ETH has hit new heights after U.S. Federal Reserve Chairman Jerome Powell signaled a Fed rate cut in September.

While speaking at the Jackson Hole Symposium, Powell said that the balance of risks is now moving to the labor market.

Source: Bitcoin Archive

That one statement altered market sentiment and pushed the price higher in just hours and was among the leading stories in Ethereum Price News for the week.

Immediately after Jerome Powell Speech, the chances of a September Fed rate cut rose from 74% to 90%.

Investors rushed into risk assets, sending it up by 13% in just one day. The cryptocurrency hit $4,933, a move widely covered in Ethereum Price News updates.

The rally marks a big move for ETH, which has experienced 29% monthly gains and 78% year-to-date.

Analysts believe that this asset is being viewed as a long-term macro asset, with increasing institutional demand. Recently Blackrock has purchased this digital currency worth $233 million.

Tom Lee, a prominent market strategist, even referred to it as "the biggest macro trade of the next 10–15 years." Reports even indicate names such as Peter Thiel and Wall Street funds are building exposure to ETH.

Eth's breakout took it over its 7-day simple moving average of $4,382 and above the Fibonacci 23.6% level of $4,524.

This technical breakout is evidence of bullish momentum, although some signs indicate short-term caution.

The Relative Strength Index (RSI) stands at around 69, which tells us ETH could be near overbought territory.

Meanwhile, the MACD histogram depicts slowing momentum, increasing the likelihood of consolidation before a new push higher.

It would leave ETH near a new All Time High and add even more weight to the argument for 5K ETH within the near term.

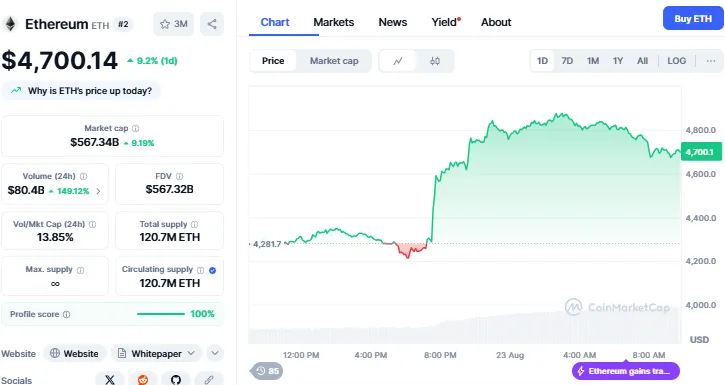

Source: CoinMarketCap

Currently it is trading at $4700 with an increase of 9.2%, while trading volume increased by 149% in the last 24 hours. A decline from 4900 to 4700 depicts profit-taking.

These benchmarks are now taking center stage in the most recent Ethereum Price News.

The Federal Reserve policy shift has also lent credibility to Eth's rally. Fed meeting minutes earlier in the week indicated that inflation was the biggest concern.

But following a weak July jobs report and downward revisions to May and June jobs, Powell's tone softened.

He now implies that subsidizing the labor market can be a reason for policy reforms. This dovish cue has propped up risk assets in general, from U.S. equities to cryptocurrencies.

The Dow Jones even finished at an all-time high after Powell's statement, adding more strength tracked in Ethereum Price News reports.

With increased adoption, institutional support, and a friendly macro environment, it cryptocurrency is again in the limelight.

The blend of policy changes and technical potency places ETH among the most-observed assets in world markets.

Looking at the Ethereum price prediction:

Breaking past $4,500 is seen as an important signal.

If it can hold above $4,700, analysts believe it could target the next Fibonacci extension at $5,299.

It is now the main topic of discussion among Ethereum Price News sites and analyst reports.

This price boost illustrates how markets are still sensitive to what the Federal Reserve says. One speech by Powell wiped out weeks of hawkish sentiment and provided crypto investors with fresh hope.

With institutions stepping in and adoption increasing, it's path to a New All Time High seems more likely than ever, and it continues to make news in Ethereum Price News.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.