The global markets are seeing a major shift in Gold Rally Amid Tariffs. For the first time ever, the physical asset has plunged past the historic $4,700 per ounce mark. Similarly, silver is at record highs near $94 per ounce. This strong move is a result of increased trade war tension and a fear of economic instability.

Source: Investing.com X (formerly Twitter)

President Trump's threats of heavy tariffs against a number of European countries sent shockwaves through investor confidence.

The rally gained speed after Trump threatened heavy export rates on European countries, including a possible 200% tariff on French wine after Emmanuel Macron reportedly refused to join the so-called “Board of Peace.”

As risk rises, money leaves volatile assets and finds its way into the safe havens like gold and silver.

The Gold hitting all time high during Trump Tariffs threat is not just a short-term spike.

XAAUSD is up nearly 78% in the last 12 months and already up 9% in the first weeks of 2026 as per the Kobeissi Letter.

Silver has jumped more than 30% this year alone.

In market value terms, XAUSD has added about $2.7 trillion since the start of 2026, while silver has gained nearly $1.2 trillion.

Just today, XAUSD added roughly $787 billion and silver added $160 billion.

These numbers show how powerful this move is. Investors are not buying XAUSD only because of inflation. They are buying it as protection against global instability, rising tariffs, and geopolitical tension.

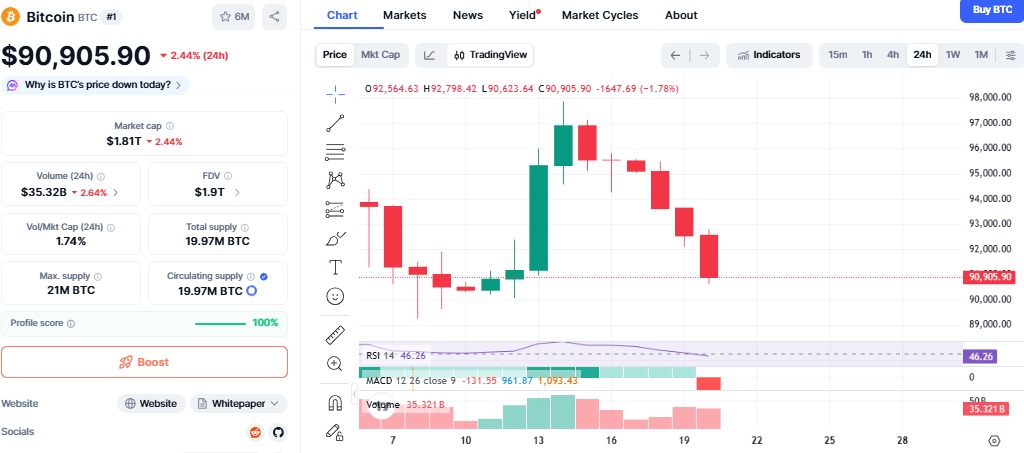

While precious metals rise, Bitcoin is struggling. BTC has dropped below $92,000 and is down nearly 1% in the last 24 hours. The broader crypto market crashes about 1.23%.

Source: CoinMarketCap Data

The US-EU trade tensions spotlights the risk-off environment. With increasing fear, the market sees fewer traders taking positions in high-risk assets like BTC.

Current statistics indicate:

865 million BTC long liquidations

$400 million from ETF outflows

Crypto Fear & Greed Index: decreased to 42 (Neutral)

This is an indication that “confidence is cooling,” but BTC is “still strong overall looking at the long-term rally.”

The current Gold price surge is directly tied to political pressure. Trump announced 10% tariffs on 8 European countries starting February 1, rising to 25% by June. The demand that Europe supports U.S. control over Greenland has added another layer of tension.

European leaders have called these moves economic coercion. Emergency talks are underway in Brussels. Markets fear retaliation, trade slowdowns, and damage to global growth.

History shows that when trade wars rise, physical metal assets usually performs well.

The Gold Rally Amid Tariffs does not spell the end for Bitcoin. But in the short run, it certainly indicates that Bitcoin is acting like a risk asset.

If tariffs continue to rise and stocks plummet, pressure on Bitcoin might rise further. In the case of a stock market crash, crypto is bound to get hurt first.

However, some analysts believe BTC is oversold while the yellow metal asset is becoming overbought. This could lead to a reversal once panic cools. Bitcoin still benefits from long-term narratives like digital scarcity and decentralization.

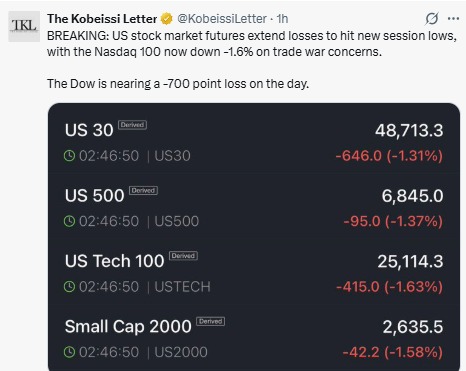

The US stock market is flashing warning signs. Charts suggest another tariff-driven crash may be forming. If equities fall, Bitcoin could follow due to liquidity pressure.

Source: The Kobeissi Letter

The Gold Rally Amid Tariffs is a loud signal from global markets. Fear is rising. Investors want safety. Gold and silver are winning that race today.

Bitcoin is facing short-term pressure, but its story is not over. If XAUUSD continues climbing while stocks weaken, crypto may soon find itself at a major turning point.

Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.

1 month ago

I am from united kingdom, I lost more than $127,000 to an online scam company about four months ago. I made payments using both my bank account and bitcoins, and they abruptly vanished for no apparent reason. Thanks to OPIMISTIC HACKER who was able to retrieve all my lost money. I won’t say anything more than to give his contact information. email…. cryptorecoveryweb @ gmail. com