BTC and ETH Options Expiry is the key event shaping Bitcoin news today and Ethereum price action. On January 9, almost $2.4 billion worth of coins expired, creating pressure around important price points.

With Bitcoin price close to $90,000, and Ethereum near $3,100, traders and market analysts are watching closely to see if this massive coin exit will change things or just pause the current trends.

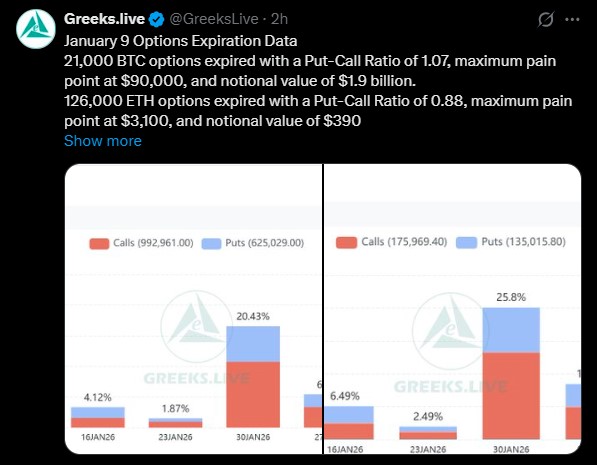

According to Greeks.live on-chain data, Bitcoin options expiry today hit around 21,000 ground with a Put-Call Ratio of 1.07, indicating a bit of bearish sentiment. The max pain point for $BTC is $90,000, with a total value of $1.9 billion.

On the other hand, 126,000 Ethereum options expired, showing a Put-Call Ratio of 0.88 and a max pain of $3,100, with $390 million in value.

Even though this expiry was small, making up only 7% of total open interest, it helps explain why BTC and ETH news feels calm despite recent ups and downs.

Market makers usually prefer prices to stay around these levels until expiry is over.

Right now, it is trading at $90,005, with 24-hour trading volume down nearly 9% to $39.3 billion as per TradingView price chart technical analysis.

Data signals weak momentum but not panic. The Relative Strength Index (RSI) on the 2-hour chart is near 40, close to oversold, while the Moving Average Convergence Divergence (MACD) is bearish but flattening.

The impact of BTC and ETH Options Expiry is clear: prices are drawn toward $90,000. If it drops below this level, the next support levels are $88,800 and $87,500. If buyers can defend this level, Bitcoin 2026 price prediction for coming days might bounce back to $91,800–$92,500, and later on towards $95,000,.

Traders should note that, for now, it seems neutral to slightly bearish until trading volume picks up again.

The altcoin is currently trading at $3,093, with volume down 11% to $21.23 billion. After the expiry event, the altcoin is holding up better than 'Crypto King', staying between $3,050 and $3,150 levels.

Its RSI is higher, and the MACD shows selling pressure is fading. The max pain is still at $3,100, acting like a pull for the long-term Ethereum price prediction for 2026.

If it stays above $3,100, it could go up to $3,180–$3,250. But if it drops below $3,050, it might fall to $3,000. In the short term, ETH price looks neutral-to-bullish compared to the “Crypto King”.

A crypto expert named Crypto Tice pointed out on its official X account that the $2.22 billion in BTC and ETH options expiring today can create volatility.

Big expiries often keep prices pinned near max pain levels. But after this event, the pressure from hedging decreases, allowing for clearer price trends to form.

This expert’s analysis clearly shows that the assets have the potential to recover soon as long as their key support level holds.

Traders should note that Market insights are based on on-chain options data, technical indicators, and derivatives market behavior observed during January 9.

The BTC and ETH Options Expiry suggests that we are in a phase of consolidation, not collapse. The direction of the market now depends on trading volume, their support levels, and follow-through. Volatility may rise in the short-run, but crypto market watchers are bullish on long-term price estimates.

YMYL Disclaimer: This content is for informational purposes only and does not count as financial advice. Cryptocurrency markets can be volatile. Readers should do their own research before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

1 week ago

The popularity of bitcoin and cryptocurrency, in general has however led to a large increase in the number of cryptocurrency investment scams and cryptocurrency scams in general. Other related forms of scams that have also skyrocketed include binary options scams, Forex scams, investment scams, etc. There are a lot of fraudulent cryptocurrency investment websites, as well as fake binary options and Forex brokers. A lot of investors have lost (are still losing) money to these bitcoin cryptocurrencies and binary options Forex investment scams. So what do you do when you want to recover scammed bitcoin, cryptocurrency, as well as funds lost to binary options Forex or investment scams? You are guaranteed to get your stolen funds back by following the three steps listed below; **File a Report with ShieldStridehub . com Contact ShieldStridehub in order to file a report. file a report with them by visiting their website, and fill the form or talk to an online representative. ShieldStridehub is a recovery company that help victims track down and recover scammed bitcoin, stolen cryptocurrency, money lost to binary options, recovery of funds lost to Forex brokers, investment scam as well as all other forms of scam including romance scam. www. ShieldStrideHub. com

