as the "big, beautiful bill", would extend his 2017 tax reductions but cut social programs. The bill has been denounced as a "disgusting abomination" by Elon Musk.

The national debt of the U.S. is already $36 trillion, over 120% of the nation's economic output. Foreign countries, business organisations, and individuals hold most of this debt. With investor confidence eroding and interest rates remaining high, the cost to service this debt will continue to increase.

Source: FRED

Another indication of trouble: investors no longer are not considering the U.S. dollar as a safe haven in times of international crisis. Typically, during war or panic in the markets, the dollar rallies. But during the Middle East crisis, the dollar has barely budged, and that has raised doubts about whether it still inspires world confidence.

The Federal Reserve, the interest rate setter that attempts to hold inflation in line, is coming under more pressure than ever. Trump has repeatedly criticized Fed Chairman Jerome Powell, calling him a "real dummy" and accusing him of damaging the U.S. economy by not cutting rates soon enough.

At the June 18 Fed meeting, Powell reaffirmed interest rates would stay flat at 4.25% to 4.5%. He further noted that previous tariffs by Trump are continuing to contribute to inflation pressure, demonstrating how politics and monetary policy are getting perilously intertwined.

Some analysts fear the Fed's independence will be eroded in a period called "fiscal dominance", where the central bank is propping up government debt rather than resisting inflation.

Armstrong posits that crypto provides a way out of these increasing dangers. Stablecoins, or cryptocurrencies pegged to the U.S. dollar, are becoming the next huge utility for everyday payments, with their market cap increasing 50% year on year, he believes. Crypto is also making inroads in cross-border payments and as an inflation hedge, particularly in ailing economies.

Crypto empowers individuals to control their money, sidesteps expensive fees, and operates 24/7 on borders. In his own words: "Crypto is about freedom and individual sovereignty."

As the U.S. economy becomes more unstable, his message is gaining more listeners: maybe it's time for a new system, one not based on debt and politics, but on transparent, worldwide blockchain technology.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.