The Hong Kong-listed financial powerhouse has officially entered the digital asset space, with a $100 million bet and partnering with YZi Labs has driven Binance Coin to a new all-time high of $900. This China Renaissance BNB investment is marking a major shift for traditional finance embracing blockchain and Web3 technologies.

Source : X

This crypto news matters because it’s the first major Hong Kong-listed financial institution to officially hold Binance as part of its asset allocation. Through a memorandum of understanding (MoU) with YZi Labs, the agreement was finalized, outlining China Renaissance BNB Investment of $100 million in coins has increased support for Web3 and blockchain development. Earlier in 2025, the financial institute hinted at expanding into cryptocurrencies.

Source : Website

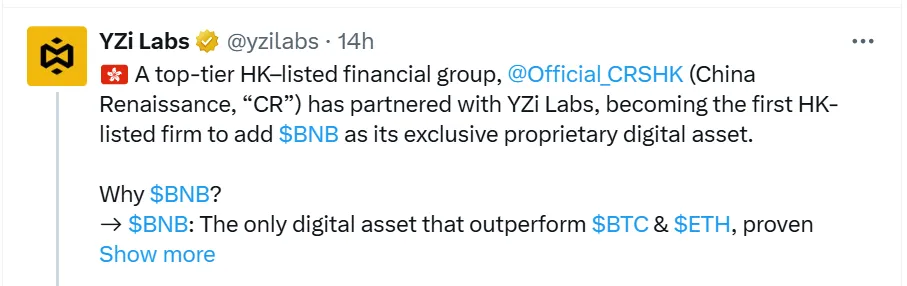

Analysts say partnership with YZi Labs step gives Binance more legitimacy as both a bet and a utility token, especially when traditional players are cautious in this space.

YZi Labs will provide guidance and technical support. The partnership will focus on projects in the Binance Chain ecosystem, including decentralized finance and other blockchain applications.

Source : X

China Renaissance BNB Investment also makes it easier for regulated investors in Hong Kong to gain exposure to Binance. Market watchers see it as a sign of growing institutional interest in cryptocurrency.

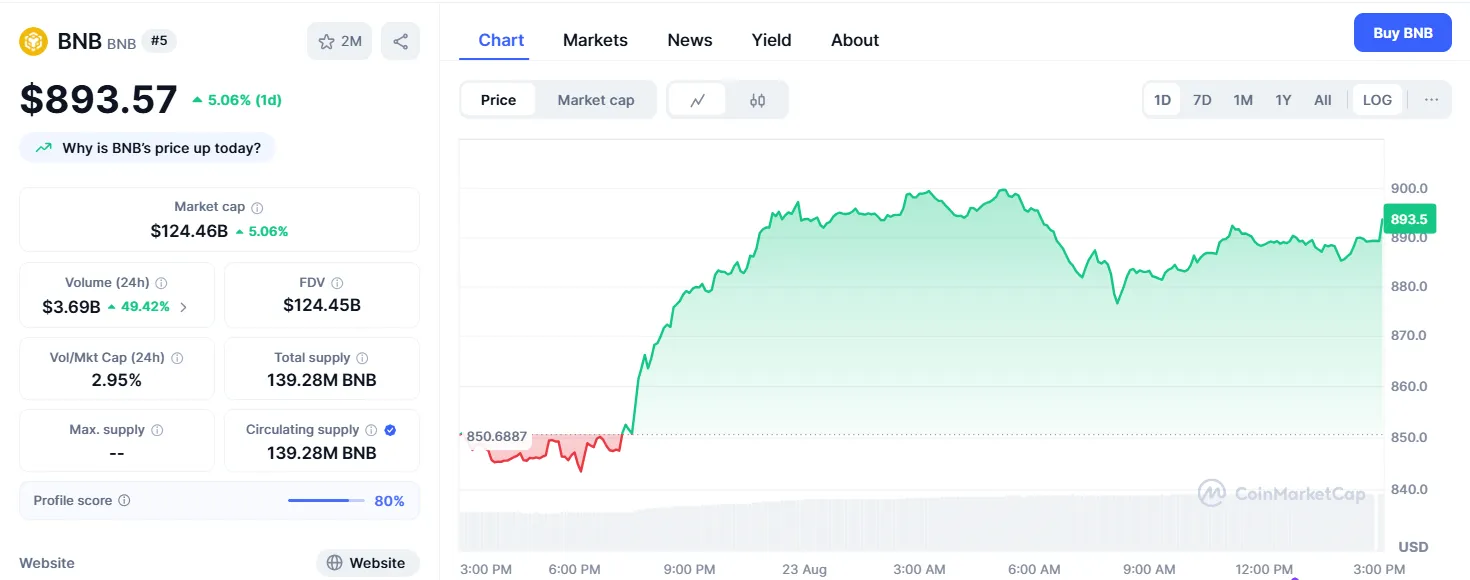

As the China Renaissance BNB Investment news floated, the coin surged to $900. Traders and investors responded quickly, boosting trading volumes across exchanges. The move has strengthened confidence in token as both financing and a digital asset.

Source : Coinmarketcap

The coin is trading at the time of writing $884 with more than 5% increase in one day. The token broke above the 23.6% Fibonacci retracement level ($860.21) from its recent swing high of $899.7 indicating high potential of reaching new ATH. Market is watching to see if this token closes the week above its extension at $945.21 to confirm a new bullish phase?

This move positions China Renaissance BNB Investment as a pioneer in traditional finance embracing Web3, and the price rally highlights growing demand for token as a core digital asset.

More companies are now holding altcoins in their reserves. What started with Bitcoin has expanded to Ethereum, Solana, and other tokens. Firms see these assets as a way to diversify, hedge against inflation, and tap into Web3 growth. With institutions like China Renaissance BNB investment exploring altcoin strategies, treasury adoption is quickly gaining momentum.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.