Chinese Govt has banned crypto for more than ten years, but now the government is looking into a new idea: digital stablecoins. Why this sudden change? Experts hint this could be part of a global financial chess game against the US Dollar superiority.

The China crypto news today has already grabbed attention worldwide, signaling that China Yuan Stablecoin shift might make a stronger influence in cross-border payments and global finance.

Chinese Govt strict crypto rules were well-known, with trading and mining banned. Now, the People’s Bank of China (PBOC) is testing a Yuan-backed Stablecoin.

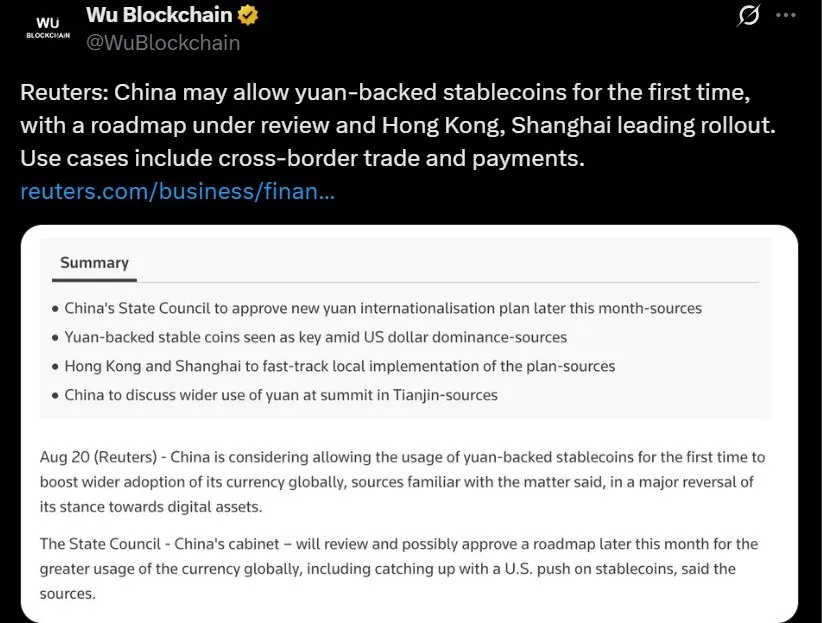

Source: Wu Blockchain X Post

Unlike cryptocurrencies such as Bitcoin, the Renminbi (RMB), which is another name for Chinese money, is completely controlled by the government. This makes it stable and easy to trust.

Analysts say this shows Beijing’s desire to modernize digital yuan cross-border payments and strengthen its global role.

The Renminbi (RMB) pilot isn’t happening everywhere. Hong Kong and Shanghai are the first hubs for testing Yuan-backed digital currency.

Local banks and payment platforms are now offering trial programs for residents and businesses. Cross-border trade using this currency is already being explored, especially in Asia.

For traders, this could mean new opportunities to use Chinese currency in international deals, bypassing traditional USD channels.

The USD has been the main money used in world trade and reserves for many years. As per The Kobeissi Letter x post on July 15, Right now, it makes up 48% of global payments, which is twice the Euro and 16 times more than the Chinese currency.

The ($) is also part of 88% of all foreign exchange deals and holds about 58% of global FX reserves, almost three times more than the Euro and gold.

For cross-border loans, the US Dollar covers 47%, while the Euro is only 30%.

The China Yuan Stablecoin could slowly challenge the Dollar’s dominance. If more countries use this yuan-backed digital currency.

Still, America has strong financial power, so any change will happen gradually. Investors and traders are closely watching this China stablecoin news to see how the yuan vs dollar competition develops in the coming days.

The road ahead is not without risks. After looking closely at this update, it seems there are two possible paths ahead:

Beijing CNY stablecoin adoption could face regulatory challenges, cybersecurity threats, and global political pressure.

On the other hand, using it early could bring advantages like faster payments, lower costs, and a more stable currency for international trade. As the pilot expands beyond Hong Kong and Shanghai, the world will react instantly impacting the crypto market

Beijing government is now testing a China Yuan Stablecoin after years of banning crypto. This is a big move and shows that the country wants more power in world finance and to challenge the US Dollar top spot.

For traders, policymakers, and businesses around the world, keeping an eye on the currency news is very important. The digital CNY won’t replace the US dollar right away, but as it grows in Hong Kong, Shanghai, and other places, it could slowly change how money is used for global payments.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.