US digital asset manager Canary Capital Group has filed a filing with the Securities and Exchange Commission (SEC) to debut the Canary Capital ETF, formally the Canary American-Made Crypto Exchange Traded Fund (MRCA).

The proposed product will be traded on Cboe BZX Exchange under the ticker symbol MRCA.

The cryptocurrency investment product is set to provide investors with exposure only to cryptocurrencies with significant connections to the United States.

This would encompass digital assets that are created, mined, or predominantly worked in the nation.

Canary Capital ETF will follow the Made-in-America Blockchain Index, which shall only accept tokens that conform to stringent criteria. Assets should be eligible for custody by a regulated US bank or trust, possess adequate liquidity, and list on multiple proven exchanges.

In order to maintain quality, the index shall exclude:

Stablecoins

Memecoins

Any pegged tokens

It will also be rebalanced every quarter to maintain transparency and stability.

Aside from tracking the index, the trust that manages the Canary Capital ETF, plans to stake proof-of-stake assets. It will be through the regulated third-party providers.

This will imply the fund receives staking rewards, which will form part of its net asset value.

By doing so, it aims to offer exposure to digital assets alongside additional yield through involvement in a blockchain.

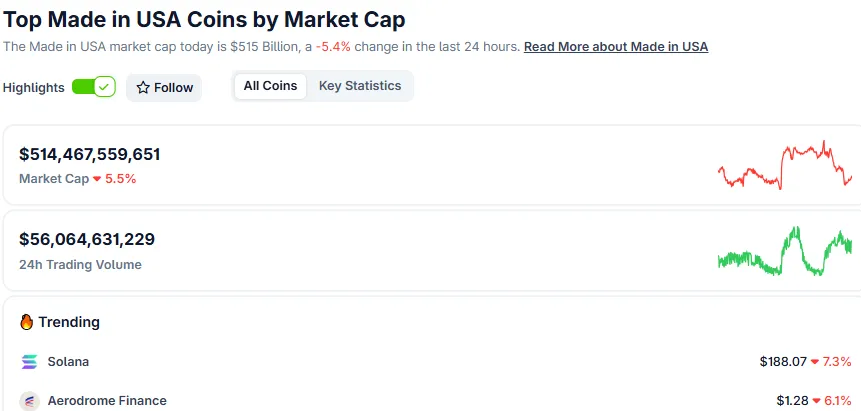

Based on CoinGecko data, made in USA crypto, account for more than $514 billion in market cap.

Source: CoinGecko

Some popular projects which tend to qualify under this umbrella are XRP, Solana, Cardano, Chainlink, Stellar, Avalanche, Hedera, and Sui.

Although the report does not indicate what tokens will be added, experts suspect these assets would be likely prospects.

Bloomberg Exchange Traded Fund analyst Eric Balchunas observed that the application demonstrates how investment managers are investigating every avenue to offer investors various means of access to the expanding crypto market.

The Canary Capital ETF filing happened during a high season for crypto fund proposals.

Earlier, just days ago, Grayscale submitted to the SEC to convert its current Avalanche Fund into a public trust. Also to list on Nasdaq as the Grayscale Avalanche Trust ETF.

Similar to this proposal, the Grayscale fund can also apply staking to earn additional yield.

Also pending at the SEC are decisions on other asset managers' spot XRP, Solana, and Dogecoin Exchange Traded Funds, such as 21Shares, Bitwise, and CoinShares.

With new regulations coming in July 2025, the SEC has compressed its review process from 240 days to 75 days. It will potentially result in faster verdicts for these products.

As much as the SEC has been conservative in accepting crypto ETFs. The changes in recent times indicate that altcoin-based products such as the Canary Capital ETF would receive a quicker response.

Industry observers state that an introduction of a US-specific crypto index fund may signal a new era in regulated digital asset investing.

If sanctioned, the Canary Capital ETF would provide investors with an opportunity to support America's native crypto initiatives while reaping staking benefits. It demonstrates a blend of security, innovation, and possible growth.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.