The digital asset market is once again heating up, and this time Ethereum news is in the spotlight. In just a few hours, $1 billion worth of USDT was created on the onchain, while hedge funds have opened a record $8 billion in short positions.

Now, the biggest question is: Will this lead to an Ethereum Short Squeeze that drives the price higher, or could it spark a sharp price crash? With both sides building huge bets, this update is dominating trader discussions today.

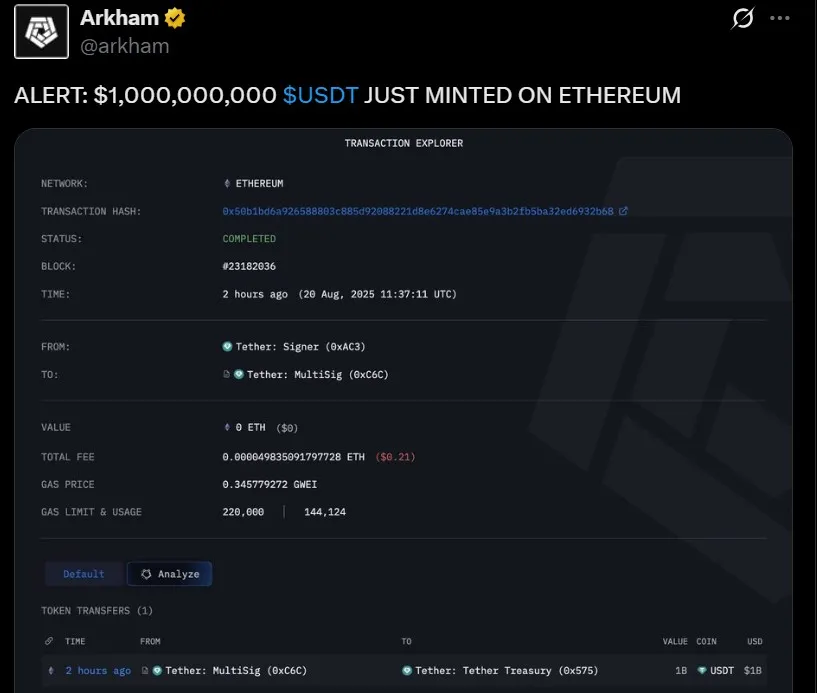

Fresh on-chain reports from Arkham Intelligence confirmed a massive ETH USDT mint worth $1B. Such a large issue of stablecoins normally means more money could flow into the market, boosting buying.

