955,526 BTC Now Held by Institutions: Coin’s Quiet Transfer of Power

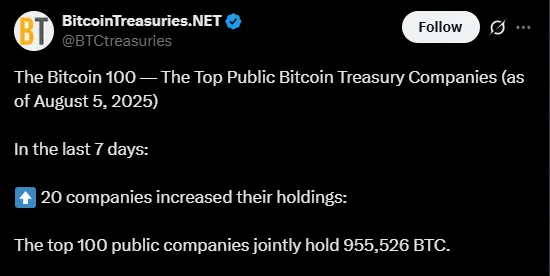

Bitcoin Treasuries recently released the top Public Bitcoin Treasury Companies indexing. As of today, Aug 5, the top 100 public sectors reserved 955,526 tokens altogether with the contribution of the 20 companies' new addings in the last seven days.

Is this showing a complete shift towards the decentralized economy, a new normal?

Source: X

At the top stands Microstrategy, with an unmatched 628,791 BTC on its balance sheet, equivalent to ~3% of total supply with over $71 billion value. Following that MARA Inc. with 50,000, XXI with 43,514, and Riot platforms with 19,239 coins.

Source: Treasuries

What stands out at the time, is the growing interest from global companies like Germany’s Next Technology (5,833 coin), China’s Cango Inc. (4,240 BTC), and Canada’s Netcoins (1,788 BTC).

While some are increasing their accumulations for example Cleanspark and Bitfarms have doubled down since beginning. These Bitcoin Treasury Companies are not just investing, they are hinting long term belief, despite short term market noise.

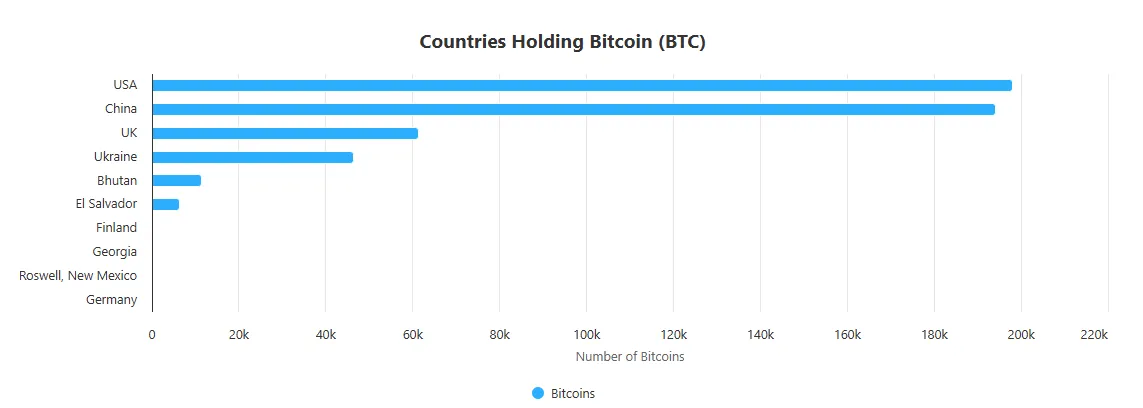

Beyond the Public Bitcoin Treasury Companies craze, governments of different states are also showing interest in new reserves strategies. Top nations include the U.S. with 200,000 coins (though not formally in treasury yet), China with 194,000 coins, UK 61,245 coins, and Ukraine with 46,300 coins.

Source:BitBo.io

Emerging economies like India, Kazakhstan, and even Pakistan are exploring reserve diversification with the token, either through direct holdings, local mining policies, or crypto taxation models.

Even with such bullish accumulation, the currency is down 3.86% in last 7 days, currently trading around $114,028 with the market cap of $2.26 trillion.

Source: CoinMarketCap

But the question is why is the digital currency suddenly driving downwards, especially after hitting its all time high of 123K last month? Or is Robert Kiyosaki’s “Bitcoin August Curse” term true?

Well August is historically a slow month for crypto markets. Add to that Weak U.S. Jobs data, Mixed Fed rate cut signals, global political tensions, keep traders cautious, and slowing the inflow in space.

The Public Bitcoin Treasury Companies holdings is not just a number, it’s a directional shift. As of today 19.9 million BTC have been minted, and 3.65 million are already out of circulation as distributed in different sectors like Custodian, public-private holdings, ETFs & funds, DeFi Protocols.

BTC may look volatile, but behind the scenes, the free float is shrinking fast, as it is no longer a speculative plaything. It is now becoming a reserved, strategic asset for varied institutions.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.

3 months ago

Refresh Renovation Southwest Charlotte 1251 Arrow Pine r c121, Charlotte, NC 28273, United tates +19803517882 Hm value ad to your

3 months ago

Refresh Renovation Southwest Charlotte 1251 Arrow Pine r c121, Charlotte, NC 28273, United tates +19803517882 Annd bathroom bright functional designs