1 month ago

In today's hyper-digital world, the threat of scams and financial fraud has become more pervasive and sophisticated than ever. The rise of online platforms and digital payment systems has created new avenues for scammers to exploit unsuspecting individuals and businesses, resulting in devastating financial consequences. From romance scams to elaborate crypto Ponzi schemes, the landscape of online deception is complex and constantly evolving. However, amidst this chaos, one company has emerged as a beacon of hope for those who have fallen victim to online scams: TECHY FORCE CYBER RETRIEVAL (TFCR). With a proven track record of recovering over $1.8 billion in stolen funds, TFCR has established itself as the most successful and legitimate asset recovery company in the world. This remarkable achievement is a testament to the company's unwavering commitment to delivering results where others fail. Website// w.w.w.techy force cyber retrieval . com WhatsApp ht tps:// wa.link / 56v49j At the heart of TFCR's success lies its team of expert professionals, comprising ethical hackers, blockchain analysts, and legal investigators. This multidisciplinary approach enables the company to combine technical precision with human understanding, providing a comprehensive solution to a wide range of fraud cases. Whether it's recovering funds from bitcoin scams, romance scams, or cryptocurrency scams, TFCR's team of experts is equipped to navigate the most complex scenarios and deliver results. One of the key factors that sets TFCR apart from other asset recovery companies is its transparent and client-centric approach. Unlike many different companies that charge exorbitant upfront fees, TFCR operates on a no-win, no-fee basis. This means that clients only pay when recovery is successful, ensuring that they are not burdened with additional financial stress during an already difficult time. TFCR's expertise extends across a wide range of areas, including: 1. Bitcoin Scams: TFCR has helped numerous clients recover funds lost to bitcoin scams, leveraging its expertise in blockchain analysis to track down and recover stolen cryptocurrencies. 2. Romance Scams: The company has assisted victims of romance scams, providing emotional support and guidance throughout the recovery process. 3. Cryptocurrency Scams: TFCR's team of experts has recovered funds lost to cryptocurrency scams, including those involving initial coin offerings (ICOs) and other digital assets. 4. Bank Transfer Scams: The company has helped clients recover funds lost to bank transfer scams, working closely with financial institutions to track down and recover stolen funds. 5. Online Banking Transactions: TFCR has assisted victims of online banking scams, providing expert guidance on how to prevent future incidents and recover lost funds. 6. FIRE (Financial Independence, Retire Early) Scams: The company has helped individuals and families recover funds lost to FIRE scams, providing support and guidance throughout the recovery process. 7. Online Shopping & E-commerce Scams: TFCR has assisted victims of online shopping and e-commerce scams, recovering funds lost to fake online stores and other scams. 8. Sweepstakes & Lottery Scams: The company has helped clients recover funds lost to sweepstakes and lottery scams, providing expert guidance on how to avoid falling victim to these types of scams. 9. Investment & Real Estate Fraud: TFCR's team of experts has recovered funds lost to investment and real estate fraud, providing support and guidance throughout the recovery process. 10. Tech Support Scams: The company has assisted victims of tech support scams, recovering funds lost to fake tech support services and other scams. 11. Phishing & Spoofing Attacks: TFCR has helped clients recover funds lost to phishing and spoofing attacks, providing expert guidance on how to prevent future incidents. In each of these areas, TFCR's team of experts has consistently demonstrated its ability to deliver results where others have failed. The company's commitment to transparency, client-centricity, and technical expertise has earned it a reputation as the most trusted and successful asset recovery company in the world. If you or someone you know has fallen victim to an online scam, don't hesitate to reach out to TFCR. With its proven track record of success and unwavering commitment to delivering results, the company is the go-to partner for anyone seeking to recover lost funds and rebuild their financial lives. Remember, with TFCR, you pay only when recovery is successful, ensuring that you are not burdened with additional financial stress during an already difficult time. Take the first step towards recovering your lost funds and rebuilding your financial future – contact TFCR today. Website// w.w.w.techy forcecy berretrieval . com WhatsApp htt ps:/ /wa. link/ 56v49j

1 month ago

I was recently scammed out of $100,000 by a fraudulent Bitcoin investment scheme, which added significant stress to my already difficult health issues, as I was also facing cancer surgery expenses. Desperate to recover my funds, I spent hours researching and consulting other victims, which led me to discover the excellent reputation of Scam Recovery Crypto, I came across a Google post It was only after spending many hours researching and asking other victims for advice that I discovered Scam Recovery Crypto reputation. I decided to contact them because of their successful recovery record and encouraging client testimonials. I had no idea that this would be the pivotal moment in my fight against cryptocurrency theft. Thanks to their expert team, I was able to recover my lost cryptocurrency back. The process was intricate, but Scam Recovery Crypto commitment to utilizing the latest technology ensured a successful outcome. I highly recommend their services to anyone who has fallen victim to cryptocurrency fraud. For assistance get in touch with: ScamRecoveryCrypto@Consultant.Com WhatsApp +44 7384 087554