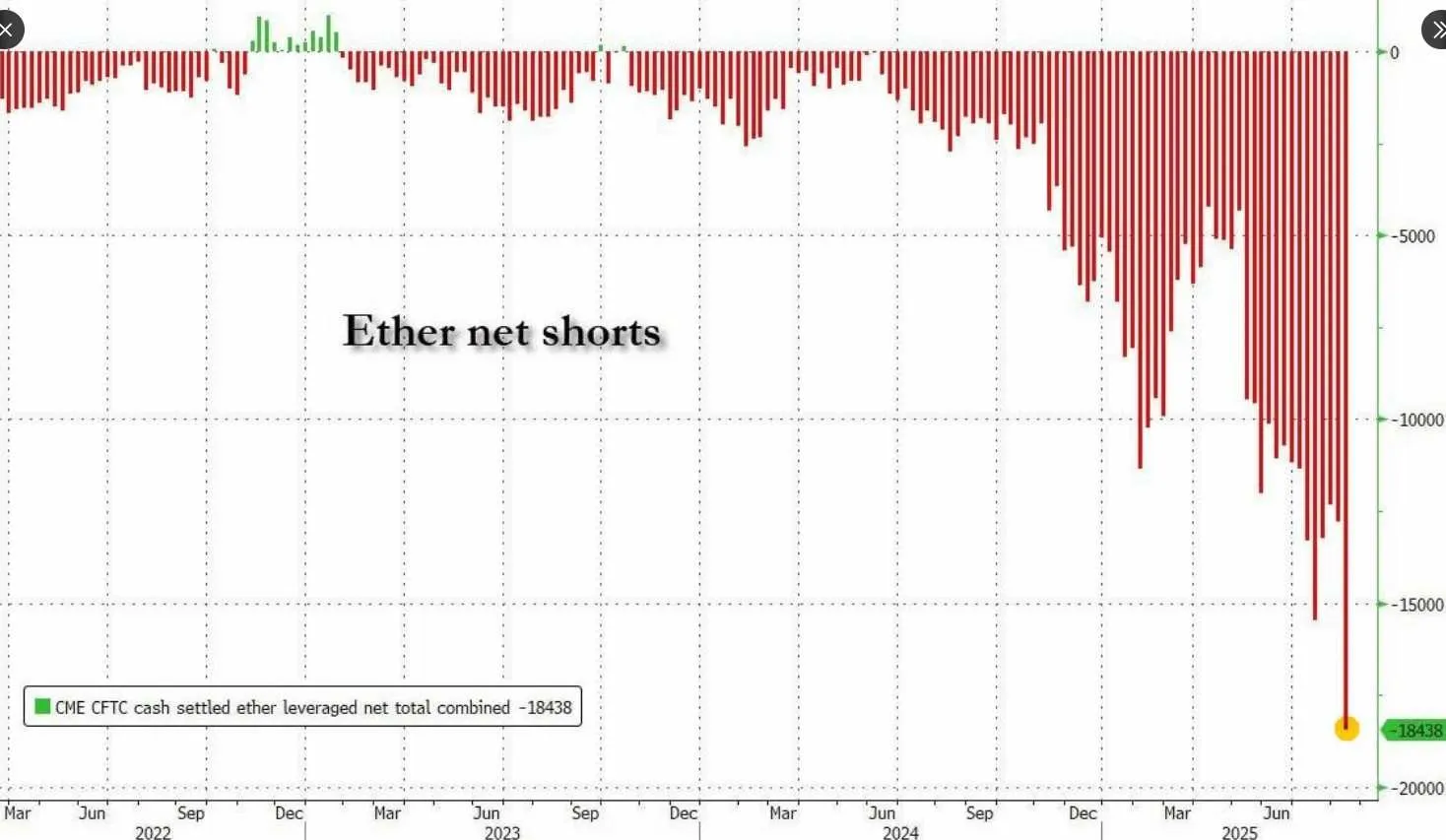

On the other side, hedge funds have lined up $8B in short positions, preparing for a potential dump.

This sets up a classic fight between bulls and bears. If the coin climbs above resistance, short sellers could face liquidation, causing a rapid Ethereum Short Squeeze.

But if bearish momentum wins, coin may slide quickly, raising fears of an price crash near $3,900. Many are warning this could be the biggest $ETH liquidation risk in months.

At present, the token is trading close to $4,267 after a small recovery. A closer look at the ETH price chart analysis today shows:

Heavy resistance is at $4,400.

First support lies near $4,100, deeper support around $3,900.

RSI reading of 57 signals neutral momentum.

MACD shows weak bearish signals, but selling strength is fading.

This means the token is stuck in a narrow zone. A push above $4,400 could lead to price target $4800, while losing $4,100 might open the door for a decline. Traders are waiting to see if a price breakout or dump comes first.

Famous trader Merlijin described the coin's $4,800 level as the “final boss,” with billions of sell orders sitting there. Weak hands may panic at this point, while experienced players could take advantage.

Short-Term (1–2 weeks): A break above $4,400 could fuel a rally to $4,800. Losing $4,100 risks a fall to $3,900.

Mid-Term (1–2 months): Holding above $4,400 may send assets toward $5,000. Failure may pull the coin closer to $3,600.

Long-Term (3–6 months): If staking and network demand remain strong, crypto could climb to $5,500–$6,000. Staying above $3,500 keeps the bullish story alive.

This makes altcoin one of the most closely-watched assets right now. Traders are split between seeing a fresh $ETH ATH or fearing another Ethereum price crash.

This update shows a tense setup. On one side, the $1B ETH USDT mint could pump new money into the system. On the other, the $8B short attack may lead to a selloff.

If bulls break through $4,400 and aim for the $4800 resistance, the Ethereum Short Squeeze could be explosive. If sellers dominate, asset may face a dip before any recovery.

For now, the coin feels like a ticking clock. The next move will decide if the market explodes higher or slides lower. Investors should stay alert, because $ETH news today proves the token is at the center of the next big crypto narrative.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.