Cathie Wood Gold Prediction moved into the spotlight as global markets witnessed one of the most violent trading sessions in recent history. Within just one hour of the US market opening, trillions of dollars were wiped out across gold, silver, stocks, and crypto, shocking investors worldwide.

Gold prices tumbled sharply from near $5,600 per ounce to around $5,400, triggering panic selling before staging a partial recovery.

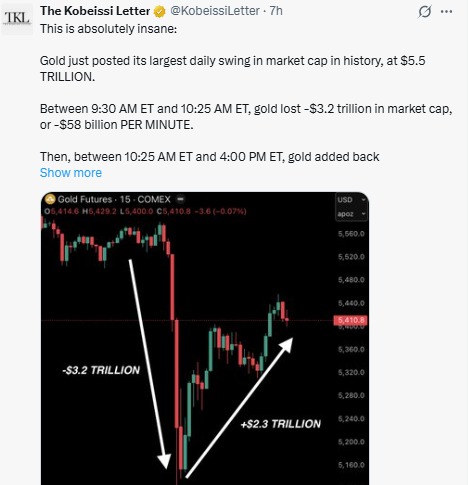

According to market data, it lost nearly $3.2 trillion in market value in less than one hour, marking the largest intraday swing ever recorded for the metal.

Source: The Kobeissi Letter

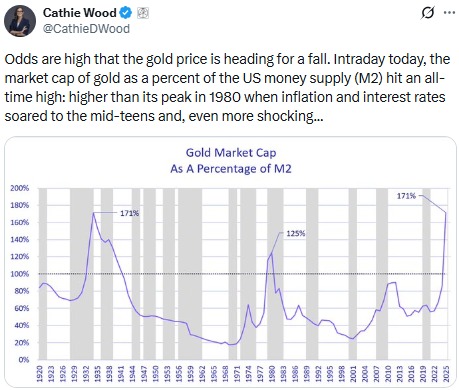

Cathie Wood Gold Prediction came from a valuation perspective rather than short-term price movement. The ARK Invest founder highlighted that asset’s total market value compared to the US money supply (M2) has reached an all-time high. This level is higher than the peak seen in 1980 and matches conditions last observed during the Great Depression in 1934.

Source: X (formerly Twitter)

Cathie Wood suggests that such extreme readings often appear near the end of a cycle. She argued that today’s US economy does not reflect crisis-level inflation or deflation, making gold’s explosive rise vulnerable to correction if the dollar strengthens.

The market reaction was immediate and brutal. XAUUSD price fell more than 8% intraday, erasing roughly $3 trillion in value at its lowest point before bouncing back by nearly $2.3 trillion later in the session. This created a total swing of $5.5 trillion in a single day, surpassing volatility seen during the 2008 financial crisis.

Silver price today performed even worse. Silver plunged over 12% intraday, wiping out nearly $760 billion in market capitalization. Traders described the move as forced liquidation driven by profit-taking after weeks of parabolic gains.

Cathie Wood Gold Prediction coincided with weakness across US equities.

The S&P 500 dropped around 1.2%, while the Nasdaq fell more than 2.5% at one point, erasing nearly $1.5 trillion combined before partial recovery.

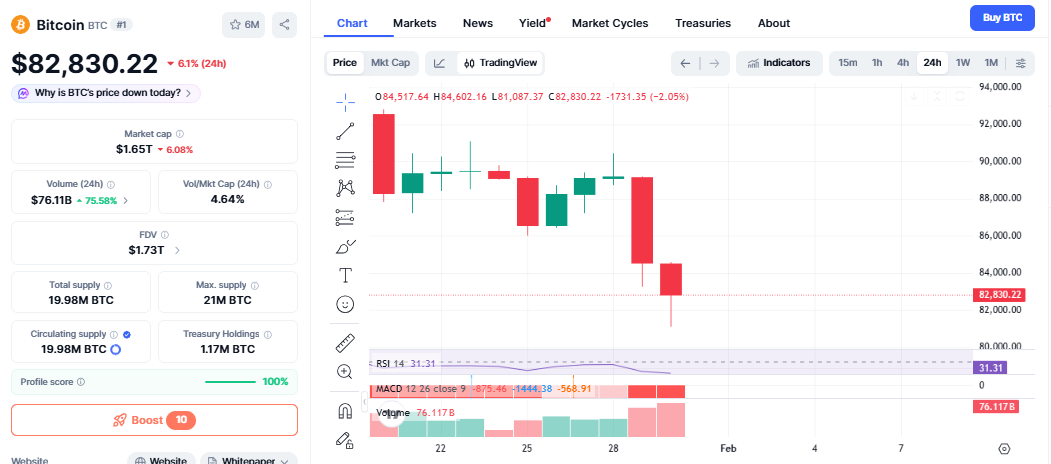

The impact quickly spilled into crypto markets. Bitcoin price today fell sharply from around $89,000 to below $82,000, triggering approximately $1.75 billion in liquidations within 24 hours. The total crypto market lost nearly $100 billion in value during the chaos.

Source: CoinMarketCap

Despite the drop, Cathie Wood bitcoin views remain long-term bullish. Some analysts believe such liquidation-driven moves often reset leverage and can later support the next Bitcoin bull run.

Cathie Wood Prediction has divided opinion. Some investors see yellow metal asset's volatility as a warning sign of overheating, while others argue central bank buying and geopolitical risks will support prices long-term.

For now, traders are closely watching metal assets price with bitcoin price today for signs of stabilization. With volatility running above 2008 levels, markets may remain unstable in the near term, making risk management more important than prediction.

Disclaimer: This content is for information only and not financial advice. Markets are volatile, do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.