What if Wall Street suddenly opened its doors to Avalanche? That’s exactly what’s on the table today, as the largest digital asset platform has quietly taken a bold step with its latest move — the Grayscale Avax ETF filing.

The twist? Instead of soaring on this headline, investors saw Avalanche price drop, leaving everyone wondering: is this the calm before a SEC approval, or something riskier is brewing inside?

Company’s Investments has officially filed a Form S-1 with the U.S. Securities and Exchange Commission to launch the Grayscale Avax ETF, aiming for a Nasdaq listing.

Source: Grayscale SEC Government

This move mirrors the firm’s earlier filings for Bitcoin and Ethereum, signaling a potential institutional gateway to Avalanche ETF news today.

Key details from the filing:

Filing Date: August 22, 2025

State of Registration: Delaware

Custodian: Coinbase Custody

Prime Broker: Coinbase, Inc.

Legal Firm: Davis Polk & Wardwell LLP (New York)

Executive Contact: Edward McGee, CFO

Now comes the most awaited question: Why does this Grayscale Avax news matter today? Form S-1 marks the first step toward launching fresh investment offerings within U.S. markets. In crypto, that path often brings trust.

The SEC decision can attract individuals seeking token’s exposure through regulated channels, proving major institutions are beginning to notice the asset seriously.

At the time of writing, according to the TradingView price chart analysis, instead of going up, price dropped 4.25% in 24 hours, sliding to $24.10. Earlier, it was near $26, but the announcement triggered selling.

Trading Volume: $1.05B (down 1.4%)

Support Level: $23–22

Resistance Zone: $26–27

RSI: 50.79, Neutral (not too hot, not too cold).

MACD: Slight weakness but still above signal line.

Candles: Sellers blocking at $26 again and again.

Downside Risk: If $23 breaks, price may fall toward $21.

Upside Chance: If $26 is cleared with power, next stop could be $30–32.

Being a crypto analyst, my analysis says; The Grayscale Avax ETF filing is a strong long-term signal. But unless the token crosses $26 with heavy buying, it may stay stuck in a range or even retest $21. Just SEC AVAX filing news is not enough for a rally.

Earlier the platform filed for Bitcoin and Ethereum trusts, their prices often went up before approval because traders expected inflows from institutions.

But, after the Grayscale Avalanche ETF SEC Filing, the token went crashing, although it's just a short term pullback because in crypto timing is the key.

Possible paths ahead:

Bullish: Break above $26 can pull a run toward $30–32.

Neutral: Sideways between $22–26 until Security exchange commission acts.

Bearish: Market-wide weakness pulls AVAX price rally down to $20–21.

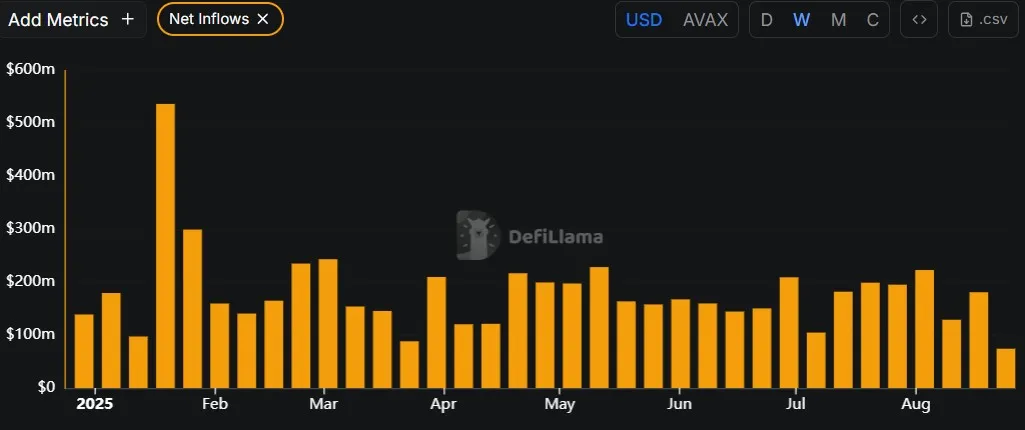

According to DeFiLlanma , the token is already pulling big money into DeFi, with hundreds of millions flowing in every month.

If the Grayscale Avax ETF gets SEC approval, that trust could grow even faster. But the big question is timing, there are two scenarios:

Approval may push Avalanche prices above $30

While delays could keep the asset stuck around $22–26.

Whether approval unlocks a rally or delays cool momentum, one thing is sure: Wall Street is finally paying attention to this ETF token news.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.