In a major development for digital finance, Canary Capital has filed a unique staked INJ ETF with the Securities and Exchange Commission (SEC). This is the first-ever regulated investment product in the U.S. that connects traditional markets to Injective Protocol while also offering on-chain staking rewards.

As reported in the latest Injective INJ news, this launch could change how American investors participate in decentralized ecosystems.

With the Canary Capital INJ ETF, both retail buyers and institutions can now access this blockchain through trusted brokers—without holding tokens directly.

Canary Capital is known for carefully selecting only a few digital asset products. It previously submitted applications linked to XRP and Solana, both of which attracted strong institutional interest.

The company’s decision to move forward with Injective shows growing confidence in the protocol’s long-term potential.

What makes this different is that it’s not a standard exchange-traded fund. This one would stake the held INJ assets, allowing investors to benefit from passive earnings, while also helping to protect the network through proof-of-stake validation.

That means the Canary Capital ETF filing with the SEC brings something new to the table: a combination of compliance, accessibility, and yield generation. In today’s market, that’s a rare mix.

Here’s what sets this product apart from previous launches:

Investors don’t just buy and hold—they earn from staking participation.

It’s structured to meet regulatory standards, making it safe for all users.

It allows exposure to blockchain rewards without technical steps.

This model is ideal for users who want a simple, secure path to passive income from the digital asset space. It’s a new take on how Canary Capital crypto ETF strategies can offer returns.

This announcement comes during Crypto Week in Congress, where U.S. lawmakers are reviewing three important bills. One of them—the CLARITY Act crypto bill—aims to clearly define whether tokens are regulated as securities or commodities.

Source: Truth Social Donald Trump X Account

Other proposals like the GENIUS Act (stablecoin regulation) and the Anti-CBDC Surveillance State Act (against government-issued digital currency) are also being debated.

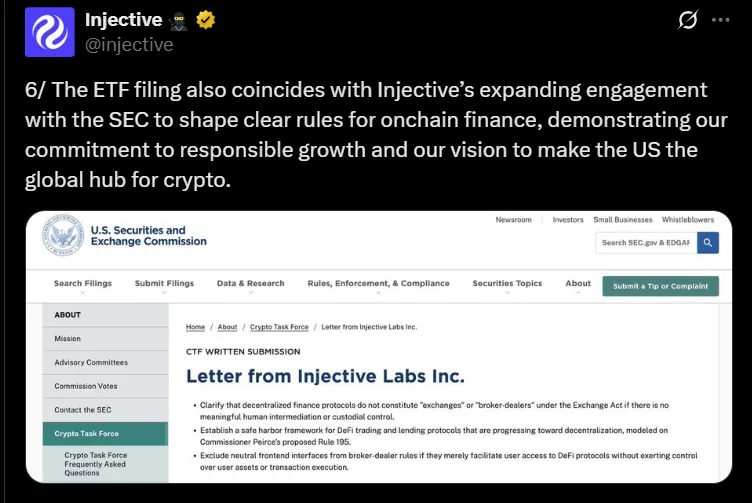

These laws could build the foundation for regulated tools like the INJ SEC filing to succeed. If these bills pass, there’s a strong chance we’ll soon see INJ Exchange traded funds approval, offering the clarity investors and companies have been waiting for.

Earlier, 21Shares launched a European ETP for Injective, which saw solid demand. That success hinted at a bigger opportunity. The U.S. market—with its financial depth and advanced infrastructure—makes the Canary Capital ETFs even more promising.

This move shows that both sides of finance—blockchain and traditional—are ready to work together. And Canary Capital news today proves that momentum is building.

This filing is much bigger than a headline. It is a step toward connecting everyday investors to emerging blockchain networks in a secure and rewarding manner.

By blending regulation with innovation, the Canary Capital INJ ETF shows that a new type of finance is possible—open, compliant, and profitable for all.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.