A quiet shift is taking place in global finance after reports that China limits US Treasuries for several of its major banks. Regulators have advised lenders to reduce their holdings of American government bonds due to concerns that heavy exposure could leave them open to sudden market swings.

This may sound like a routine financial decision, but US Treasuries play a major role in the world economy. They help set interest rates, guide borrowing costs, and support liquidity across markets. When a large investor like China steps back, it naturally raises questions not just for traditional markets but also for crypto.

For decades, US government bonds were viewed as one of the safest investments available.

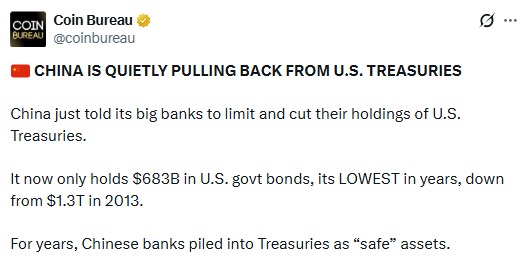

Source: X (formerly Twitter)

Chinese institutions once held massive amounts of this debt, but those holdings have gradually dropped to about $683 billion, far below the $1.3 trillion peak seen in 2013.

Officials reportedly described the move as a diversification strategy rather than a political signal.

The goal appears to be reducing risk, not abandoning US assets entirely.

The guidance mainly applies to private banks, while China’s official reserves remain unchanged.

So far, markets have reacted calmly. Treasury yields moved slightly higher, and the US dollar weakened a bit.

There is no panic selling, but when China limits US Treasuries, investors often see it as an early sign of changing financial priorities.

At the same time, the country has been steadily increasing its gold reserves, now holding more than 2,300 tonnes. This suggests a stronger preference for physical assets that are not directly tied to any single currency.

The trend is global. Central banks bought over 860 tons of gold in 2025, showing continued trust in the metal during uncertain economic periods.

The contrast is clear while China limits US Treasuries, it is strengthening positions in gold. Many analysts believe this reflects a broader strategy of spreading risk rather than relying too heavily on dollar-based assets.

Large macro changes often affect crypto indirectly. If demand for Treasuries weakens, liquidity across financial markets could tighten. Higher borrowing costs and cautious investor behavior usually create pressure on risk assets, including cryptocurrencies.

However, there is another angle. When confidence in traditional financial systems starts to shift, some investors look toward decentralized assets like Bitcoin as alternatives. Because of this, when China limits US Treasuries, crypto could see short-term volatility but also attract long-term interest.

The final outcome will depend largely on global market sentiment. Currently the total crypto market cap sits at Trillion with an increase of % in the last 24 hours.

Whereas the nation might have changed its reserve strategy, it still has stringent regulations over the activities of cryptocurrencies. Trading, mining, as well as other operations, are still prohibited, especially for foreign countries.

Authorities frequently mention risks such as financial instability and capital outflows. Meanwhile, the nation is actively pushing its own digital yuan, indicating its clear support for state-controlled digital finance instead of tokens.

When China reduces its holdings of US Treasuries, this indicates a change in the risk outlook of major economies; however, the situation cannot be said to imply a crisis at hand but reflects a rise in caution levels in the international financial system.

For crypto investors, the impact may not be immediate, yet it is worth watching. Changes in liquidity and investor confidence often shape how risk assets perform. In financial markets, the biggest transitions usually happen quietly but their effects can be far-reaching.

YMYL Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.