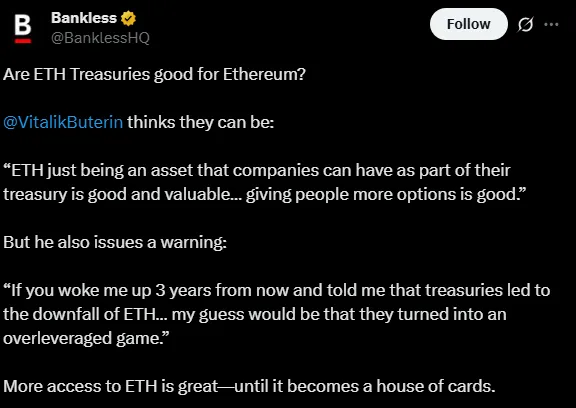

Vitalik Buterin on ETH Treasury: Opportunity or Risk?

Ethereum co-founder Vitalik Buterin has shared a balanced view on the idea of companies holding ether in their treasuries. Speaking on the topic, he called ether an asset that offers value and flexibility for corporate reserves, but he also warned that mismanagement could turn it into a dangerous “overleveraged game.”

Source: X

According to Buterin on ETH Treasury view, allowing companies to hold ether as part of their reserve is useful and important because it gives people more choices.

The firms like Tesla, MicroStrategy, and Square are already treating crypto as a capital Asset with their BTC hoards. By treating Ethereum the same could lead holdings of companies in a billion dollars' figure in upcoming years.

Along with a positive side, Buterin on ETH Treasury, raises a warning. The concern is that companies might borrow too much using their digital asset or trade too many risky derivatives. If prices drop suddenly, it could cause a chain reaction like in 2022 when overleveraged crypto lenders collapsed and were forced to sell everything quickly.

The price effects depend on scale:

Small-scale adoption: Could stabilize the currency in the $3,000 - $4,000 range.

Large-scale adoption: Could push the coin toward new all-time highs.

Overleveraged adoption: Could cause sharp downturns if companies are forced to sell during market stress.

Although the sharp tone of Buterin on ETH Treasury raises concerns, the larger investors have continued adding the virtual coins to their reserves. The top position is held by BitMine Immersion Technology with 833,100 coins ($3.2B), following SharpLink Gaming ($2B), the Ether Machine (1.34B).

More than 1% of the total supply of the asset is now held by crypto capital companies, with a surging speculation of up to 10% in upcoming years by the experts.

Along with this, the currency, this year faced a very dramatic journey. It started with $3,300 in January, hit its year lowest of $1,385 on April 9, and here in August setting heights at $3,967 at the time of writing, a major rise of 185% from last month’s low.

Source: CoinMarketCap

This rebound coincides with increasing capital demand, hinting at a possible link between corporate ETH buying and the market's recovery.

More corporate access to ethereum could be a transformative force for its adoption, just as it was for Bitcoin. However,Buterin on ETH Treasury warning highlights the thin line between healthy growth and dangerous speculation. The coming years will test whether ether reserve become a foundation for stability or a house of cards in the crypto economy.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.